Creating an impressive bank teller resume is the key to succeeding in the highly competitive financial sector. A top-notch document showcases your strengths that set you apart from the competition.

This guide will walk you through the process of writing a resume for a bank teller. You'll find expert writing tips and detailed bank teller resume examples to help you effectively present your achievements and knowledge.

By following this guide, you'll be able to craft an application that captures the attention of potential employers.

Bank teller resume examples

With the growing demand for digital services, banks are looking for specialists who possess a diverse set of skills including customer service, cash handling, and technology proficiency.

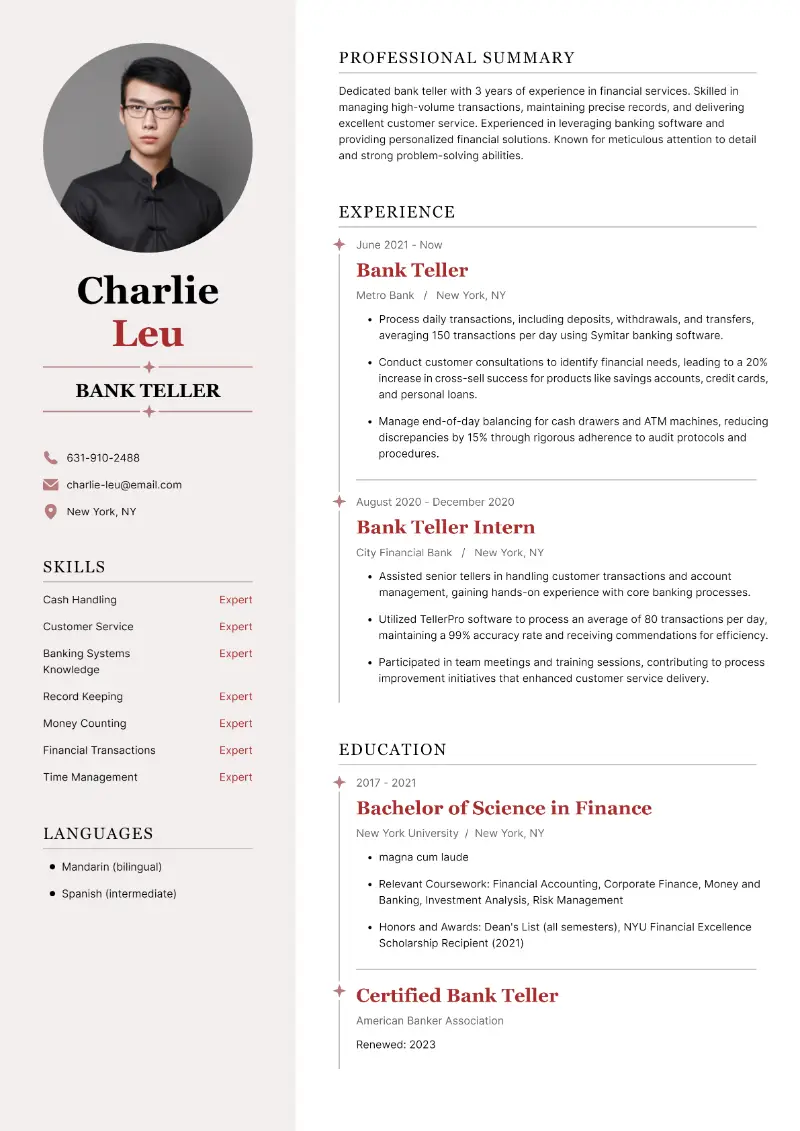

Bank teller resume template

Sample bank teller resume

John Manning

john-manning@email.com | 724-712-2951 | Pittsburgh, PAProfessional Summary

Detail-oriented and customer-focused bank teller with 8 years of experience in financial institutions. Proven ability to manage high-volume transactions, maintain accurate records, and provide exceptional customer service. Strong skills in cross-selling banking products and a solid understanding of banking regulations. Committed to maintaining the highest standards of confidentiality and integrity.

