With the financial sector's competitive landscape, your credit risk analyst resume must highlight your analytical skills, attention to detail, and industry knowledge effectively.

In this article, we’ll explore essential credit analyst resume examples and provide practical tips to help you present your qualifications in the best light.

Whether you're a seasoned professional or new to the field, these insights will guide you in creating a resume that will capture the attention of hiring managers and set you apart from the competition.

Credit analyst resume examples

- Private risk credit analyst resume

- Commercial credit analyst resume

- Senior credit analyst resume

- Entry-level credit analyst resume

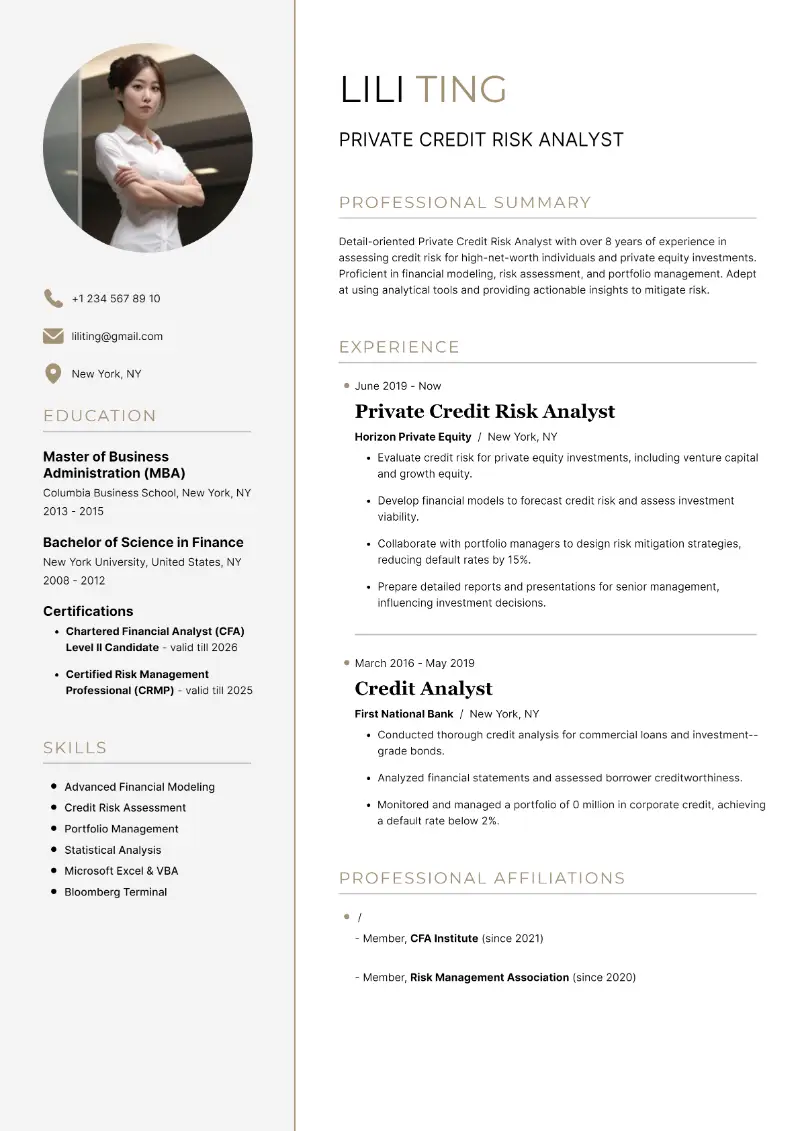

Private credit risk resume template

Private credit risk analyst resume sample

Resume for private credit analysts | Plain text

Professional Summary

Detail-oriented Private Credit Risk Analyst with over 9 years of experience in assessing credit risk for high-net-worth individuals and private equity investments. Proficient in financial modeling, risk assessment, and portfolio management. Adept at using analytical tools and providing actionable insights to mitigate risk.

Experience

Private Credit Risk Analyst

Horizon Private Equity, New York, NY

June 2019 – Present

- Evaluate credit risk for private equity investments, including venture capital and growth equity.

