A well-crafted tax associate resume is your first step toward securing a role in the competitive field of taxation.

Whether you're just starting your professional journey or looking to make a career shift, it's crucial to highlight the skills, experience, and qualifications that employers value most.

In this article, we’ll explore how to write an effective resume that will make you stand out from the competition.

Tax associate resume examples

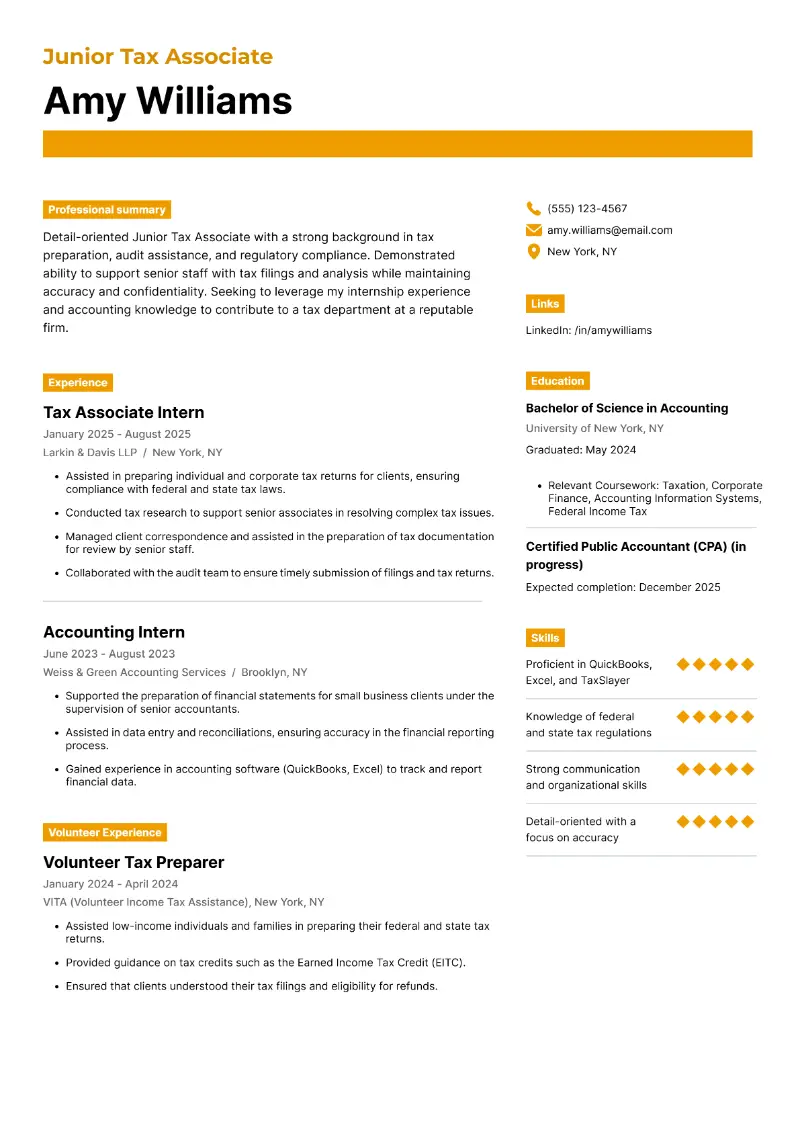

Junior tax associate resume sample

Junior tax associate resume template

Resume for junior tax associate | Plain text

Amy Williams

amy.williams@email.com | (555) 123-4567 | LinkedIn: /in/amywilliams | New York, NY

Professional Summary

Detail-oriented Junior Tax Associate with a strong background in tax preparation, audit assistance, and regulatory compliance. Demonstrated ability to support senior staff with tax filings and analysis while maintaining accuracy and confidentiality. Seeking to leverage my internship experience and accounting knowledge to contribute to a tax department at a reputable firm.

Education

Bachelor of Science in Accounting

University of New York, NY | Graduated: May 2024

- Relevant Coursework: Taxation, Corporate Finance, Accounting Information Systems, Federal Income Tax

Experience

Tax Associate Intern

Larkin & Davis LLP, New York, NY

January 2025 – August 2025

- Assisted in preparing individual and corporate tax returns for clients, ensuring compliance with federal and state tax laws.

- Conducted tax research to support senior associates in resolving complex tax issues.

- Managed client correspondence and assisted in the preparation of tax documentation for review by senior staff.

- Collaborated with the audit team to ensure timely submission of filings and tax returns.

Accounting Intern

Weiss & Green Accounting Services, Brooklyn, NY

June 2023 – August 2023

- Supported the preparation of financial statements for small business clients under the supervision of senior accountants.

- Assisted in data entry and reconciliations, ensuring accuracy in the financial reporting process.

- Gained experience in accounting software (QuickBooks, Excel) to track and report financial data.

Skills

- Proficient in QuickBooks, Excel, and TaxSlayer

- Knowledge of federal and state tax regulations

- Strong communication and organizational skills

- Detail-oriented with a focus on accuracy

Certifications

Certified Public Accountant (CPA) (in progress)

Expected completion: December 2025

Volunteer Experience

Volunteer Tax Preparer

VITA (Volunteer Income Tax Assistance), New York, NY

January 2024 – April 2024

- Assisted low-income individuals and families in preparing their federal and state tax returns.

