Securing a position in finance requires more than just knowledge of bank regulations; it necessitates a compelling tax preparer resume that effectively showcases your qualifications, experience, and unique skills.

A well-crafted document can significantly influence hiring decisions, setting you apart from the competition in a crowded job market.

In this article, we will delve into the key components of an effective tax preparer resume. From outlining the essential skills and certifications to detailing relevant experience and education, we’ll provide best resume examples to help you create a resume that captures the attention of employers.

Tax preparer resume examples

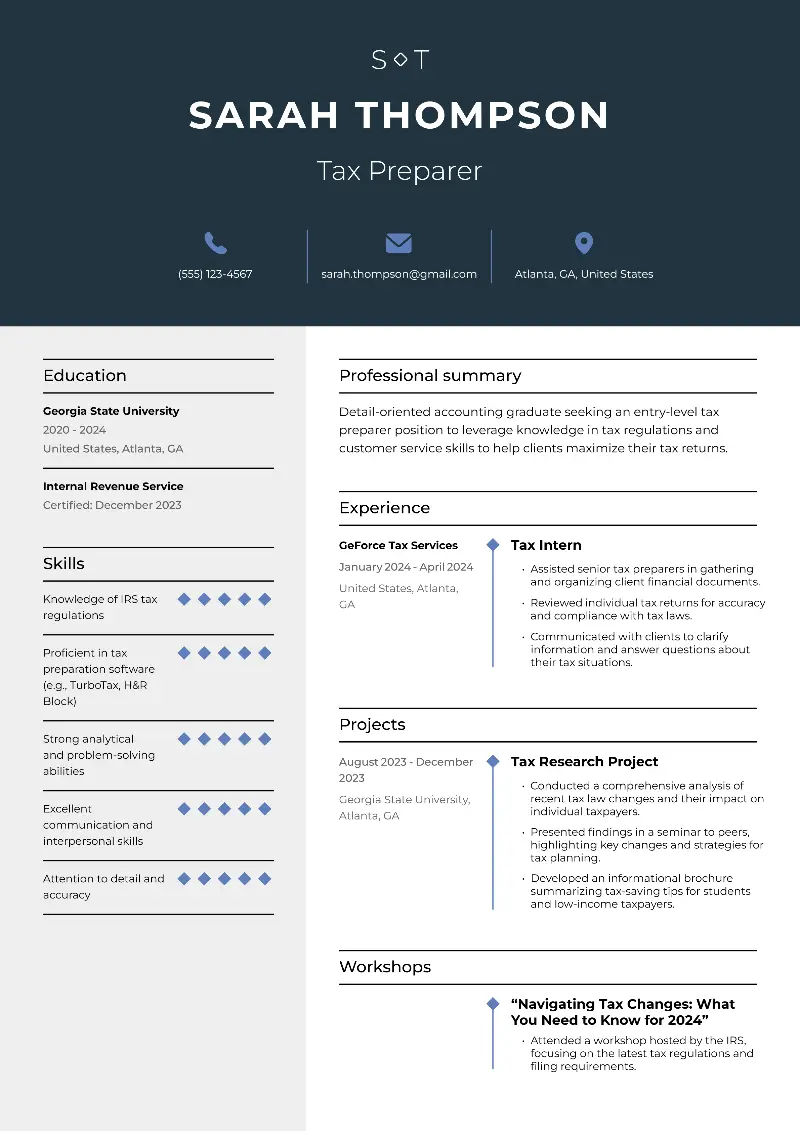

Entry-level tax preparer resume template

Entry-level tax preparer resume sample | Plain text

Sarah Thompson

Atlanta, GA

Email: sarah.thompson@gmail.com

Phone: (555) 123-4567Objective

Detail-oriented accounting graduate seeking an entry-level tax preparer position to leverage knowledge in tax regulations and customer service skills to help clients maximize their tax returns.

Education

Bachelor of Business Administration in Accounting

Georgia State University, Atlanta, GA

Graduated: May 2025

Projects

Tax Research Project

Georgia State University, Atlanta, GA

August – December 2024

- Conducted a comprehensive analysis of recent tax law changes and their impact on individual taxpayers.

- Presented findings in a seminar to peers, highlighting key changes and strategies for tax planning.

- Developed an informational brochure summarizing tax-saving tips for students and low-income taxpayers.

- Collaborated with team members to compare state-level tax differences and create data-driven visuals.

Workshops

“Navigating Tax Changes: What You Need to Know for 2024”

- Attended a workshop hosted by the IRS, focusing on the latest tax regulations and filing requirements.