- Develop financial models to forecast credit risk and assess investment viability.

- Collaborate with portfolio managers to design risk mitigation strategies, reducing default rates by 15%.

- Prepare detailed reports and presentations for senior management, influencing investment decisions.

- Assess borrower capital structure and liquidity position using stress-testing scenarios under various macroeconomic conditions.

Credit Analyst

First National Bank, New York, NY

March 2016 – May 2019

- Conducted thorough credit analysis for commercial loans and investment-grade bonds.

- Analyzed financial statements and assessed borrower creditworthiness.

- Monitored and managed a portfolio of $200 million in corporate credit, achieving a default rate below 2%.

- Partnered with relationship managers to review covenant compliance and assess credit exposure over time.

Education

Master of Business Administration (MBA)

Columbia Business School, New York, NY

Graduated: 2015

Bachelor of Science in Finance

New York University, NY

Graduated: 2012

Certifications

- Chartered Financial Analyst (CFA) Level II Candidate - valid till 2027

- Certified Risk Management Professional (CRMP) - valid till 2026

Skills

- Advanced Financial Modeling

- Credit Risk Assessment

- Portfolio Management

- Statistical Analysis

- Microsoft Excel & VBA

- Bloomberg Terminal

- Moody’s RiskCalc & S&P Capital IQ

- Financial Statement Interpretation

Professional Affiliations

- Member, CFA Institute (since 2021)

- Member, Risk Management Association (since 2020)

Strong sides of this credit analyst resume example:

- It includes specific accomplishments in resume, such as reducing default rates by 15% and managing a portfolio of $200 million, which demonstrates tangible impacts.

- Membership in relevant professional organizations adds credibility and shows engagement in the industry.

- The inclusion of an MBA in resume and a CFA candidacy showcases a high level of education and commitment to professional development.

Risk comes from not knowing what you're doing.

How to properly format a credit risk analyst resume

- Choose professional fonts like Arial, Calibri, or Times New Roman. Stick to one type throughout your document.

- Use 10-12 points for the body text. Headings can be slightly larger (14-16 points).

- Keep resume margins between 0.5 and 1 inch on all sides to ensure your content is neatly framed.

- Align your text to the left for a clean, professional appearance.

- Aim for one page resume, especially if you have less than 10 years of experience.

- In the header, include your name, phone number, email address, and LinkedIn profile (if applicable).

- Incorporate keywords in resume from the job description to pass Applicant Tracking Systems (ATS).

- Avoid typos and grammatical errors. Ask someone else to review your document for clarity and accuracy.

Using an online AI resume builder can be a great way to avoid formatting issues.

Resume Trick offers professional resume templates that ensure your application looks polished and consistent. They handle font sizes, margins, and spacing automatically.

Create your professional Resume in 10 minutes for FREE

Build My Resume

Commercial credit analyst resume example

Commercial credit analyst resume sample

Professional Summary

Experienced Commercial Credit Analyst with a strong background in assessing creditworthiness for corporate clients. Skilled in financial statement analysis, risk assessment, and credit portfolio management. Committed to delivering insightful recommendations to support lending decisions.

Experience

Commercial Credit Analyst

Wells Fargo, San Francisco, CA

January 2018 – Present

- Analyze credit applications for commercial loans, including large-scale and small business clients.

- Perform detailed credit analysis and risk assessments, recommending limits and terms.

- Reduce loan delinquency rates by 10% through proactive risk management and monitoring.

- Generate credit reports and presented findings to the committee.

- Monitor macroeconomic trends to anticipate shifts in borrower performance and industry risk.

Junior Credit Analyst

Citibank, San Francisco, CA

June 2015 – December 2017

- Assisted in evaluating credit risk for a variety of commercial clients and industries.

- Conducted financial statement reviews and assessed borrower creditworthiness.

- Supported senior analysts in preparing credit risk reports and recommendations.

- Contributed to the automation of credit review processes, enhancing reporting efficiency.

