In the fast-paced and highly regulated financial industry, a strong entry-level KYC analyst resume is your first opportunity to showcase your skills and qualifications as a Know Your Customer specialist.

Whether you’re new to the field or transitioning into a compliance role, creating good resume can set you apart in a competitive job market.

This guide will help you create an effective application, providing free resume examples to help you highlight the key elements that hiring managers look for in candidates.

KYC analyst resume examples

Entry-level KYC analyst resume

Entry-level KYC analyst resume template

Entry-level KYC analyst resume sample | Plain text

Sarah Thompson

Miami, FL

Email: sarah.thompson@gmail.com

Phone: (305) 123-4567Resume Summary

Detail-oriented and highly motivated KYC Analyst with a foundational understanding of financial regulations and customer due diligence. Skilled in conducting customer risk assessments, ensuring compliance with Anti-Money Laundering standards, and adept at utilizing KYC software. Eager to apply my analytical skills and attention to detail to enhance the integrity of financial institutions.

Experience

Entry-Level KYC Analyst

JPMorgan Chase & Co., Miami, FL — January 2025 – Present

- Perform comprehensive KYC checks on new and existing customers to ensure adherence to regulatory requirements.

- Conduct risk assessments by analyzing customer information, financial history, and transaction activity.

- Verify the accuracy and completeness of customer data using multiple verification methods, including government-issued IDs, utility bills, and other documentation.

- Support senior analysts in investigating and escalating suspicious activities in compliance with AML guidelines.

- Collaborate with cross-functional teams, including compliance and legal department.

Customer Service Representative

Bank of America, Miami, FL — June 2023 – December 2024

- Provided frontline customer support for account-related inquiries, maintaining high levels of satisfaction.

- Assisted customers with updating personal information and resolving issues related to account discrepancies.

- Gained familiarity with financial services, banking regulations, and basic KYC principles during training and day-to-day operations.

Education

Bachelor of Science in Finance

University of Miami, FL — Graduated: May 2025

Certifications

- Certified Anti-Money Laundering Specialist , ACAMS — October 2023

- KYC & AML Compliance Certification, FINRA — August 2023

Skills

- KYC Due Diligence and Risk Assessment

- Anti-Money Laundering (AML) Regulations

- Customer Identification Programs (CIP)

- Knowledge of Financial Crime Prevention

- KYC Software (e.g., ACI Worldwide, Actimize)

- Strong Communication and Analytical Skills

- Proficient in Microsoft Office Suite

Why this beginner resume for KYC analyst example is effective?

- Even with limited experience, Sarah demonstrates the skills in resume she has gained from her prior customer service role, showing a clear understanding of concepts.

- She has included relevant certifications on resume, which boosts her credibility as a compliance professional.

- Her abilities are directly aligned with the role's requirements, making it easy for hiring managers to see her capacities.

- How to format a KYC experience resume?

- One page length resume—focus on relevant experience and skills.

- Use professional fonts like Arial, Calibri, Times New Roman.

- Font size: 10-12 pt for body text, 14-16 pt for headings.

- Set margins to 0.5–1 inch.

- Apply 1.0–1.15 line spacing between resume sections.

- Begin bullet points with impactful verbs: Analyzed, Reviewed, Investigated.

- Avoid repetitive language—utilize varied, active phrasing.

- Keep the tone professional and concise.

- Tailor the resume to job keywords and refrain from unnecessary jargon.

- Save your paper as a PDF for final submission.

- Carefully proofread for typos, grammar, and clarity.

If you're unsure where to start, consider trying an online resume builder for free to help guide you through the process.

Resume Trick offers a variety of easy resume templates tailored to different industries.

Create your professional Resume in 10 minutes for FREE

Build My Resume

Junior KYC analyst resume

Junior KYC analyst resume example

Michael Davis

New York, NY

Email: michael.davis@gmail.com

Phone: (212) 987-6543Resume Summary

Diligent and detail-oriented Junior KYC Analyst with experience specializing in customer due diligence and anti-money laundering (AML) practices. Adept at managing KYC documentation, performing comprehensive risk assessments, and ensuring strict adherence to international financial regulations.

Professional Experience

Junior KYC Analyst

Citigroup, New York, NY — March 2025 – Present

- Conduct comprehensive reviews of new account openings to ensure full compliance with KYC and AML regulations.

- Collect and verify essential KYC documentation, ensuring that customer information is accurate, current, and complete.

- Work closely with senior analysts to address discrepancies, resolve issues, and update missing or incorrect data in KYC records.

- Collaborate with compliance teams to prepare detailed reports and support audits to identify potential areas of risk.

KYC Analyst Intern

Goldman Sachs, New York, NY — May 2024 – March 2025

- Assisted KYC analysts with conducting initial customer background checks to evaluate financial risks.

- Supported the verification of identification documents for new clients, ensuring they meet regulatory standards.

- Contributed to ensuring KYC files were accurate and in compliance with both internal policies and external regulations.

- Coordinated with the AML team to identify potential red flags or suspicious activities, supporting investigations into financial crime.