Certifications

IRS Annual Filing Season Program Certification

Internal Revenue Service

Certified: December 2024

Experience

Tax Intern

GeForce Tax Services, Atlanta, GA

January – April 2025

- Assisted senior tax preparers in gathering and organizing client financial documents.

- Reviewed individual tax returns for accuracy and compliance with tax laws.

- Communicated with clients to clarify information and answer questions about their tax situations.

- Inputted data into electronic filing systems and flagged discrepancies for follow-up.

Skills

- Knowledge of IRS tax regulations

- Proficient in tax preparation software (e.g., TurboTax, H&R Block)

- Strong analytical and problem-solving abilities

- Excellent communication and interpersonal skills

- Attention to detail and accuracy

- Capable of handling confidential information with discretion and professionalism

Why this tax specialist resume example works:

- Sarah’s resume starts with a concise objective, indicating her career goals and relevant skills.

- Her education section highlights her accounting degree, which is crucial for a tax preparer role.

- The skills listed are specifically tailored to the requirements of beginner positions, demonstrating her readiness to assist clients effectively.

What is the ideal layout for the tax professional resume?

- For entry-level positions, aim for a one-page resume.

- If you have extensive experience, you can extend to two pages resume format.

- Use plain fonts such as Arial, Calibri, Times New Roman, or Helvetica.

- Apply a font size between 10 and 12 points for body text. Headings can be slightly larger.

- Set standard margins (1 inch on all sides) to provide a clean, organized look of your tax preparer resume.

- Clearly label sections of resume using bold or slightly larger font.

- Add bullet points to list responsibilities and achievements.

- Opt for formal language that conveys professionalism.

- Start descriptions with strong action verbs (e.g., "Prepared," "Assisted," "Analyzed," "Collaborated").

- Be concise and to the point. Use short, impactful sentences that convey your skills.

- While it’s important to utilize relevant terminology, avoid overloading your resume with jargon.

- Carefully proofread your document for spelling and grammatical errors.

- Customize your resume for each application by incorporating keywords mentioned in the job description.

- Place your name prominently at the top of tax preparer resume, followed by your contact information (phone number, email, LinkedIn profile, if applicable).

If you need to create a resume quickly and don’t have time to follow all the formatting rules, our online resume maker offers a quick and easy solution.

With a user-friendly interface, it offers a wide range of resume templates tailored for various job sectors, allowing you to choose the perfect layout for your needs.

Create your professional Resume in 10 minutes for FREE

Build My Resume

Seasonal tax preparer resume example

Emily Carter

Chicago, IL

Email: emily.carter@gmail.com

Phone: (555) 456-7890Objective

Enthusiastic and detail-oriented seasonal tax preparer with 3 years of experience providing exceptional service during tax season. Committed to helping clients navigate their tax obligations efficiently.

Experience

Seasonal Tax Preparer

TurboTax, Chicago, IL

January 2023 – November 2025

- Provided tax preparation services to over 300 clients during peak tax season, ensuring accuracy and compliance.

- Educated clients on tax-saving strategies and encouraged electronic filing for faster refunds.

- Managed time effectively to meet deadlines during the busiest months of the year.

- Collaborated with team members to resolve complex tax issues and improve client satisfaction.

Accounting Assistant

Smith & Co. Accounting, Chicago, IL

June – December 2022

- Assisted in bookkeeping tasks and supported tax preparers in gathering necessary documentation.

- Maintained organized financial records and prepared monthly financial statements.

- Utilized spreadsheet software to track expenses and reconcile accounts.

Education

Associate Degree in Accounting

Chicago Community College, IL

Graduated: May 2022

Certifications

Enrolled Agent

National Association of Enrolled Agents

Certification Date: June 2024

Certified Tax Professional

National Association of Tax Professionals

Certified: November 2022

Skills

- Expertise in seasonal tax preparation

- Proficient in tax software (e.g., Intuit ProConnect)

- Excellent time management and organizational skills

- Strong customer service focus

- Ability to work efficiently under pressure

- Familiar with QuickBooks and Sage

- Capable of maintaining confidentiality and handling sensitive financial data

Why this resume for tax preparer example is good?

- Emily’s resume clearly outlines her experience as a part-time preparer, which is relevant to many companies during tax season.

- She emphasizes skills like time management, which are critical during peak periods.

- The inclusion of certifications underscores her commitment to professional development and credibility.

How to show experience on a tax assistant resume

- Put your work history in reverse chronological order.

- Clearly state your position and title (e.g., Tax Assistant, Accounting Intern).

- Define the name of the organization where you worked.

- Add the city and state of the company.

- Specify the start and end dates to provide a timeline of your experience.

- Detail your responsibilities, focusing on tasks relevant to tax preparation.