Professional Experience

Senior Bank Teller at Greenfield Bank Pittsburgh, PA April 2022 – Present

- Manage daily operations of the teller line, ensuring efficient and accurate processing of over 200 transactions daily using TellerPro software.

- Train and mentor 10 new tellers, resulting in a 20% improvement in team performance and customer service scores.

- Identify opportunities to cross-sell bank products, increasing product referrals by 15% through targeted customer interactions.

Bank Teller at Riverside Credit Union Pittsburgh, PA June 2017 – March 2022

- Processed a wide range of transactions, maintaining a 99.9% accuracy rate in daily reconciliations using Finacle banking software.

- Assisted customers with account inquiries and financial solutions, contributing to a 25% increase in customer satisfaction scores.

- Promoted and sold additional banking services such as savings accounts, CDs, and credit cards, resulting in a 30% increase in product uptake.

Customer Service Representative at Steel City Bank Pittsburgh, PA July 2016 – May 2017

- Addressed and resolved customer inquiries and issues, achieving a 95% resolution rate on the first contact using CRM software.

- Supported branch operations by processing transactions, verifying account details, and performing end-of-day reconciliations, maintaining a 98% accuracy rate.

- Conducted product demonstrations and provided personalized financial advice, leading to a 10% growth in new account openings.

Skills

- Cash Handling and Management

- Customer Service Excellence

- Cross-Selling and Upselling

- Transaction Processing

- Regulatory Compliance

- Team Training and Leadership

- Problem Resolution

- Financial Product Knowledge

- TellerPro and Finacle Software Proficiency

- CRM Systems

Education

Bachelor of Science in Finance from University of Pittsburgh Graduated in May 2017

Certifications

- Certified Bank Teller (CBT) | American Banker Association (renewed in 2024)

- Certified Customer Service Professional (CCSP) | National Customer Service Association (renewed in 2022)

References

Available upon request.