- Provided guidance on tax credits such as the Earned Income Tax Credit (EITC).

- Ensured that clients understood their tax filings and eligibility for refunds.

Strong sides of this tax associate resume example:

- The internship provides relevant, hands-on experience in tax preparation and compliance, which is crucial for a junior role.

- The inclusion of certification (CPA in progress) shows dedication to professional development and a commitment to future growth.

- Volunteering at VITA adds credibility and demonstrates a willingness to help others while gaining tax-related skills.

- How to properly format a resume for a tax associate?

- Stick with simple fonts such as Arial, Calibri, or Times New Roman. These options are both clear and commonly accepted in the industry.

- For your main text, select a size between 10.5 and 12 points. Use a larger font (14-16 points) for headings to help them stand out.

- Keep margins between 0.5 inches and 1 inch on all sides of tax associate resume. This allows for ample white space, so your resume doesn't feel congested.

- Single or 1.15 line spacing is ideal for the main text. For headings, consider 1.5 spacing to distinguish them from the body text.

- If you're early in your career or have minimal experience, limit your resume to one page. If you've been in the workforce for several years, you may extend it to two pages, but refrain from excessive details.

- Ensure that all sections follow the same structure. This includes alignment, font choice, and bullet point styles. Consistency makes your tax associate resume look organized.

- Unless you're applying for a creative role, steer clear of unnecessary graphics or images. These elements can distract from the content and hinder the ATS from correctly parsing.

To avoid issues with layout and formatting, consider trying an AI resume builder.

Resume Trick provides online resume templates, you can make sure your application looks polished, saving time and effort in the writing process.

Create your professional Resume in 10 minutes for FREE

Build My Resume

Senior tax associate resume example

Sample senior tax associate resume

Timothy Fortin

timothy.fortin@email.com | (555) 987-6543 | LinkedIn: /in/timothyfortin | Chicago, IL

Professional Summary

Experienced Senior Tax Associate with over 9 years in tax preparation, audit support, and corporate tax compliance. Proven ability to lead teams in preparing complex tax returns for individuals and businesses. Adept at utilizing tax software to streamline processes and minimize liabilities. Looking to bring my expertise to a dynamic firm to further enhance operational efficiency.

Education

Master of Science in Taxation

University of Chicago, IL | Graduated: May 2015

Bachelor of Science in Accounting

Illinois State University, Bloomington, IL | Graduated: May 2012

Experience

Senior Tax Associate

Grant Thornton LLP, Chicago, IL

January 2020 – Present

- Manage a portfolio of corporate tax clients, preparing federal and state tax returns and providing guidance on tax planning strategies.

- Supervise and mentor junior associates, reviewing work and providing training on tax regulations and software.

- Conduct comprehensive tax research for clients, ensuring compliance with changing tax laws and regulations.

- Collaborate with audit teams to review financial statements and ensure tax filings are accurate and timely.

Tax Associate

Ernst & Young, Chicago, IL

June 2016 – December 2019

- Assisted in the preparation and review of tax filings for large corporations and high-net-worth individuals.

- Worked with clients to identify potential tax savings opportunities and strategies for minimizing liabilities.

- Prepared tax provision calculations for multi-state corporations.

- Participated in client meetings to discuss tax compliance issues and provide recommendations.

Tax Associate

KPMG, Chicago, IL

July 2012 – May 2016

- Prepared federal and state tax returns for individuals and small businesses, ensuring timely submission.

- Reviewed tax documents for accuracy and completeness.

- Supported senior associates in client meetings and provided research on tax regulations.

- Assisted clients with tax planning and helped them understand deductions, credits, and exemptions.

Skills

- Proficient in tax software (ProSystem fx, GoSystem Tax RS)

- In-depth knowledge of tax laws and compliance for individuals and corporations

- Strong project management and leadership skills

- Excellent communication and client relations skills

Professional Development

Tax Law and Planning for Corporations, Certificate

Northwestern University, Chicago, IL | Completed: September 2020

Projects

Tax Strategy for Acquisitions

- Led a team in developing a comprehensive tax strategy for a $50M acquisition, resulting in a 15% tax savings for the client.

Here are a few reasons why this example of a tax associate resume will impress recruiters:

- The extensive work experience with three job entries shows deep expertise across multiple firms, giving a strong impression of versatility.

- The inclusion of supervisory responsibilities highlights leadership abilities and the capacity to mentor junior associates.

- Certifications like CPA and specialized tax law training underscore the candidate's commitment to staying current with industry standards.

- Should I choose a tax associate resume objective or summary?

- Best for individuals with experience in the tax field.

- It emphasizes your expertise and highlights your achievements.

Tax associate resume summary sample:

Tax associate with over 5 years of experience in tax preparation, compliance, and client management. Proven ability to handle complex tax returns and audits while ensuring full regulatory compliance.

- More suitable for those just starting their careers or changing industries.

- It conveys your goals and eagerness to contribute to a new role.