Education

Bachelor of Science in Accounting

New York University, NY — Graduated: May 2024

- Relevant coursework: Financial Accounting, Risk Management, Anti-Money Laundering, International Regulations.

Certifications

- Certified Anti-Money Laundering Specialist, ACAMS — February 2023

- Advanced KYC Compliance and Risk Assessment — October 2022

Skills

- Customer Due Diligence

- KYC/AML Risk Assessment and Compliance

- Financial Crime Prevention Strategies

- KYC Documentation & Verification

- Research & Analytical Expertise

- Familiarity with KYC Tools

- Knowledge of International Financial Regulations

- Strong Written and Verbal Communication Skills

- Proficient in Microsoft Office Suite (Excel, Word, PowerPoint)

Professional Development

AML Best Practices Webinar

Financial Compliance Institute — Attended: January 2023

- A comprehensive session on the latest best practices in anti-money laundering and customer due diligence procedures.

KYC Data Management Seminar

Global Compliance Solutions — Attended: September 2022

- Focused on advancements in KYC data management systems and regulatory changes.

Additional Information

- Languages: Basic proficiency in French

- Volunteer Work:

Financial Literacy Educator — New York, NY — January 2021 – Present

- Provide pro-bono financial education to underserved communities, focusing on basic banking, fraud prevention, and understanding KYC processes.

Why this sample of entry-level KYC analyst resume is solid?

- The resume opening statement concisely reveals the candidate's skills and experience, emphasizing key areas.

- Proficiency in French adds value, especially in global financial institutions where multiple languages can be beneficial.

- Volunteer work demonstrates social responsibility, communication skills, and a commitment to giving back to the community.

- What is the difference between entry-level KYC analyst resume summary and objective?

| Aspect | Summary | Objective |

|---|---|---|

| Purpose | Highlights the skills, experience, and strengths. | States the goals and what they seek in a role. |

| Content | Centers on relevant competencies. | Outlines aspirations and specific targets. |

| Tone | Results-oriented. | Forward-looking. |

| Length | 2-4 sentences. | 1-2 sentences. |

| Use Case | Best for those with some expertise. | Ideal for beginners or those transitioning industries. |

| Example | Bilingual (English and Spanish) KYC Analyst with experience working with diverse clientele. Skilled in conducting background checks, verifying international documentation, and ensuring compliance with global KYC/AML regulations. Committed to upholding financial integrity and regulatory standards. | Motivated to apply my technical proficiency and data analysis skills in a KYC position, supporting the team in ensuring thorough compliance with AML standards. |

- How to organize education on a resume for KYC analyst?

What to include:

- Degree Type

- Institution Name

- Location

- Graduation Date

- Relevant Coursework or Projects

- GPA (optional, if 3.0 or higher)