Education

Bachelor of Science in Accounting

University of California, Berkeley

Graduated: 2015

Certifications

- Certified Public Accountant (CPA) - renewed in 2024

- Credit Risk Certification (CRC) - renewed in 2023

Skills

- Credit Risk Analysis

- Financial Statement Analysis

- Portfolio Management

- Data Analysis Tools

- Microsoft Office Suite

- Moody’s Analytics

- Underwriting Procedures

- Industry Benchmarking

- Internal Credit Rating Models

Awards

- Outstanding Performance Award, Wells Fargo (2023)

- Employee of the Month, Citibank (September 2017)

Why this resume example for credit analyst will impress recruiters:

- It highlights specific accomplishments like reducing loan delinquency rates by 10%, showing a direct impact on the company's financial health.

- Recognition such as the Outstanding Performance Award and Employee of the Month adds value and illustrates a track record of excellence.

- Proficiency in data analysis software like Moody’s Analytics is highlighted, shows a solid foundation in necessary tools and computer skills for the role.

Should I choose a credit analyst resume objective or summary?

A resume summary emphasizes your experience, skills, and accomplishments.

- It provides a snapshot of what you bring to the table and how you can add value to the company based on your past performance.

Mortgage analyst resume summary sample:

Detail-oriented and analytical Mortgage Analyst with over 5 years of experience in evaluating mortgage applications, assessing financial risk, and ensuring compliance with regulatory standards. Proven track record in improving loan processing efficiency and reducing approval times.

An objective statement typically highlights your career goals and what you aim to achieve in the role.

- It's a good way to convey your enthusiasm, aspirations and work goals, especially if you’re new to credit analysis.

Mortgage analyst resume objective example:

Seeking a Mortgage Analyst position at a reputable financial institution where I can apply my expertise in mortgage processing, data analysis, and regulatory compliance. Eager to contribute to the organization’s success by providing high-quality support to clients.

