As organizations continue to face diverse challenges, the demand for skilled professionals who can mitigate potential issues has grown significantly. A well-crafted risk management resume is essential for standing out in a competitive job market.

Your application should highlight your expertise in identifying, assessing, and managing risks to show employers that you’re a good fit for the position.

In this guide, we’ll explore the key components that make up an effective risk manager resume and provide tips to help you write a resume online.

Risk management resume examples

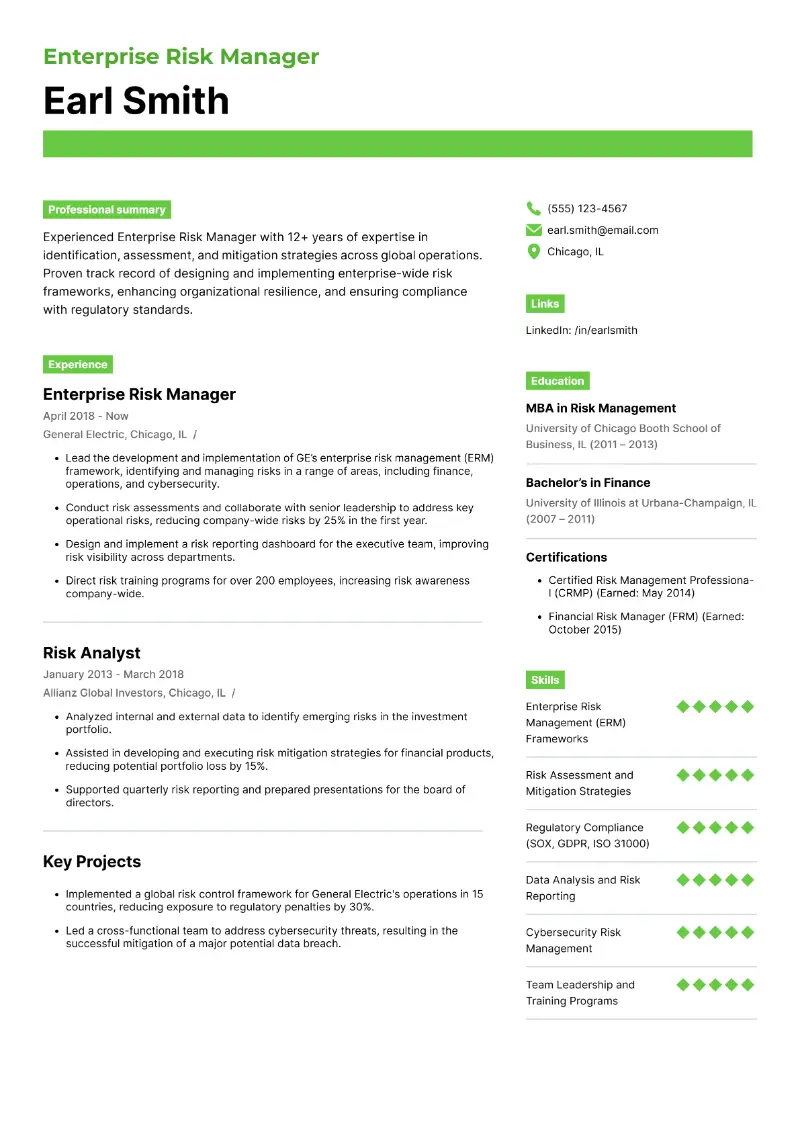

Enterprise risk management resume sample

Enterprise risk manager resume template

Resume for enterprise risk management | Plain text

Earl Smith

Phone: (555) 123-4567 | Email: earl.smith@email.com | LinkedIn: /in/earlsmith | Location: Chicago, IL

Summary

Experienced Enterprise Risk Manager with 12+ years of expertise in identification, assessment, and mitigation strategies across global operations. Proven track record of designing and implementing enterprise-wide risk frameworks, enhancing organizational resilience, and ensuring compliance with regulatory standards.

Skills

- Enterprise Risk Management (ERM) Frameworks

- Risk Assessment and Mitigation Strategies

- Regulatory Compliance (SOX, GDPR, ISO 31000)

- Data Analysis and Risk Reporting

- Cybersecurity Risk Management

- Team Leadership and Training Programs

Experience

Enterprise Risk Manager

General Electric, Chicago, IL

April 2018 – Present

- Lead the development and implementation of GE’s enterprise risk management (ERM) framework, identifying and managing risks in a range of areas, including finance, operations, and cybersecurity.

- Conduct risk assessments and collaborate with senior leadership to address key operational risks, reducing company-wide risks by 25% in the first year.

- Design and implement a risk reporting dashboard for the executive team, improving visibility across departments.

- Direct risk training programs for over 200 employees, increasing awareness company-wide.

Risk Analyst

Allianz Global Investors, Chicago, IL

January 2013 – March 2018

- Analyzed internal and external data to identify emerging risks in the investment portfolio.

- Assisted in developing and executing risk mitigation strategies for financial products, reducing potential portfolio loss by 15%.

- Supported quarterly risk reporting and prepared presentations for the board of directors.