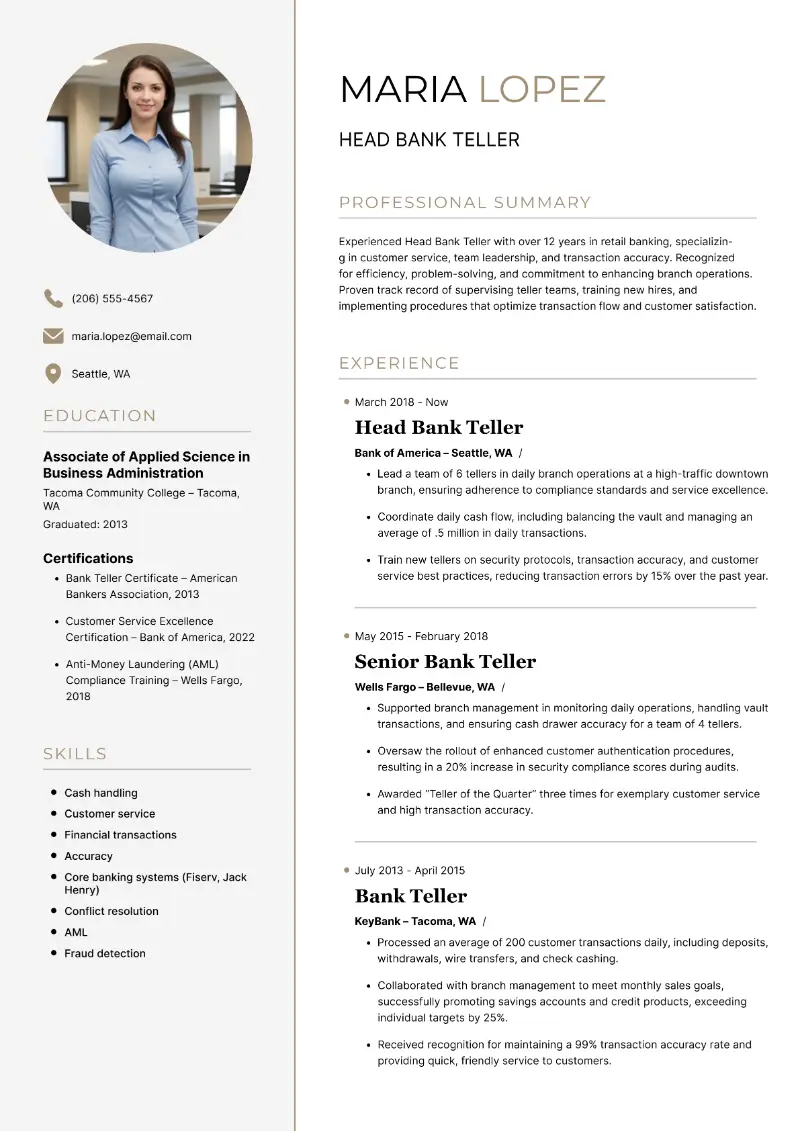

Head bank teller resume example

Resume writing guidelines

As you begin building a resume for a bank teller position, prioritize clarity. Below are some essential tips for creating a polished resume.

Resume font

- Choose a clean, professional font such as Arial, Calibri, or Times New Roman. They are easy to read and are commonly used for formal documents.

- Stick to a font size between 10 and 12 points for the main text and a bit larger for the headings.

Word choice for resume

- Incorporate keywords for resume from the job descriptions and industry-specific terms.

- Use precise, active language to describe your experience and skills.

Opt for strong action verbs like "managed", "processed", "assisted", and "resolved" to convey your responsibilities and achievements.

Resume spacing

- Utilize single spacing between lines and double between resume sections. Such an organization creates a polished look and makes it easy for hiring managers to quickly scan your bank teller resume.

Margins in resume

- Maintain consistent margins on all sides of your resume. Standard margins are 1 inch on the top, bottom, and sides.

If you need to fit more information, you can reduce the margins to 0.75 inches, but avoid going any smaller.

Bullet points in resume

- Employ bulleted lists to describe your responsibilities and accomplishments under each job entry.

- Aim for 3-5 bullet points per position to highlight your most relevant experience without overwhelming the reader.

Resume length

- Create a one page resume, especially if you have less than 10 years of experience. A concise, focused application is more effective than a lengthy one.

If you find the formatting process daunting, consider using a resume builder. With its help, you can create a well-structured and professional document that effectively demonstrates your suitability for the role.

Choose from a variety of customizable bank teller resume templates. They allow you to focus on highlighting your qualifications and not on the technical aspects.

Your application documents are the first impression employers will have of you, so make it count with the help of Resume Trick!

Create your professional Resume in 10 minutes for FREE

Build My Resume

Contact information

The contact details are a crucial part of your bank teller resume. You have to ensure that recruiters can easily reach out to you for follow-up questions, an interview, or a job offer.

What to include in contact information resume section:

- Full Name. Use the name as it appears on your legal documents.

- Phone Number. Provide a number that you will answer and ensure your voicemail message is appropriate.

- Email Address. Write a professional email address, ideally consisting of your name and initials.

- Location. Include your current city and state or the place where you'd like to relocate.

- LinkedIn Profile. If you have an active account, share the URL to your LinkedIn.

- Portfolio. Share a link if you have one showcasing your work or projects.

Double-check that all the provided information on your bank teller resume is accurate and up-to-date.

Resume objective or summary

Depending on where you are in your career, you can begin your document with a summary or objective.

A resume objective is a brief statement that describes your career goals. Usually, it's used by entry-level professionals or those transitioning to the role from a different field.

Tips for writing a bank teller resume objective:

- Use short, clear sentences to convey your message.

- Make sure your objective reflects the specific position you are applying for.

- Be as specific as possible about your personal goals for work and how they align with the role.

Bank teller resume objective sample:

Seeking a bank teller position to apply the theoretical knowledge gained through getting a degree in Finance. Aiming to enhance customer experience and support the bank's operational goals with strong practical skills and financial expertise.

For professionals with extensive banking experience, the summary would be a better choice.

A resume summary is a short overview of your skills, experiences, and achievements from the past that highlight why you are the perfect fit for a job.

Writing tips for a bank teller resume summary:

- Start with your job title and years of experience.

