Crafting a compelling claims adjuster resume is crucial for standing out in a competitive job market.

Whether you're an experienced professional or just starting in the industry, build a resume that highlights your skills, achievements, and expertise can make all the difference.

In this article, we provide examples and expert tips tailored to help you create a document that grabs attention and land interviews.

Claims adjuster resume examples

- Insurance adjuster resume

- Independent adjuster resume

- Auto claims adjuster resume

- Property adjuster resume

- Entry-level claims adjuster resume

Insurance claims adjuster resume sample

Insurance claims adjuster resume template

Resume for insurance claims adjuster | Plain text

Vince Chism

Dallas, TX

(555) 123-4567

vincechism@email.comProfessional Summary

Detail-oriented Insurance Claims Adjuster with over 10 years of experience in managing and evaluating claims for major insurance companies. Proven track record of handling complex claims efficiently and resolving disputes with a focus on customer satisfaction.

Experience

Senior Insurance Claims Adjuster

State Farm Insurance, Dallas, TX

June 2018 – Present

- Manage an average caseload of 80 claims per month, including high-value and complex cases.

- Conduct thorough investigations and site visits to determine the validity of claims.

- Negotiate settlements and provide recommendations for claims payments based on findings.

- Train and mentor new adjusters, improving team efficiency and accuracy.

- Collaborate with underwriting and risk management teams to identify trends and reduce losses.

Insurance Claims Adjuster

Allstate Insurance, Dallas, TX

March 2014 – May 2018

- Processed and assessed auto and property insurance claims from initiation to resolution.

- Collaborated with legal teams to handle disputed claims and litigation processes.

- Achieved a 95% satisfaction rate in customer surveys through effective communication and problem-solving.

Education

Bachelor of Science in Business Administration

University of Texas, Dallas, TX

Graduated: 2013

Certifications

- Certified Insurance Adjuster (CIA), Renewed: January 2023

- Licensed Insurance Adjuster in Texas, Renewed: March 2022

Skills

- Expert in claims management and dispute resolution

- Proficient in claims management software (e.g., Xactimate, Claims Connect)

- Strong analytical and negotiation skills

- Ability to interpret complex policy language and legal documents

- Skilled in coordinating cross-functional teams to expedite claim settlements

- Adept at maintaining detailed documentation and audit trails

Professional Affiliations

- Member, National Association of Independent Insurance Adjusters (since 2017)

Strong sides of this insurance claims adjuster resume example:

- Ability to manage an average of 80 claims per month, including complex and high-value cases, shows capacity for handling substantial workloads.

- Experience in training and mentoring new adjusters highlights leadership and a dedication to team development.

- Membership in NAIIA indicates ongoing engagement with the industry and a commitment to professional standards.

- How to properly format an insurance adjuster resume?

- Choose a professional, easy-to-read font like Arial, Calibri, or Times New Roman.

- For the body text of claims adjuster resume, use a font size between 10 and 12 points.

- Aim for a one-page resume if you have less than 10 years of experience.

- Set your margins to 1 inch on all sides. If you need more space, you can reduce them slightly.

- Include your name, phone number, email address, and LinkedIn profile (if applicable) at the top of the page.

- Use bullet points to list your responsibilities and achievements under each job title.

- Stick to a simple, clean design. Avoid too many colors, graphics, or complex layouts.

- To preserve the layout, save and submit your claims adjuster resume as a PDF file unless the employer specifies otherwise.

Resume Trick offers downloadable resume templates that automatically handle formatting issues.

Our online resume maker comes with features that standardize fonts, spacing, and margins. This reduces the risk of inconsistencies and errors that can occur when creating the document manually.

Create your professional Resume in 10 minutes for FREE

Build My Resume

Independent claims adjuster resume example

Sample independent claims adjuster resume

Jane Smith

Phoenix, AZ

(555) 987-6543

jane.smith@email.comProfessional Summary

Experienced Independent Claims Adjuster with a robust background in handling diverse claims types for multiple clients. Skilled in negotiating settlements, conducting investigations, and managing workload efficiently.

Experience

Independent Claims Adjuster

Freelance, Phoenix, AZ

January 2017 – Present

- Provide claims adjustment services for various insurance companies on a contract basis.

- Conduct field inspections, gather evidence, and evaluate damage to determine claim validity.

- Prepare detailed reports and recommendations for insurance companies and clients.

- Maintain a high level of accuracy and professionalism while working independently.

- Develop strong client relationships through clear communication and timely follow-up.