Key Projects

- Implemented a global risk control framework for General Electric's operations in 15 countries, reducing exposure to regulatory penalties by 30%.

- Led a cross-functional team to address cybersecurity threats, resulting in the successful mitigation of a major potential data breach.

Education

MBA in Risk Management

University of Chicago Booth School of Business, IL (2011 – 2013)

Bachelor’s in Finance

University of Illinois at Urbana-Champaign, IL (2007 – 2011)

Certifications

- Certified Risk Management Professional (CRMP) (Earned: May 2014)

- Financial Risk Manager (FRM) (Earned: October 2015)

Strong sides of this risk management resume example:

- Clear and concise structure with a well-written summary showcasing extensive experience and quantifiable achievements.

- A strong focus on technical and leadership skills relevant to enterprise risk management, including regulatory compliance and team training.

- Detailed project descriptions that highlight measurable outcomes, demonstrating the candidate's ability to deliver impactful results.

- Combines strategic risk management with hands-on implementation, such as designing dashboards and leading cybersecurity initiatives.

- How to properly format a resume for a risk manager?

- Choose a clean font such as Arial, Calibri, or Times New Roman. Stick to 10-12 point size for readability.

- Keep your paper to one page resume format if you have less than 10 years of experience. If you have more, you can extend it to two pages resume format.

- Set your margins to 1 inch on all sides of risk management resume. This ensures your document looks balanced and doesn’t appear cramped.

- Use single spacing within resume sections and add extra space (1.15-1.5 spacing) between different parts for clarity.

- Make sure the headings (like Experience, Skills, Education) are bolded or slightly larger so they stand out.

- Align text to the left for easy reading. Avoid using centered or right-aligned text as it can disrupt the flow.

- Employ bullet points to list achievements and responsibilities. Keep them concise and action-oriented.

To make sure your application looks polished, use free resume builder.

Resume Trick provides professional resume templates, ensuring perfect formatting every time.

Create your professional Resume in 10 minutes for FREE

Build My Resume

Financial risk manager resume example

Sample financial risk management resume

Emily Davis

Phone: (555) 987-6543 | Email: emily.davis@email.com | LinkedIn: /in/emilydavis | Location: New York, NY

Summary

Accomplished Financial Risk Manager with 11+ years of experience in analysis, portfolio management, and regulatory compliance. Expertise in managing financial risk exposure and implementing strategies to protect assets. Strong understanding of market trends, financial instruments, and economic factors influencing risk.

Skills

- Financial Risk Modeling and Mitigation

- Portfolio Risk Management

- Market and Credit Risk Assessment

- Basel III and Dodd-Frank Compliance

- Hedging Strategies and Derivatives

- Bloomberg Terminal and MATLAB

- Data Visualization (Tableau, Power BI)

- Liquidity Risk Management

Experience

Senior Financial Risk Manager

J.P. Morgan Chase, New York, NY

June 2017 – Present

- Manage financial risk for a $3 billion portfolio, performing assessments and recommending hedging strategies to mitigate market volatility.

- Lead the implementation of risk control measures aligned with the Basel III regulatory framework, ensuring compliance with international standards.

- Work closely with the treasury team to develop and implement liquidity models that reduce risk exposure by 20%.

- Present monthly risk reports to the senior management team, enabling timely decision-making.

Financial Risk Analyst

Goldman Sachs, New York, NY

August 2014 – May 2017

- Assisted in assessing market, credit, and operational risks for fixed-income securities and derivatives.

- Developed and maintained risk metrics and models to support financial decision-making processes.

- Collaborated with the audit team to ensure the accuracy of risk reports and compliance with internal policies.

Technical Skills

- Proficient in risk management tools such as Bloomberg Terminal, SAS, and MATLAB.

- Advanced expertise in data visualization tools like Tableau and Power BI.

- Strong knowledge of regulatory frameworks, including Basel III and Dodd-Frank Act compliance.

Education

Master’s in Finance

Columbia Business School, New York, NY (2012 – 2014)

Bachelor’s in Economics

Boston University, MA (2008 – 2012)

Certifications

- Chartered Financial Analyst (CFA) Level II Candidate (Earned Level I: December 2016)

- Financial Risk Manager (FRM) (Earned: July 2018)

This risk management resume example is great as:

- Highlights technical expertise in financial risk tools and regulatory frameworks, making the application stand out for finance-specific roles.

- Includes achievements such as managing high-value portfolios and reducing risk exposure, supported by concrete data.

- Offers a tailored technical and computer skills section that emphasizes proficiency in key software for financial analysis.

- Education and certifications align directly with the position, showing a strong foundation in finance and ongoing professional development.

- Should I choose a risk management resume objective or resume summary?

- When to use: If you have substantial experience in risk management and want to highlight your expertise.

- Length: 3-4 sentences.

- What to include: Key accomplishments, your job history, top skills, and how you contribute to the company strategies.

Risk management resume summary sample:

Experienced risk management professional with 8+ years in risk assessment, compliance, and financial analysis. Proven track record of identifying and mitigating risks across multiple industries, including finance and manufacturing. Expert in implementing effective risk management frameworks and strategies.

