When it comes to securing a job, your mortgage underwriter resume is your first chance to make a great impression. Employers in the financial industry look for specific qualifications, such as attention to detail and a strong understanding of loan regulations.

In this guide, we’ll walk you through how to write a resume that not only highlights your skills but also demonstrates your ability to contribute effectively to a lending team.

Whether you're a seasoned professional or new to the field, we’ve got tips and job resume examples to help you stand out.

Mortgage underwriter resume examples

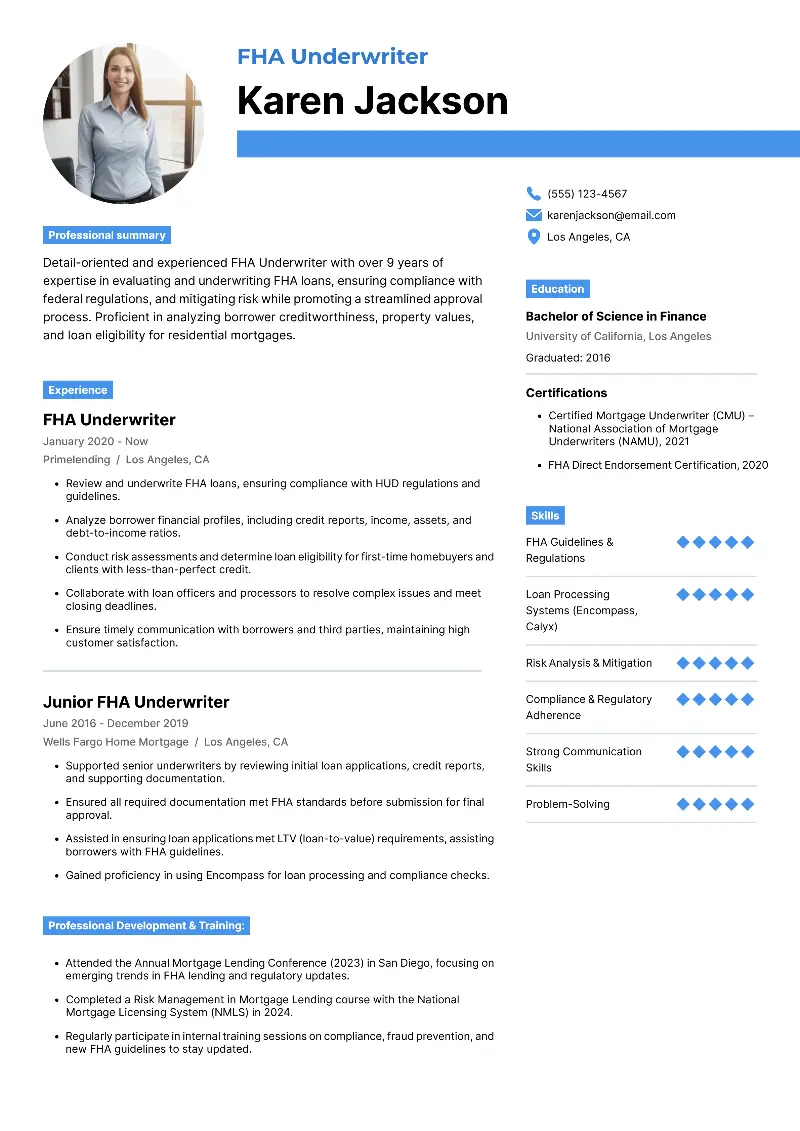

FHA mortgage underwriter resume sample

FHA underwriter resume template

Resume for FHA underwriter | Plain text

Name: Karen Jackson

Location: Los Angeles, CA

Email: karenjackson@gmail.com | Phone: (555) 123-4567

LinkedIn: /in/karenjacksonProfessional Summary:

Detail-oriented and experienced FHA Underwriter with over 9 years of expertise in evaluating and underwriting FHA loans, ensuring compliance with federal regulations, and mitigating risk while promoting a streamlined approval process. Proficient in analyzing borrower creditworthiness, property values, and loan eligibility for residential mortgages.

Professional Experience:

FHA Underwriter

Primelending, Los Angeles, CA

January 2020 – Present

- Review and underwrite FHA loans, ensuring compliance with HUD regulations and guidelines.

- Analyze borrower financial profiles, including credit reports, income, assets, and debt-to-income ratios.

- Conduct risk assessments and determine loan eligibility for first-time homebuyers and clients with less-than-perfect credit.

- Collaborate with loan officers and processors to resolve complex issues and meet closing deadlines.

- Ensure timely communication with borrowers and third parties, maintaining high customer satisfaction.

- Contribute to internal audits and pipeline reviews to improve underwriting accuracy and reduce rework.