Claims Adjuster

Liberty Mutual, Phoenix, AZ

June 2013 – December 2016

- Assessed and resolved a wide range of property and auto insurance claims.

- Collaborated with clients, contractors, and legal professionals to expedite claim processes.

- Developed a strong network of industry contacts and maintain up-to-date knowledge of market trends.

Education

Bachelor of Arts in Criminal Justice

Arizona State University, Phoenix, AZ

Graduated: 2012

Certifications

- Certified Claims Professional (CCP), Certified: June 2016

- Licensed Insurance Adjuster in Arizona, Licensed: April 2013

Skills

- Claims Investigation

- Policy Interpretation

- Negotiation

- Field Adjusting

- Catastrophe Claims Handling

- Report Writing

- Customer Service

- Risk Assessment and Mitigation

- Conflict Resolution

- Time Management and Prioritization

Professional Development

- Attended National Insurance Adjusters Conference, 2023

- Completed Advanced Negotiation Techniques workshop, 2022

Why this independent insurance adjuster resume will impress recruiters:

- Experience as an independent contractor demonstrates adaptability and the competence to handle a diverse range of claims without direct supervision.

- Work with various clients and insurance companies indicates a wide range of expertise and adaptability in different claims environments.

- Certifications like CCP enhance credibility and professional standing in the claims adjustment field.

- Should I choose a claims adjuster resume summary or objective?

If you have significant experience in claims adjusting, a resume summary is usually the better choice.

- It allows you to showcase your skills, accomplishments, and what you bring to the role in a succinct way.

Claims adjuster resume summary:

Results-driven Claims Adjuster with over 8 years of experience managing complex claims and negotiating settlements. Proven track record of reducing claim processing time by 20% and increasing customer satisfaction through effective communication and problem-solving skills.

If you’re new to the field or transitioning from a different career, an objective statement in resume can help you communicate your enthusiasm for the role.

- It’s useful if you want to clearly state your goals for work and how they align with the position you’re applying for.

Claims adjuster resume objective:

Motivated and detail-oriented individual seeking a Claims Adjuster position to leverage strong analytical skills and a commitment to exceptional customer service. Eager to contribute to the company and grow within the industry.