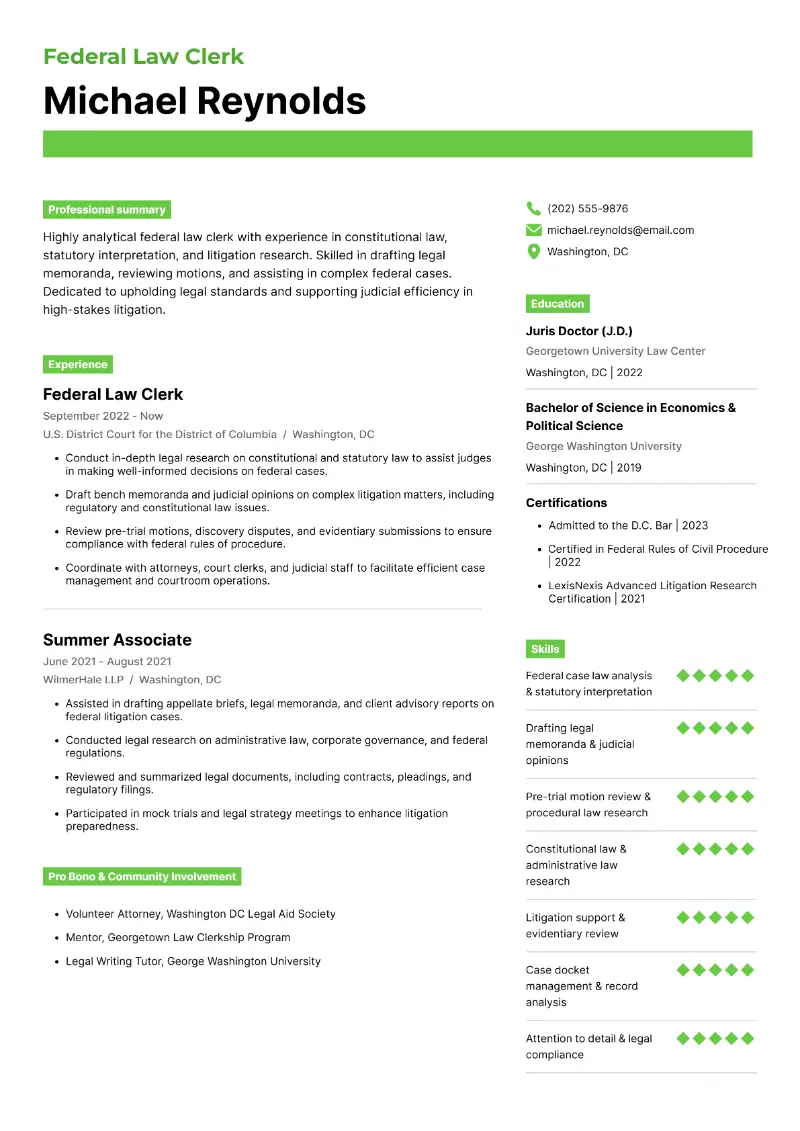

Senior credit analyst resume sample

Senior credit analyst resume example

Resume for experienced credit analysts | Text version

Professional Summary

Seasoned Senior Credit Analyst with over 13 years of experience in risk management and financial analysis. Expertise in managing large credit portfolios, developing risk mitigation strategies, and leading cross-functional teams. Proven track record of enhancing credit risk assessment processes and improving financial outcomes.

Experience

Senior Credit Analyst

JP Morgan Chase, Chicago, IL

August 2016 – Present

- Lead a team of credit analysts in evaluating and managing a diverse portfolio.

- Develop and implement credit risk assessment models, increasing forecasting accuracy by 20%.

- Conduct high-level credit reviews and presented findings to executive management.

- Spearhead a project to streamline the credit approval process, reducing turnaround time by 25%.

- Perform stress testing and scenario analysis to evaluate portfolio resilience under adverse conditions.

Credit Analyst

Goldman Sachs, Chicago, IL

July 2012 – July 2016

- Conducted detailed credit analyses for corporate and institutional clients.

- Monitored credit portfolios and assessed risk exposure to ensure compliance with company policies.

- Provided strategic recommendations to mitigate potential credit risks.

- Collaborated with external rating agencies to validate internal credit scoring methods.

Education

Master of Finance

University of Chicago Booth School of Business, IL

Graduated: 2012

Bachelor of Business Administration

University of Michigan, Ann Arbor, MI

Graduated: 2009

Certifications

- Chartered Financial Analyst (CFA) - valid till 2026

- Certified Risk Manager (CRM) - renewed in 2024

Skills

- Risk Management Strategy

- Credit Portfolio Management

- Financial Modeling & Analysis

- Leadership & Team Management

- Advanced Excel & SQL

- Risk Management Software (e.g., SAS Risk Management)

- Quantitative Risk Assessment

- Regulatory Reporting

- Cross-Functional Collaboration

Professional Affiliations

- Member, CFA Institute (since 2019)

- Member, Global Association of Risk Professionals (since 2015)

This credit analyst resume sample is effective for several reasons:

- It highlights leadership responsibilities, such as managing a team of analysts and leading cross-functional projects.

- An advanced degree (Master of Finance) and certifications (CFA, CRM) reflect a high level of expertise and professional standing.

- Membership in prestigious organizations reinforces industry involvement and credibility of this credit analyst resume.

How to showcase your credit analyst skills

The resume skill section provides a quick reference for your qualifications, allowing hiring managers to see at a glance that you have the capabilities needed for the role without having to dig through the entire resume.

- Hard skills are specific, teachable abilities or knowledge sets that are usually quantifiable and often acquired through education, training, or hands-on experience. They are generally job-specific and can be measured.

- Soft skills are interpersonal or behavioral traits that influence how effectively you interact with others and approach tasks. They are often harder to quantify and are developed through personal development.

Credit analyst resume hard skills:

- Financial Modeling

- Credit Risk Assessment

- Data Analysis

- Financial Reporting

- Excel Proficiency

- Regulatory Compliance

- Forecasting

- Investment Analysis

- Statistical Analysis

- Knowledge of Credit Scoring Systems

Credit analyst soft skills examples:

- Analytical Thinking

- Communication

- Problem-Solving

- Attention to Detail

- Time Management

- Teamwork

- Adaptability

- Negotiation

- Critical Thinking

- Decision-Making

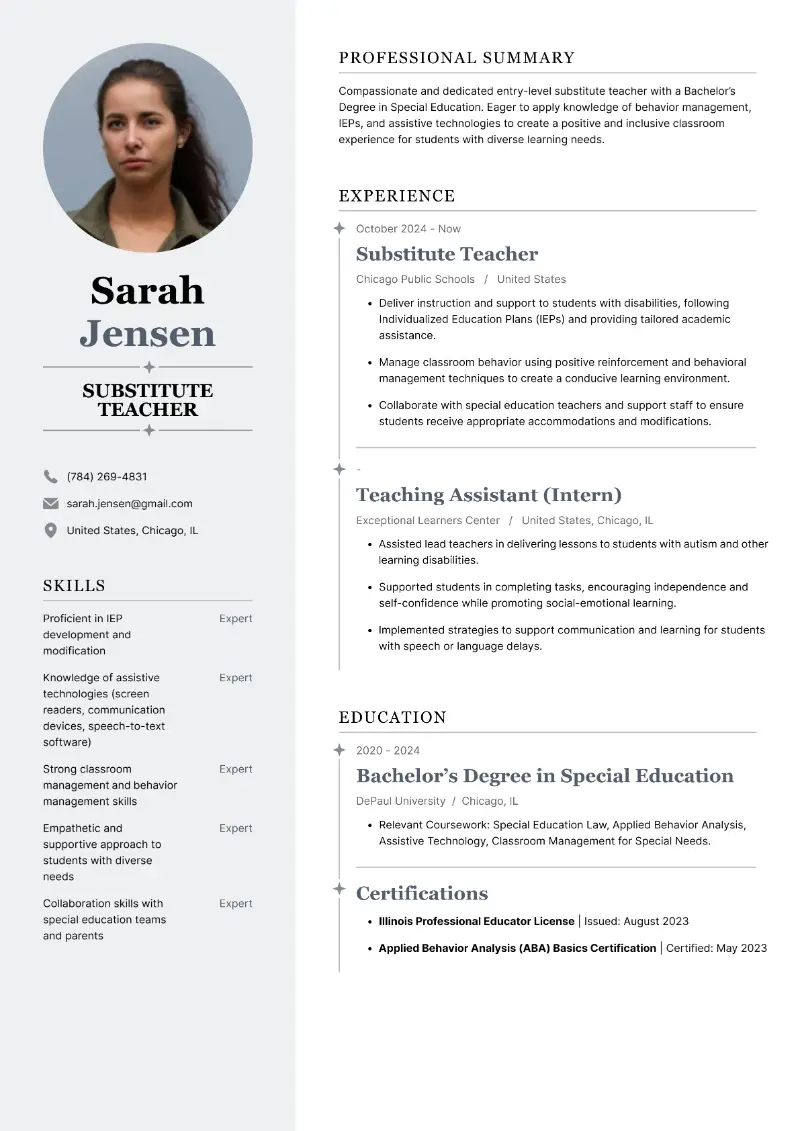

Entry-level credit analyst resume example

Beginner credit risk analyst resume sample

Objective

Recent finance graduate with strong analytical skills and a passion for credit analysis. Eager to leverage academic knowledge and internship experience to contribute as an Entry-Level Credit Analyst. Adept at financial analysis, data interpretation, and supporting senior analysts in credit assessments.

Experience

Credit Analyst Intern

Bank of America, Charlotte, NC

June – August 2025

- Assisted in reviewing credit applications and analyzing financial statements.

- Supported the credit risk assessment process by preparing preliminary reports.

- Collaborated with the team to evaluate creditworthiness and monitor portfolio performance.

- Participated in cross-departmental discussions to streamline credit approval workflows.

Finance Intern

Barclays, Charlotte, NC

June – August 2024

- Provided analytical support for financial projects and research.

- Assisted in data collection and analysis for financial reports and presentations.

- Gained exposure to various financial instruments and credit analysis techniques.

- Created detailed spreadsheets tracking loan performance metrics and key financial ratios.