- Highlight your key resume skills and accomplishments.

- Tailor your summary to the job description.

- Keep it between 3-5 sentences.

Bank teller resume summary example:

Experienced bank teller with 5 years in financial services, skilled in managing transactions, maintaining accuracy, and delivering top-notch customer service. Adept at cross-selling products and resolving issues efficiently. Known for strong communication skills and attention to detail.

Experience

In most cases, work history will hold the most significant weight in your bank teller resume. This part showcases your responsibilities and results in previous roles and gives employers an idea of why you should be hired.

Organize your experience in resume

Your employment history should be listed in reverse chronological order, starting with your most recent or current role. This allows employers to see your most relevant experience first and get a clear understanding of your career progression.

Quantify achievements

Employers want to see concrete examples of how you have contributed to the success of your past companies. Using numbers and statistics can make your achievements more impressive and specific, showing the impact you made.

Include relevant details

Mention only pertinent positions and tasks that correspond with your chosen employment opportunity. This can tell about your customer service experience, as well as transferable skills such as cash handling and attention to detail.

Sample bank teller resume experience section:

Bank Teller Prairie State Credit Union (Lincoln, NE) June 2021 – Present

- Efficiently process an average of 180 transactions per day, including deposits, withdrawals, and transfers, maintaining a 99.7% accuracy rate using Core Banking System software.

- Enhance customer satisfaction by providing personalized financial solutions and resolving inquiries promptly, contributing to a 25% increase in positive feedback scores.

- Assist with daily cash management and balancing, reducing discrepancies by 10% through meticulous end-of-day reconciliations.

Bank Teller Intern Nebraska National Bank (Omaha, NE) September 2020 – May 2021

- Supported senior tellers in handling daily transactions and customer account management, processing up to 100 transactions daily with a 98% accuracy rate.

- Gained hands-on experience with banking software such as Finacle and provided detailed assistance during high-volume periods, enhancing overall branch efficiency.

- Participated in training sessions on financial products and compliance, contributing to a 15% increase in new account openings by effectively promoting credit union services.

Education

The academic background description needs to showcase your solid understanding of finance or banking principles. Moreover, you have to indicate your dedication to learning and staying up-to-date with industry standards.

List your education in chronological order, starting with the most recent degree or certification.

- Associate’s or Bachelor’s degree in finance, business, or related field (optional but preferred)

- Name of school and location

- Graduation year or expected date

- Relevant coursework (e.g., Accounting, Economics, Customer Service)

- Honors or GPA (if 3.5+ and you're early in your career)

Be sure to include all applicable credentials and training. Fresh college graduates may also expand on their academic details by listing the GPA, selected coursework, honors, and extracurricular activities in resume.

Bank teller resume sample education section:

Bachelor of Science in Finance University of North Carolina at Chapel Hill

- Graduated: May 2024

- Relevant Coursework: Financial Management, Investment Analysis, Banking and Financial Institutions, Corporate Finance

- Honors: Dean's List (2021-2024), Beta Gamma Sigma Honor Society (since 2022)

- Activities: Member of the Finance Club, Treasurer of the Investment Society

Certified Bank Teller (CBT) The American Bankers Association

- in progress

On-site training First National Bank (New York, NY)

- Summer 2023

- Completed a training program for interns, focusing on transaction processing, customer service, and compliance with banking regulations.

- Acquired practical skills in cash handling and software systems.

Bank teller resume skills

Including a combination of soft and hard skills on a bank teller resume is essential for crafting a comprehensive and competitive application. Companies are looking not only for candidates who possess the necessary technical skills but also those who can work well with customers and other employees.

Study the job description and highlight keywords that match your own abilities.