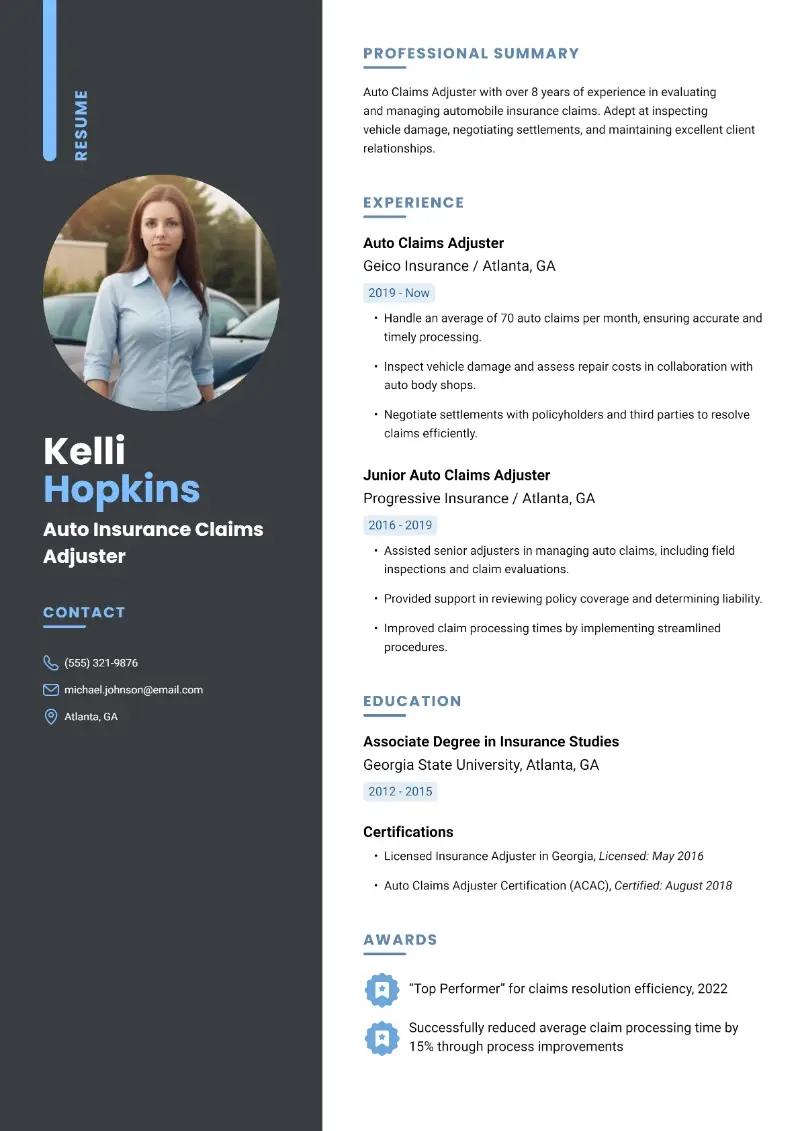

Auto claims adjuster resume template

Auto claims adjuster resume sample

Auto claims adjuster resume | Text version

Kelli Hopkins

Atlanta, GA

(555) 321-9876

michael.johnson@email.comProfessional Summary

Auto Claims Adjuster with over 8 years of experience in evaluating and managing automobile insurance claims. Adept at inspecting vehicle damage, negotiating settlements, and maintaining excellent client relationships.

Experience

Auto Claims Adjuster

Geico Insurance, Atlanta, GA

August 2019 – Present

- Handle an average of 70 auto claims per month, ensuring accurate and timely processing.

- Inspect vehicle damage and assess repair costs in collaboration with auto body shops.

- Negotiate settlements with policyholders and third parties to resolve claims efficiently.

- Investigate fraudulent claims by reviewing documentation and interviewing involved parties.

Junior Auto Claims Adjuster

Progressive Insurance, Atlanta, GA

April 2016 – July 2019

- Assisted senior adjusters in managing auto claims, including field inspections and claim evaluations.

- Provided support in reviewing policy coverage and determining liability.

- Improved claim processing times by implementing streamlined procedures.

Education

Associate Degree in Insurance Studies

Georgia State University, Atlanta, GA

Graduated: 2015

Certifications

- Auto Claims Adjuster Certification (ACAC), Certified: August 2018

- Licensed Insurance Adjuster in Georgia, Licensed: May 2016

Achievements

- Recognized as "Top Performer" for claims resolution efficiency, 2022

- Successfully reduced average claim processing time by 15% through process improvements

This sample auto claims adjuster resume is effective for several reasons:

- Focused expertise in auto adjustment, with a solid track record of handling an average of 70 claims per month, indicates depth in a specific area of insurance.

- Recognition as a "Top Performer" and improvements in processing time highlight achievements and efficiency in claim handling.

- ACAC certification underscores specialized knowledge in auto claims.

- How to showcase your claims adjuster resume skills?

The skills resume section allows you to showcase your proficiency in key areas relevant to claims adjusting, such as negotiation, investigation, and communication. This helps demonstrate that you possess the exact abilities needed for the job.

- Hard skills are specific, teachable capabilities or knowledge sets that are often gained through education, training, or hands-on experience.

- Soft skills are less tangible and relate to how you interact with others and approach your work.

Claims adjuster hard skills:

- Claims Management Software (e.g., Xactimate, ClaimXperience)

- Insurance Policy Analysis

- Risk Assessment

- Data Analysis

- Documentation and Reporting

- Legal and Regulatory Compliance

- Investigation Techniques

- Valuation of Damages

- Negotiation Skills

- Financial Acumen

Soft skills for a claims adjuster:

- Communication

- Problem-Solving

- Empathy

- Time Management

- Attention to Detail

- Negotiation

- Conflict Resolution

- Customer Service

- Organizational Skills

- Adaptability

Property adjuster resume sample

Sample property claims adjuster resume

Emily Davis

Chicago, IL

(555) 654-3210

emily.davis@email.comProfessional Summary

Seasoned Property Claims Adjuster with a solid background in evaluating property damage and handling complex insurance claims. Expertise in inspecting properties, estimating repair costs, and managing large-scale claims.

Experience

Property Claims Adjuster

Nationwide Insurance, Chicago, IL

May 2018 – Present

- Manage a portfolio of residential and commercial property claims, averaging 50 claims per month.

- Conduct on-site inspections and collaborate with contractors to estimate repair costs.

- Analyze policy coverage and provide recommendations for claim settlements.

- Prepare detailed reports summarizing findings and claim status for internal review.

Claims Adjuster

Farmers Insurance, Chicago, IL

January 2014 – April 2018

- Evaluated and processed a diverse range of property insurance claims.

- Worked closely with policyholders, legal teams, and repair professionals to resolve disputes.

- Achieved a 90% claim resolution rate within the designated time frame.