- When to use: If you're a recent graduate or switching careers.

- Length: 2-3 sentences.

- What to include: Your work goals, interest in the position, and what you aim to contribute to the company.

Risk management resume objective example:

Motivated and detail-oriented recent graduate with a focus on risk management seeking an entry-level position where I can apply my academic knowledge and problem-solving skills to contribute to effective risk assessment and management.

- How to showcase your risk management resume skills?

The skills resume section is crucial because it show your ability to perform the essential tasks needed for the job.

- Hard skills are competencies specific to risk management, such as assessment, compliance knowledge, or financial analysis. These are typically acquired through education, certifications, or hands-on experience in the field.

- Soft skills are interpersonal traits that help you work well with others, such as communication, problem-solving, or teamwork. These are often developed through work or personal development.

Risk management hard skills examples:

- Risk assessment

- Regulatory compliance

- Financial analysis

- Insurance management

- Data analysis

- Project management

- Audit management

- Cybersecurity risk analysis

- Disaster recovery planning

- Business continuity planning

Soft skills for risk management examples:

- Problem-solving

- Communication

- Analytical thinking

- Attention to detail

- Time management

- Team collaboration

- Adaptability

- Decision-making

- Negotiation

- Leadership

Insurance risk management resume template

Insurance risk manager resume sample

Resume for risk management | Text version

David Johnson

Phone: (555) 654-3210 | Email: david.johnson@email.com | LinkedIn: /in/davidjohnson | Location: Los Angeles, CA

Summary

Experienced Insurance Risk Manager with 10+ years in managing risk and exposure in the insurance industry. Skilled at developing risk management policies, evaluating insurance claims, and implementing cost-effective strategies. Proven ability to reduce risk exposure and enhance mitigation measures for large insurance portfolios.

Skills

- Risk Analysis and Underwriting Practices

- Claims Data Analysis and Risk Pricing

- Regulatory Compliance (NAIC Guidelines)

- Risk Mitigation Strategies

- Team Management and Leadership

- Actuarial Collaboration and Model Development

- Insurance Portfolio Risk Assessment

- Microsoft Access and SQL

Experience

Insurance Risk Manager

State Farm Insurance, Los Angeles, CA

July 2019 – Present

- Lead risk analysis for State Farm’s property and casualty insurance portfolio, identifying and mitigating potential claims risks.

- Design risk mitigation strategies that resulted in a 15% decrease in claims costs year-over-year.

- Manage a team of 5 risk analysts, providing training on assessment techniques and compliance with insurance regulations.

- Conduct quarterly risk audits and prepare comprehensive reports for the executive team.

Insurance Risk Analyst

Allstate Insurance, Los Angeles, CA

February 2015 – June 2019

- Analyzed underwriting data to identify trends in claims, helping to refine risk pricing models.

- Collaborated with the actuarial team to develop risk-adjusted pricing strategies for insurance products.

- Assessed operational and financial risks related to insurance claims processing and provided recommendations to minimize exposure.

Professional Development

- Attended "Advanced Insurance Risk Management" workshop conducted by the International Risk Management Institute (IRMI) in 2022.

- Regular contributor to the "Insurance Risk Journal," publishing articles on claims risk analysis and emerging trends in the insurance industry.

Education

Bachelor’s in Risk Management & Insurance

University of Southern California, Los Angeles, CA (2011 – 2015)

Certifications

- Associate in Risk Management (ARM) (Earned: September 2017)

- Certified Insurance Counselor (CIC) (Earned: April 2019)

This sample risk management resume is effective for several reasons:

- Focuses on industry-specific achievements, such as reducing claims costs and enhancing risk mitigation strategies.

- Strong integration of certifications and professional development activities that reinforce credibility in the insurance field.

- Organized layout with clear sections that make it easy to identify relevant skills, experience, and education at a glance.

- Demonstrates promotions on resume from analyst to manager, highlighting leadership and mentoring capabilities within a team environment.

- What academic credentials should I add to my risk manager resume?

Your education resume section is essential because it proves your academic qualifications and readiness for the industry.

- List your highest level of education (e.g., Bachelor's, Master’s) and the field of study (e.g., Risk Management, Finance, Business Administration).

- Name the school or university you attended.

- Include the year you graduated or your expected date.

- If applicable, add certifications such as the Certified Risk Management Professional (CRMP) or any other relevant credentials.

- How to organize the experience section in a risk management resume?

- Start with your job title followed by the company name and the dates you worked there.

- Highlight specific outcomes or improvements you contributed to, such as risk reduction or cost savings.

- Begin bullet points with strong action verbs like "managed," "developed," or "implemented."

- Whenever possible, quantify your achievements with numbers or percentages.

Conclusion

In summary, a strong risk management resume goes beyond listing your qualifications—it demonstrates your ability to protect an organization from potential pitfalls.

By including relevant skills, quantifiable achievements, and tailored experiences, you can increase your chances of landing the job you desire.

Remember, your application is your opportunity to showcase your expertise and prove that you have what it takes to manage risk effectively.

Create your professional Resume in 10 minutes for FREE

Build My Resume