- Whenever possible, incorporate metrics or outcomes that showcase your contributions.

How to choose between resume summary and objective

Resume summary:

It is a brief opening statement of your professional background. It centers on what you can bring to the employer rather than what you hope to gain from the position.

- Length: 2-4 sentences.

- Best For: Candidates with relevant experience.

Example of tax preparer resume summary:

Seasoned tax preparation manager with over eight years of experience in leading teams of tax preparers and streamlining tax processes. Exceptional ability to train and mentor staff while managing a diverse client portfolio. Committed to optimizing operational efficiency and enhancing client experience through effective tax strategies.

Resume objective:

It is an overview of your career goals and what you wish to achieve in a specific post. It generally focuses on your aspirations and long term goals rather than your past experiences.

- Length: 1-2 sentences.

- Best For: Entry-level candidates, students, career changers, or those with limited expertise.

Example of tax preparer resume objective:

Certified tax preparer with specialized knowledge in real estate and investment taxation. Seeking to utilize expertise in tax implications for property transactions to assist clients in maximizing their financial benefits.

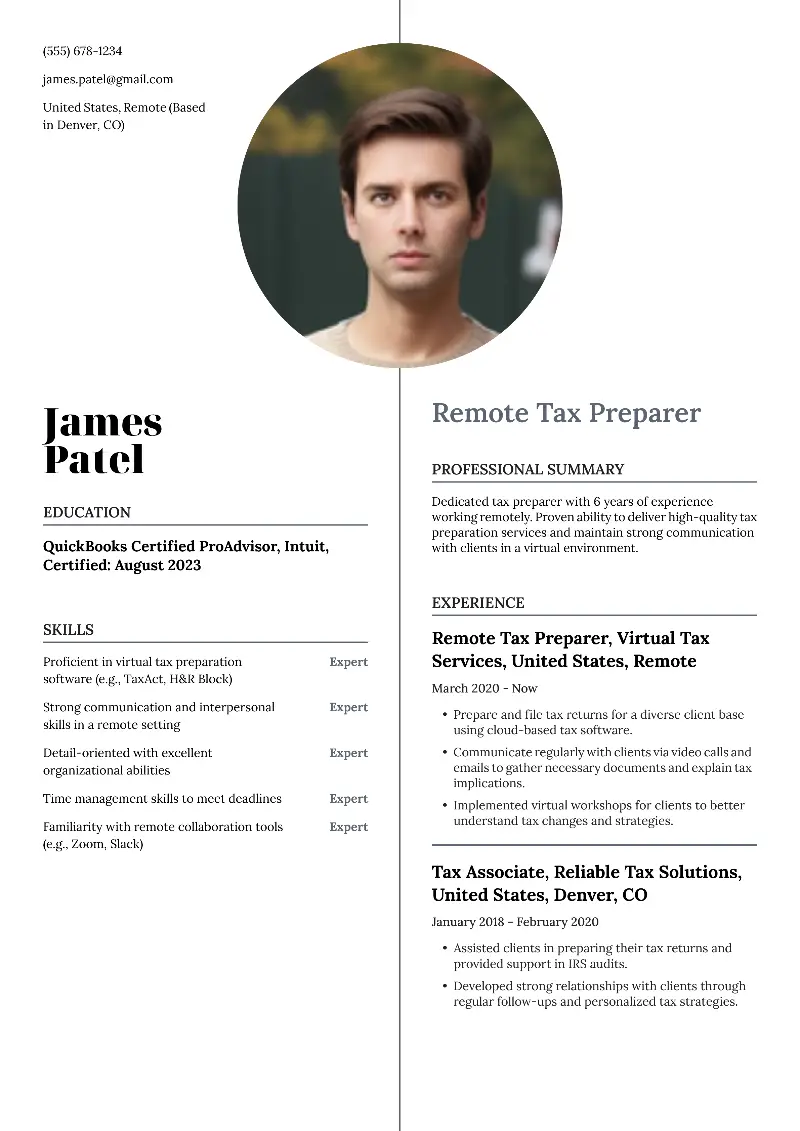

Remote tax preparer resume template

Remote tax preparer resume sample | Plain text

James Patel

Remote (Based in Denver, CO)

Email: james.patel@gmail.com

Phone: (555) 678-1234Summary

Dedicated tax preparer with 7 years of experience working remotely. Proven ability to deliver high-quality tax preparation services and maintain strong communication with clients in a virtual environment.

Experience

Remote Tax Preparer

Virtual Tax Services, Remote

March 2020 – Present

- Prepare and file tax returns for a diverse client base using cloud-based tax software.

- Communicate regularly with clients via video calls and emails to gather necessary documents and explain tax implications.