Skills

- Property Damage Assessment

- Estimating Software

- Claims Handling

- Inspection

- Contractor Liaison

- Quality Control and Compliance

- Effective Communication with Stakeholders

- Documentation and Record Keeping

Education

Bachelor of Science in Risk Management

University of Illinois, Chicago, IL

Graduated: 2013

Certifications

- Property Claims Adjuster Certification (PCAC), Certified: October 2016

- Licensed Insurance Adjuster in Illinois, Issued: July 2014

Volunteer Work

Volunteer

Chicago Habitat for Humanity

2020 – Present

- Provide pro bono consulting for homeowners navigating insurance claims for property repairs

Why is this claims adjuster resume sample effective?

- Extensive experience in managing both residential and commercial property claims demonstrates the ability to handle complex and high-stakes cases.

- Volunteering with Habitat for Humanity shows community involvement and a willingness to contribute beyond professional duties.

- PCAC certification highlights specialized knowledge in property claims.

- What educational credentials should I add to my resume for a claims adjuster?

Employers use this section to verify that you have completed the required level of education for the job.

List the highest degree obtained including its name (e.g., Bachelor’s in Business Administration, Associate Degree in Insurance), the institution, and the graduation date.

Diplomas in fields like Business, Finance, Risk Management, or Insurance are particularly relevant.

If you graduated with latin honors or received awards relevant to your field of study, mention these on claims adjuster resume as they can enhance your credibility.

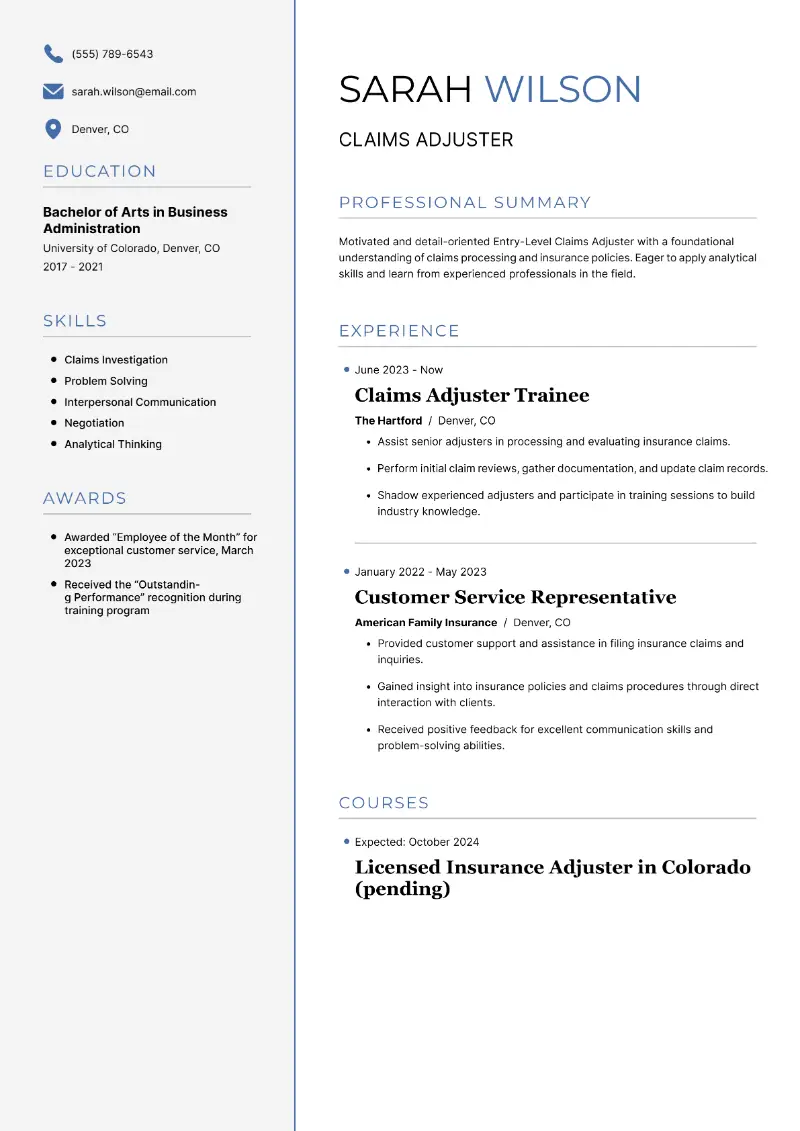

Beginner claims adjuster resume example

Entry-level claims adjuster resume template

Resume for a claims adjuster without experience | Sample text

Sarah Wilson

Denver, CO

(555) 789-6543

sarah.wilson@email.comProfessional Summary

Motivated and detail-oriented Entry-Level Claims Adjuster with a foundational understanding of claims processing and insurance policies. Eager to apply analytical skills and learn from experienced professionals in the field.