Tax associate resume objective example:

Aspiring tax professional with a strong background in accounting seeking a tax associate position to apply analytical skills and tax knowledge to assist clients in minimizing liabilities.

- How to showcase your tax associate resume skills?

The skills section serves as a quick reference to your capabilities, enabling employers to assess whether you have the necessary expertise for the role.

- Hard skills refer to specific, teachable competencies related to tax law, accounting, and technology.

- Soft skills are personal attributes that enable you to interact effectively with others and adapt to challenges in the workplace.

Tax associate hard skills:

- Tax return preparation

- Proficiency with tax software (e.g., QuickBooks, TurboTax)

- Knowledge of tax laws and regulations

- Auditing and financial review

- Data analysis

- Financial reporting

- Regulatory compliance

- Account reconciliation

- Understanding of tax deductions and credits

- Client portfolio management

Soft skills for tax associates:

- Effective communication

- Strong attention to detail

- Organizational skills

- Time management

- Problem-solving

- Adaptability

- Teamwork

- Client relations

- Critical thinking

- Conflict resolution

Corporate tax associate resume template

Corporate tax associate resume sample

Resume for corporate tax associate | Text version

Emily Clark

emily.clark@email.com | (555) 321-4321 | LinkedIn: /in/emilyclark | Los Angeles, CA

Professional Summary

Highly skilled Corporate Tax Associate with 11 years of experience in managing tax compliance and strategic planning for corporate clients. Proven ability to assess corporate tax risks, structure transactions efficiently, and ensure compliance with both federal and state regulations. Seeking to leverage my expertise in corporate tax strategy in a fast-paced, growth-oriented environment.

Education

Master of Business Administration (MBA) in Taxation

University of California, Los Angeles, CA | Graduated: May 2017

Bachelor of Science in Business Administration (Accounting)

University of Southern California, Los Angeles, CA | Graduated: May 2014

Experience

Corporate Tax Associate

PwC (PricewaterhouseCoopers), Los Angeles, CA

July 2018 – Present

- Manage corporate tax compliance for a portfolio of medium to large-sized clients, ensuring timely and accurate tax filings.

- Advise clients on tax-efficient strategies for mergers, acquisitions, and restructuring.

- Conduct research on tax laws and regulations to ensure compliance with evolving federal and state tax requirements.

- Collaborate with the finance team to prepare and review quarterly and annual tax provisions.

Corporate Tax Associate

Deloitte, Los Angeles, CA

August 2014 – June 2018

- Prepared federal and state tax returns for corporate clients, including multinational entities and S-corporations.

- Assisted clients with tax planning strategies to reduce liabilities and improve overall tax efficiency.

- Supported the audit team during tax audits by gathering documentation and preparing responses to IRS inquiries.

- Developed and maintained relationships with clients to understand their tax needs and provide timely solutions.

Skills

- Expertise in corporate tax compliance and planning

- Advanced knowledge of international tax regulations and transfer pricing

- Skilled in using tax software (OneSource, CCH Axcess)

- Strong analytical and problem-solving abilities

- Ability to communicate complex tax concepts to clients in a clear, concise manner

Certifications

Certified Public Accountant (CPA)

State of California | License Number: 1234567 | Issued: January 2019

Professional Development

Corporate Tax Strategy Seminar

University of California, Los Angeles, CA | Attended: March 2019

International Taxation, Certificate

American Institute of CPAs (AICPA) | Completed: November 2018

This sample tax associate resume is effective for several reasons:

- The dual corporate experience with top-tier firms like PwC and Deloitte demonstrates exposure to high-level clients and complex tax strategies.

- Advanced degrees and certifications (MBA and CPA) convey a highly qualified candidate with a strong academic foundation.

- The projects (e.g., tax strategy for acquisitions) illustrate real-world application of tax knowledge and leadership in managing large-scale tax issues.

- What academic credentials should I add to my tax associate resume?

Your education demonstrates that you have the necessary academic background in accounting, taxation, or finance.

- Start tax associate resume with your most advanced degree (e.g., Bachelor's in Accounting or Finance).

- Mention the institution where you earned your diploma.

- Include the graduation year, or if you're still studying, provide your expected date.

- If you have any relevant certifications, such as CPA or Enrolled Agent, be sure to add them.

- Highlight academic awards or recognition that are relevant to the job.

- How to organize the experience section in a tax associate resume?

- List your jobs starting with the most recent position. This allows employers to see your relevant experience first.

- Utilize bullet points to present your responsibilities and achievements in a clear and concise manner.

- Whenever possible, use numbers to demonstrate your impact, such as "Reduced tax liabilities by 10%" or "Processed over 100 tax returns per season."

- Begin each bullet with a dynamic action verb (e.g., "Analyzed," "Managed," "Advised") to give your accomplishments on tax associate resume more weight.

Conclusion

In conclusion, a strong tax associate resume can make all the difference when it comes to landing your dream job.

By emphasizing relevant skills, experience, and certifications, you can increase your chances of impressing hiring managers.

Tailor your document to each application, and keep it clear and professional to ensure the best possible results.

Create your professional Resume in 10 minutes for FREE

Build My Resume