Education

Bachelor of Science in Finance

University of North Carolina at Chapel Hill, NC

Graduated: 2025

Certifications

- Bloomberg Market Concepts (BMC) - valid till 2026

Skills

- Financial Analysis

- Data Interpretation

- Credit Risk Assessment

- Microsoft Excel & PowerPoint

- Basic SQL

- Attention to Detail

- Database Querying

- Time Management & Prioritization

- Problem-Solving Techniques

Extracurricular Activities

- Finance Club Member, UNC Chapel Hill (2022 - Now)

- Volunteer, Financial Literacy Program (2021 - 2022)

Why is this credit analyst resume sample effective?

- It includes hands-on experience through internships at notable companies, demonstrating practical exposure to credit analysis.

- A recent finance degree from a reputable university shows up-to-date academic knowledge, which is important for entry-level positions and students

- The certification indicates a proactive approach to gaining relevant qualifications.

What educational credentials should I add to my credit risk analyst resume?

Start by listing your highest degree first, such as a Bachelor's or Master's in finance, economics, or a related field. Include the name of the institution and the graduation year.

Include any academic honors (like summa cum laude or others) or scholarships (e.g., Dean’s List, Finance Award).

Additionally, if you have any specialized certifications, such as the Chartered Financial Analyst (CFA) or Financial Risk Manager (FRM), these should be mentioned as they demonstrate specialized knowledge and expertise in risk management.

How to organize the credit analyst job experience description for a resume

List your work experience starting with the most recent job and work backward. This format helps employers see your most relevant experience first.

For each position on credit analyst resume, include the following details:

- Job title. Clearly state your role, such as "Credit Analyst" or "Senior Credit Analyst".

- Company name. Mention the name of the organization where you worked.

- Location. Include the city and state (or country) of the company.

- Dates of employment. Use the month and year format (e.g., January 2022 – August 2024).

Highlight the tasks you performed and the results you achieved. Utilize bullet points for clarity and conciseness. Whenever possible, add numbers and metrics to quantify your achievements.

Credit analyst cover letter

A cover letter is a formal document sent along with a resume or job application.

It introduces you to a potential employer and provides a more detailed explanation of your background, highlighting how they align with the occupation you're applying for.

A good cover letter includes the following sections:

- Header. Your contact information and the employer's details.

- Introduction. A brief opening that states the position you're applying for and where you found the job listing.

- Body. The main part, where you discuss your relevant skills, qualifications, and experiences. You explain why you're a good fit for the role and how you can contribute to the company.

- Conclusion. A cover letter ending expressing interest in discussing the opportunity further in an interview. It may also contain a polite thank you.

- Signature. A formal sign-off like "Sincerely" or "Best regards," followed by your name.

Create your professional Cover letter in 10 minutes for FREE

Build My Cover Letter

Dear Mr. Anderson,

I am writing to express my interest in the Credit Analyst position at JPMorgan Chase & Co., as advertised on your careers page. With over two years of experience assessing credit risk at Bank of America, I am confident that my skills make me a strong candidate.

In my current role, I am responsible for analyzing the creditworthiness of individuals and businesses by reviewing financial statements. I’ve developed a strong understanding of financial modeling and risk assessment techniques, and I have consistently helped the team make informed lending decisions, contributing to a reduction in loan defaults. My ability to manage high volumes of data, perform in-depth analysis, and provide actionable insights aligns well with the skills required for the role at JPMorgan Chase & Co.

I have long admired JPMorgan Chase for its global reach and commitment to excellence in financial services, and I am excited about the opportunity to contribute to your team. I am eager to bring my expertise in credit analysis and risk management to a leading institution like JPMorgan Chase, where I believe my skills can have a positive impact on the company’s continued success.

I would welcome the chance to discuss how my background and expertise can contribute to the success of your credit team. Thank you for considering my application. I look forward to the opportunity to speak with you.

Sincerely,

Emma Thompson

Conclusion

A well-crafted resume is your gateway to a successful career as a credit analyst.

With these credit risk analyst resume examples and our expert strategies, you’ll be well on your way to landing interviews and advancing your career in the financial industry.

Remember to tailor your application to highlight your unique skills and experiences, and keep it updated to reflect any new achievements.

Create your professional Resume in 10 minutes for FREE

Build My Resume