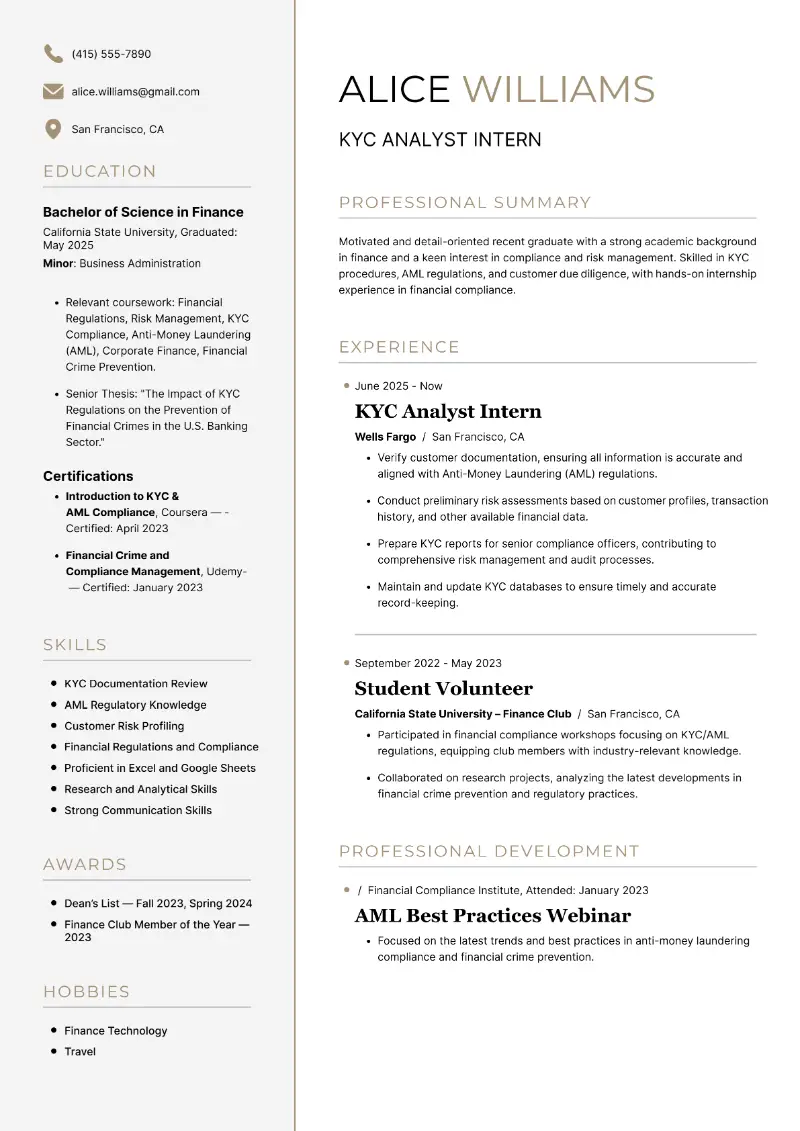

Entry-level KYC analyst intern resume

Entry-level KYC analyst intern resume template

Entry-level KYC analyst intern resume sample | Plain text

Alice Williams

San Francisco, CA

Email: alice.williams@gmail.com

Phone: (415) 555-7890Resume Summary

Motivated and detail-oriented recent graduate with a strong academic background in finance and a keen interest in compliance and risk management. Skilled in KYC procedures, AML regulations, and customer due diligence, with hands-on internship experience in financial compliance.

Professional Experience

KYC Analyst Intern

Wells Fargo, San Francisco, CA — June 2025 – Present

- Verify customer documentation, ensuring all information is accurate and aligned with Anti-Money Laundering (AML) regulations.

- Conduct preliminary risk assessments based on customer profiles, transaction history, and other available financial data.

- Prepare KYC reports for senior compliance officers, contributing to comprehensive risk management and audit processes.

- Maintain and update KYC databases to ensure timely and accurate record-keeping.

Student Volunteer

California State University – Finance Club, San Francisco, CA — September 2022 – May 2023

- Participated in financial compliance workshops focusing on KYC/AML regulations, equipping club members with industry-relevant knowledge.

- Collaborated on research projects, analyzing the latest developments in financial crime prevention and regulatory practices.

Education

Bachelor of Science in Finance

California State University, San Francisco, CA — Graduated: May 2025

- Relevant coursework: Financial Regulations, Risk Management, KYC Compliance, Anti-Money Laundering (AML), Corporate Finance, Financial Crime Prevention.

- Senior Thesis: "The Impact of KYC Regulations on the Prevention of Financial Crimes in the U.S. Banking Sector."

Certifications

- Introduction to KYC & AML Compliance, Coursera — Certified: April 2023

- Financial Crime and Compliance Management, Udemy — Certified: January 2023

Skills

- KYC Documentation Review

- AML Regulatory Knowledge

- Customer Risk Profiling

- Financial Regulations and Compliance

- Proficient in Excel and Google Sheets

- Research and Analytical Skills

- Strong Communication Skills

Professional Development

AML Best Practices Webinar

Financial Compliance Institute — Attended: January 2023

- Focused on the latest trends and best practices in anti-money laundering compliance and financial crime prevention.

Awards

- Dean’s List — California State University, San Francisco, CA — Fall 2023, Spring 2024

- Finance Club Member of the Year — California State University, San Francisco, CA — 2023

Interests

- Finance Technology

- Travel

Strong sides of this entry-level KYC analyst resume example:

- Alice showcases her hands-on internship at Wells Fargo, where she gained practical experience in KYC and AML processes.

- Being on the Dean’s List adds credibility and demonstrates strong academic performance.

- Hobbies reflect her curiosity and adaptability, traits valued in the financial and compliance industries.

- How to list experience on a resume?

- Start with your most recent occupation and go backward.

- Write the title in bold. Include the company, location, and employment dates (month and year).

- Use bullets for responsibilities and achievements.

- Prioritize relevant roles for the position you're applying for.

- Frame points around your impact and contributions.

- What skills are required for KYC analyst?

- Hard skills are teachable abilities or knowledge sets that can be quantified and typically learned through formal education, training, or on-the-job experience. These are often measurable.

- Soft skills refer to personal attributes that affect how we interact with others and navigate work environments. These are less tangible and harder to quantify, often assessed through feedback or observation.

Hard skills:

- KYC Documentation Review

- AML Regulatory Knowledge

- Customer Risk Profiling

- KYC/AML Compliance Procedures

- Anti-Money Laundering Software (e.g., World-Check, RDC)

- Data Entry & Management

- Financial Analysis

- Report Generation and Documentation

- Knowledge of International Financial Regulations

- Knowledge of Sanctions and Watchlists

- Proficient in Microsoft Excel, Word, and PowerPoint

- Database Management

- Basic Financial Accounting

- Transaction Monitoring Systems

Soft skills:

- Strong Communication Skills

- Attention to Detail

- Problem-Solving Abilities

- Time Management

- Analytical Thinking

- Team Collaboration

- Adaptability

- Multitasking

- Critical Thinking

- Organizational Skills

- Ethical Judgment and Integrity

- Decision Making

- Customer Service Orientation

- Willingness to Learn

Conclusion

Whether you’re just starting in the field, interning, or looking to advance career, tailoring an entry-level KYC analyst resume is crucial for making a lasting impression.

Each of the resume samples provided showcases how specific experiences, relevant certifications, and key skills can be framed to highlight your qualifications.

Create your professional Resume in 10 minutes for FREE

Build My Resume