- Implemented virtual workshops for clients to better understand tax changes and strategies.

- Streamlined digital document management processes to enhance efficiency and reduce errors.

Tax Associate

Reliable Tax Solutions, Denver, CO

January 2018 – February 2020

- Assisted clients in preparing their tax returns and provided support in IRS audits.

- Developed strong relationships with clients through regular follow-ups and personalized tax strategies.

- Conducted detailed tax research to resolve complex filing issues and optimize returns.

Certifications

QuickBooks Certified ProAdvisor

Intuit

Certified: August 2023

Skills

- Proficient in virtual tax preparation software (e.g., TaxAct, H&R Block)

- Strong communication and interpersonal skills in a remote setting

- Detail-oriented with excellent organizational abilities

- Time management skills to meet deadlines

- Familiarity with remote collaboration tools (e.g., Zoom, Slack)

- Experienced in digital workflow automation for tax document processing

Strong sides of this tax consultant resume sample:

- James’s resume highlights his experience in a remote setting, making it relevant for online tax preparation roles.

- His familiarity with virtual tools is a valuable asset in today’s online work environment.

- The document is well-organized with clear headings, making it easy for hiring managers to quickly locate information.

How to add education to a resume for tax preparer

List your education in reverse chronological order (most recent first). Align the text to the left for easy reading.

Information to underline:

- The type of degree you earned (e.g., Associate, Bachelor, MBA).

- Your major or concentration (e.g., Accounting, Finance).

- The name of the school or university.

- The city and state (or country, if applicable).

- The month and year of graduation (or "Expected Graduation" if you are still in school).

- Relevant latin honors, awards, or distinctions.

What are the needed tax preparer resume skills?

- Hard skills are teachable abilities or knowledge sets that can be defined and measured. They are often acquired through education, training, and hands-on experience.

- Soft skills are interpersonal attributes that enable individuals to communicate effectively, work collaboratively, and manage their emotions. They are more subjective and harder to quantify.

Tax preparer hard skills:

- Proficiency in tax preparation software (e.g., TurboTax, H&R Block)

- Knowledge of federal and state tax regulations

- Experience with bookkeeping and accounting principles

- Data entry and analysis

- Preparation of various tax forms (1040, 1120, etc.)

- Familiarity with IRS audit processes

- Financial statement preparation

- Tax planning strategies

- Understanding of payroll tax regulations

- Knowledge of tax credits and deductions

Tax preparer soft skills:

- Strong communication skills

- Attention to detail

- Time management

- Problem-solving abilities

- Customer service orientation

- Organizational skills

- Ability to work under pressure

- Adaptability to changing tax laws

- Team collaboration

- Client relationship management

Cover letter for tax preparer

A cover letter is a formal document that you submit alongside your resume.

It serves as a personalized introduction to your application, giving you an opportunity to highlight your qualifications, skills, and experiences in a way that specifically relates to the job.

While your tax preparer resume outlines your experience and education, the cover letter explains why you’re the best fit for the role and how you can contribute to the organization.

Create your professional Cover letter in 10 minutes for FREE

Build My Cover Letter

Tax preparer cover letter

Dear Hiring Manager,

I am writing to express my interest in the Tax Preparer position at H&R Block, as advertised. With over three years of experience in tax preparation, a strong eye for detail, and a proven commitment to customer service, I am confident in my ability to assist clients in preparing their taxes accurately while helping them maximize their deductions.

In my current role as a Tax Preparer at Jackson Hewitt Tax Service, I have developed expertise in preparing both individual and small business tax returns, ensuring compliance with federal and state regulations. I take pride in my ability to analyze financial data and identify opportunities for clients to reduce their tax liability.

I am proficient in using tax software like H&R Block’s own Tax Software and TurboTax, which allows me to work efficiently and accurately during peak tax season. Additionally, I have extensive experience conducting client interviews, addressing their concerns, and explaining complex tax concepts in an understandable way.

What excites me most about the opportunity at H&R Block is the company’s long-standing reputation for providing high-quality tax services and the focus on client relationships. I am drawn to your mission of helping people navigate their taxes with ease and peace of mind, and I would love the opportunity to bring my skills in tax preparation and client service to your team.

Thank you for considering my application. I would be thrilled to further discuss how I can contribute.

Sincerely,

Lindsay J. Gray

Conclusion

Your tax preparer resume serves as a key tool to showcase your qualifications.

The resume samples provided illustrate various approaches to presenting your credentials, allowing you to adapt your document to fit your unique career path.

Ultimately, investing time in creating a polished and tailored document will significantly increase your chances of securing interviews and advancing your career in tax preparation.

Create your professional Resume in 10 minutes for FREE

Build My Resume