Junior FHA Underwriter

Wells Fargo Home Mortgage, Los Angeles, CA

June 2016 – December 2019

- Supported senior underwriters by reviewing initial loan applications, credit reports, and supporting documentation.

- Ensured all required documentation met FHA standards before submission for final approval.

- Assisted in ensuring loan applications met LTV (loan-to-value) requirements, assisting borrowers with FHA guidelines.

- Gained proficiency in using Encompass for loan processing and compliance checks.

- Liaised with processors to correct discrepancies and gather outstanding documentation.

Education:

Bachelor of Science in Finance

University of California, Los Angeles

Graduated: 2016

Certifications:

- Certified Mortgage Underwriter (CMU) – National Association of Mortgage Underwriters (NAMU), 2021

- FHA Direct Endorsement Certification, 2020

Skills:

- FHA Guidelines & Regulations

- Loan Processing Systems (Encompass, Calyx)

- Risk Analysis & Mitigation

- Compliance & Regulatory Adherence

- Strong Communication Skills

- Problem-Solving

- Income & Credit Evaluation

- HUD Handbook Interpretation

- Self-Employed Borrower Analysis

Professional Development & Training:

- Attended the Annual Mortgage Lending Conference (2023) in San Diego, focusing on emerging trends in FHA lending and regulatory updates.

- Completed a Risk Management in Mortgage Lending course with the National Mortgage Licensing System (NMLS) in 2024.

- Regularly participate in internal training sessions on compliance, fraud prevention, and new FHA guidelines to stay updated.

Strong sides of this mortgage underwriter resume example:

- It clearly demonstrates a well-defined career path, showing growth and increasing responsibility.

- Technical computer skills related to FHA-specific underwriting help the candidate stand out as a specialized expert.

- The description of daily duties is detailed and tailored to the position, using action verbs that emphasize initiative.

- How to properly format a resume for a mortgage underwriter?

- Choose a professional, easy-to-read font. Arial, Calibri, Times New Roman, or Verdana are great options.

- Keep your font size between 10.5pt and 12pt for the body text.

- Use 14pt to 16pt for your name and resume section headings to make them stand out.

- Add 1.15 to 1.5 line spacing for the body text, and double space between parts to give your document a clean, open appearance.

- A resume size should be 1 to 2 pages, depending on your level of experience.

- Employ 1-inch margins on all sides. This ensures the looks well-balanced and avoids overcrowding.

- Align the text to the left, and utilize center alignment for your name and contact information at the top.

To avoid any formatting issues, especially if you're unsure about spacing or overall design, use an online AI resume editor.

Resume Trick offers easy-to-use free resume templates, so you can focus on content rather than worrying about alignment or font sizes.

Create your professional Resume in 10 minutes for FREE

Build My Resume

Senior mortgage underwriter resume example

Sample senior mortgage underwriter resume

Name: Mark Johnson

Location: Chicago, IL

Email: markjohnson@gmail.com | Phone: (555) 987-6543

LinkedIn: /in/markjohnsonProfessional Summary:

Senior Underwriter with 11+ years of experience in high-volume mortgage underwriting, specializing in both conventional and non-conforming loan products. Expert in evaluating complex borrower profiles, managing risk, and maintaining strict compliance with lending regulations.

Professional Experience:

Senior Underwriter

JPMorgan Chase, Chicago, IL

March 2018 – Present

- Underwrite and approve complex loan applications, including conventional, jumbo, and non-QM loans, for high-net-worth clients.

- Lead and mentor a team of 5 junior underwriters, providing training on underwriting guidelines, system usage, and regulatory compliance.

- Ensure compliance with company policies and federal guidelines, while maintaining high-quality loan production.

- Collaborate closely with sales teams to understand client needs and ensure smooth loan processes, reducing turnaround times by 15%.

- Assess creditworthiness and financial stability of borrowers, including self-employed individuals and large investors.

- Review layered risk factors and recommend alternative loan structures when necessary.

Underwriter

Quicken Loans, Chicago, IL

February 2014 – February 2018

- Underwrote and approved conventional and FHA loans, managing risk and ensuring compliance with underwriting standards.

- Worked with borrowers and loan officers to resolve credit or eligibility issues, improving the approval rate by 12%.

- Contributed to process improvements, reducing loan approval time by 20%.

- Performed automated and manual underwriting reviews using DU and LP systems.

Education:

Bachelor of Science in Business Administration

DePaul University, Chicago, IL

Graduated: 2013

Certifications:

- Certified Mortgage Underwriter (CMU), 2019

- Fannie Mae and Freddie Mac Underwriting Certification, 2018

- Certified Risk and Compliance Professional (CRCP), 2017

Skills:

- Complex Loan Underwriting

- Risk Management

- Regulatory Compliance (QM, Dodd-Frank, TRID)

- Jumbo & Non-Conforming Loans

- Team Leadership & Training

- Loan Processing Software (Encompass, Ellie Mae)

- Portfolio Review & Quality Control -Tax Return & Self-Employment Income Evaluation

- Pipeline Management & Workflow Optimization

Leadership & Mentorship:

- Mentor to Junior Underwriters. Developed and led a mentoring program within JPMorgan Chase to foster the development of junior underwriters, improving team efficiency by 25%.