Soft resume skills for a bank teller:

- Communication

- Customer service

- Problem-solving

- Attention to detail

- Time management

- Interpersonal skills

- Adaptability

- Empathy

- Conflict resolution

- Teamwork

- Multitasking

- Professionalism

- Active listening

Hard bank teller resume skills:

- Cash handling

- Data entry

- Computer skills

- Knowledge of banking software

- Basic accounting

- Mathematical skills

- Record keeping

- Foreign currency exchange

- Financial product knowledge

- Regulatory compliance

- Transaction reconciliation

- Check verification techniques

- Fraud detection tools

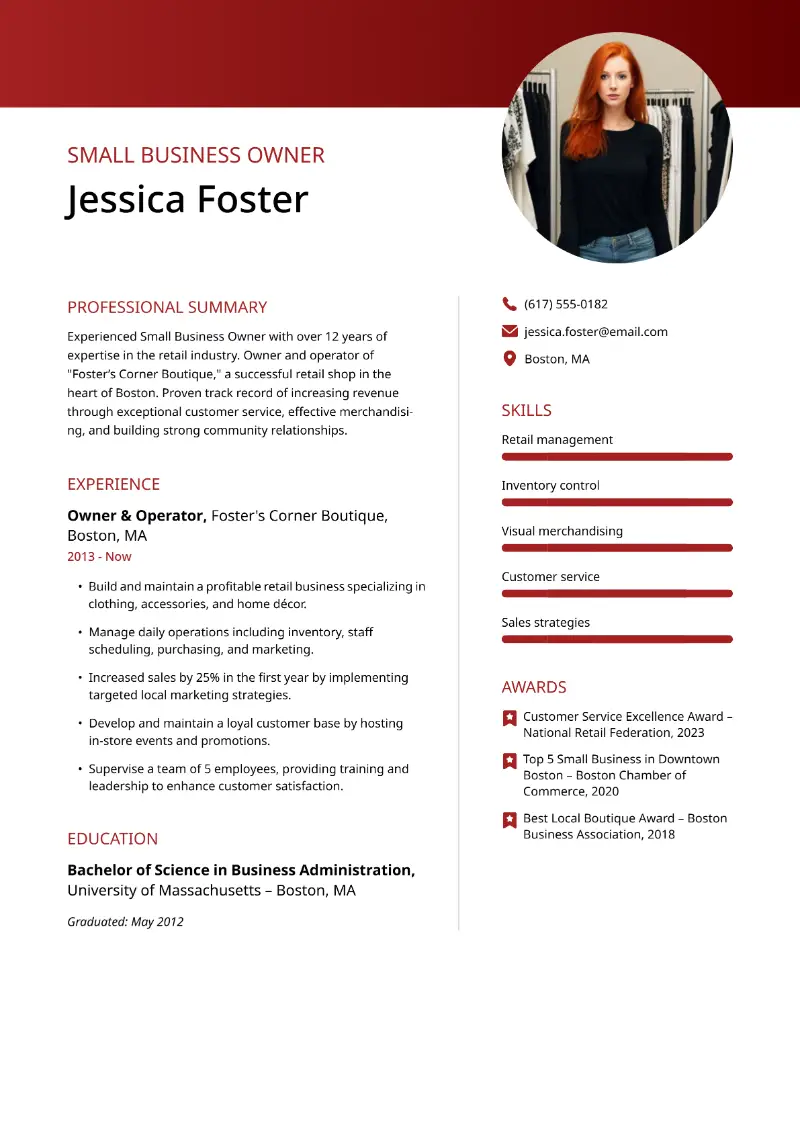

Additional information

To stand out among other candidates, it's essential to go beyond the basics of detailing work experience and education. Supplementary resume sections can showcase your unique qualifications and make a lasting impression.

Consider adding to your bank teller resume some of the following facts:

| Section | Why it’s beneficial to include |

|---|---|

| Languages | Shows ability to serve diverse customers and foreign partners. |

| Awards | Highlights recognition and honors you earned. |

| Courses | Indicates a commitment to professional development. |

| References | Provides credible endorsements. |

| Internship | Displays practical experience and industry knowledge for entry-level candidates. |

| Volunteering | Reflects community involvement and strong character. |

Providing such details offers a more comprehensive view of your abilities. Each section adds a layer of depth to your professional profile, thereby making you a more attractive candidate for the bank teller position.