Experience

Claims Adjuster Trainee

The Hartford, Denver, CO

June 2023 – Present

- Assist senior adjusters in processing and evaluating insurance claims.

- Perform initial claim reviews, gather documentation, and update records.

- Shadow experienced adjusters and participate in training sessions to build industry knowledge.

- Communicate with claimants to collect essential information and provide updates.

Customer Service Representative

American Family Insurance, Denver, CO

January 2022 – May 2023

- Provided customer support and assistance in filing insurance claims and inquiries.

- Gained insight into insurance policies and claims procedures through direct interaction with clients.

- Received positive feedback for excellent communication skills and problem-solving abilities.

Education

Bachelor of Arts in Business Administration

University of Colorado, Denver, CO

Graduated: 2021

Certifications

- Licensed Insurance Adjuster in Colorado (pending), Expected: October 2024

Skills

- Claims Investigation

- Problem Solving

- Interpersonal Communication

- Negotiation

- Analytical Thinking

- Conflict Management

- Decision Making

- Attention to Detail

Awards and Honors

- Awarded "Employee of the Month" for exceptional customer service, March 2023

- Received the "Outstanding Performance" recognition during training program

This example of a resume for claims adjuster is strong for several reasons:

- Recent graduation and initial professional experience as a claims adjuster trainee demonstrate eagerness and foundational knowledge in the field.

- Previous role on claims adjuster resume as a customer service representative at an insurance company indicates strong communication skills and understanding of customer needs.

- Pending license and relevant coursework demonstrate commitment to completing necessary qualifications for the role.

- How to organize the experience section in a claims adjuster resume?

List your most recent job first and work backward. This format highlights your most current and relevant experience, which is typically of greater interest to employers.

For each position, provide the following details:

- Clearly state your role.

- Include the name of the company or organization where you worked.

- Specify the city and state (or country if international).

- Mention the start and end dates (month and year).

Use bullet points for responsibilities and accomplishments as it makes it easier for hiring managers to quickly scan and understand them.

Quantifying your achievements in resume (e.g., reduced processing time by 20%, handled claims worth $500,000) provides concrete evidence of your effectiveness and the value you brought to your previous roles.

Cover letter for claims adjuster

A cover letter is a document that you send with your resume when applying for a job. It serves as a way to introduce yourself and explain why you are the right person for the role.

A cover letter generally includes:

- A brief opening where you mention the title and how you learned about the opportunity.

- A section in which you emphasize your strengths that make you a suitable candidate.

- A few sentences about why you are drawn to the company and how your values align with theirs.

- A polite closing that invites the employer to reach out for a job interview or further discussion.

Create your professional Cover letter in 10 minutes for FREE

Build My Cover Letter

Claims adjuster cover letter example

Dear Hiring Manager,

I am writing to express my interest in the Claims Adjuster position at State Farm Insurance, as advertised.

With over five years of experience in claims processing and customer service, I am confident that my skills and background make me an excellent candidate for this role. I am well-versed in evaluating claims, reviewing policy details, and providing effective solutions to both customers and the company.

In my previous position as a Claims Assistant at Progressive Insurance, I gained hands-on experience reviewing insurance claims, assessing damages, and communicating with clients to gather all necessary information.

My attention to detail, organizational skills, and ability to analyze and resolve complex issues have consistently contributed to efficient claim handling and customer satisfaction. I have developed a strong understanding of insurance regulations and policy terms, which allows me to handle claims accurately and in a timely manner.

I am particularly drawn to State Farm Insurance because of its reputation for exceptional customer service and commitment to integrity in the claims process. I admire the company’s values and would love to contribute my skills to a team that prioritizes quality and client satisfaction.

I would welcome the opportunity to further discuss my qualifications and how I can contribute to the continued success of State Farm Insurance. Thank you for considering my application. I look forward to the possibility of speaking with you soon.

Sincerely,

Diane Wolf

Conclusion

A strong claims adjuster resume showcases your ability to manage claims efficiently, communicate effectively, and deliver results.

By following the examples and tips provided, you'll be better positioned to craft a document that reflects your unique strengths and aligns with the needs of potential employers.

Take the time to tailor your resume, and you'll increase your chances of advancing in your career as a claims adjuster.

Create your professional Resume in 10 minutes for FREE

Build My Resume