- Process Improvement Leader. Spearheaded the creation of a standardized underwriting checklist, reducing the number of rejections by 18% and improving the accuracy of loan approvals.

This example of a resume for mortgage underwriter will impress recruiters:

- The ability to mentor and train others is a key selling point, demonstrating leadership skills that are essential for a senior role.

- The competence to work with high-net-worth individuals is particularly attractive for employers looking for experienced underwriters capable of handling sophisticated financial scenarios.

- The resume includes specific examples of process improvement, such as the creation of a standardized checklist, which demonstrates an ability to drive operational efficiency.

- Should I choose a mortgage underwriter resume objective or summary?

A resume summary quickly highlights your experience, key achievements, and what you bring to the role.

- Best for: Experienced professionals.

Mortgage underwriter resume summary sample:

Results-driven mortgage underwriter with 8+ years of experience evaluating loan applications and assessing financial risk. Proven track record of identifying and mitigating risk while ensuring compliance with state and federal regulations. Excellent communication and problem-solving skills.

An objective in resume focuses on your work goals and what you aim to achieve in the role.

- Best for: Entry-level candidates or those changing careers.

Mortgage underwriter resume objective example:

Motivated and detail-oriented individual seeking to leverage my analytical skills and knowledge of mortgage lending regulations to contribute to a dynamic mortgage underwriting team.

- How to showcase your mortgage underwriter resume skills?

The skills section in resume is vital because it demonstrates your expertise and qualifications in a concise, easy-to-read format.

- Hard skills are the technical, job-specific competencies that are typically acquired through training, education, or experience.

- Soft skills are the personal qualities and attributes that influence how you interact with others and approach tasks.

Mortgage underwriter hard skills examples:

- Mortgage Loan Origination Systems (LOS)

- Risk Assessment and Management

- Knowledge of Federal and State Regulations

- Credit Analysis

- Financial Statement Analysis

- Underwriting Guidelines (Fannie Mae, Freddie Mac, FHA, VA)

- Loan Documentation Review

- Debt-to-Income (DTI) Ratio Calculation

- Mortgage Compliance and Auditing

- Property Appraisal Analysis

Samples of soft skills for a mortgage underwriter:

- Attention to Detail

- Critical Thinking

- Problem-Solving

- Communication

- Time Management

- Adaptability

- Teamwork and Collaboration

- Customer Service

- Decision-Making

- Organizational Skills

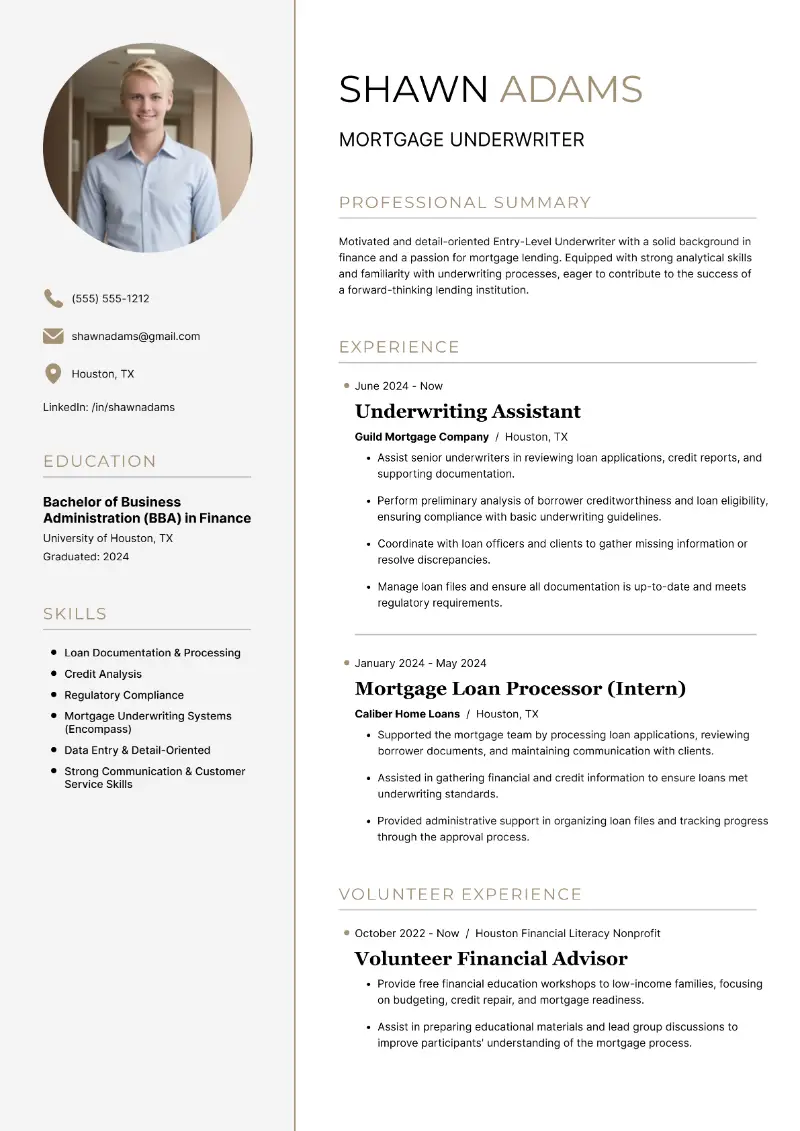

Entry-level mortgage underwriter resume template

Beginner mortgage underwriter resume sample

Resume for mortgage underwriter | Text version

Name: Shawn Adams

Location: Houston, TX

Email: shawnadams@gmail.com | Phone: (555) 555-1212

LinkedIn: /in/shawnadamsProfessional Summary:

Motivated and detail-oriented Entry-Level Underwriter with a solid background in finance and a passion for mortgage lending. Equipped with strong analytical skills and familiarity with underwriting processes, eager to contribute to the success of a forward-thinking lending institution.

Professional Experience:

Underwriting Assistant

Guild Mortgage Company, Houston, TX

June 2024 – Present

- Assist senior underwriters in reviewing loan applications, credit reports, and supporting documentation.

- Perform preliminary analysis of borrower creditworthiness and loan eligibility, ensuring compliance with basic underwriting guidelines.

- Coordinate with loan officers and clients to gather missing information or resolve discrepancies.

- Manage loan files and ensure all documentation is up-to-date and meets regulatory requirements.

- Support quality control by verifying accuracy and completeness of loan documentation.

Mortgage Loan Processor (Intern)

Caliber Home Loans, Houston, TX

January 2024 – May 2024

- Supported the mortgage team by processing loan applications, reviewing borrower documents, and maintaining communication with clients.

- Assisted in gathering financial and credit information to ensure loans met underwriting standards.

- Provided administrative support in organizing loan files and tracking progress through the approval process.

- Coordinated with title companies and appraisal services to ensure timely delivery of required reports.

Education:

Bachelor of Business Administration (BBA) in Finance

University of Houston, TX

Graduated: 2024

Skills:

- Loan Documentation & Processing

- Credit Analysis

- Regulatory Compliance

- Mortgage Underwriting Systems (Encompass)

- Data Entry & Detail-Oriented

- Strong Communication & Customer Service Skills

- File Management

- Deadline Tracking

- Vendor Coordination (Appraisal, Title)

Volunteer Experience:

Volunteer Financial Advisor

Houston Financial Literacy Nonprofit

October 2022 – Present

- Provide free financial education workshops to low-income families, focusing on budgeting, credit repair, and mortgage readiness.

- Assist in preparing educational materials and lead group discussions to improve participants' understanding of the mortgage process.

This sample mortgage underwriter resume is effective for several reasons:

- The BBA in Finance from the University of Houston is appropriate and relevant for the role, showing foundational knowledge in finance and lending.

- The volunteer section demonstrates the proactive nature, commitment to helping others, and understanding of financial literacy.

- The layout makes it easy for hiring managers to quickly assess the candidate's qualifications.

- What academic credentials should I add to my mortgage underwriter resume?

The education resume section is important because it shows your qualifications and knowledge base in the finance industry.

Most mortgage underwriters hold at least a bachelor’s degree in a related field such as finance, economics, or business administration.

- Write your degree(s), such as Bachelor of Science in Finance.

- Include the name of the university or college where you earned your diploma.

- Your graduation date gives employers a timeline of your educational background.

- If you have certifications for resume like the Certified Mortgage Underwriter (CMU), add them here.

- If you’re a recent graduate or have specific coursework related to underwriting, mention it briefly.

- How to organize the experience section in a mortgage underwriter resume?

- List your most recent role first, followed by previous positions in reverse chronological order.

- Use bullet points to make this part easy to skim.

- Be sure to quantify your achievements whenever possible.

- Start each bullet point with a strong action verb.

Conclusion

A well-crafted mortgage underwriter resume is essential for capturing the attention of hiring managers in a competitive job market.

By showcasing your relevant experience, certifications, and key skills like risk assessment and regulatory compliance, you can position yourself as an ideal candidate for the position.

Remember to tailor your document to each job application and keep it clear, concise, and focused on your strengths.

Create your professional Resume in 10 minutes for FREE

Build My Resume