Create your professional Resume in 10 minutes for FREE

Build My Resume

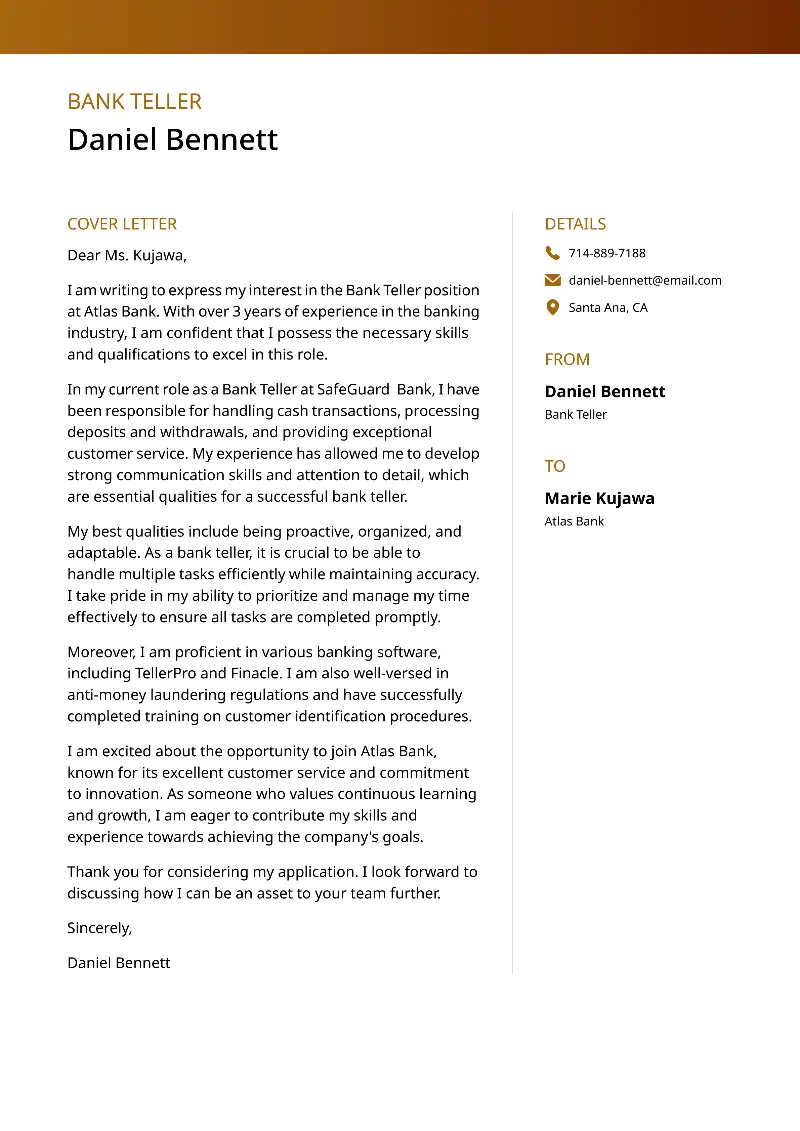

Bank teller cover letter writing

In your pursuit of a bank teller position, your cover letter allows you to expand on your resume claims. A good supporting letter showcases your skills and experience and also highlights your enthusiasm for the position.

How to write an effective cover letter for a bank teller job:

- Begin by addressing the hiring manager by name, if possible.

- Explain why you are interested in this position and why you are a good fit.

- Share any pertinent experience or skills and provide specific examples from your previous work experience or education.

- Use positive language and convey your desire to work at this particular bank.

- Keep your cover letter short, between 250-400 words, and stick to the most relevant information.

Now, let's look at some good bank teller cover letter examples: one for an experienced candidate, and one for an entry-level applicant.

Bank teller cover letter example:

Dear Ms. Swinney,

I am writing to express my enthusiasm for the bank teller position at Evergreen National Bank. I have over three years of experience in retail banking and a strong commitment to delivering exceptional customer service. Hence, I am confident in my ability to contribute effectively to your team.

In my current role as a client care specialist at Summit Financial Services, I have developed excellent communication and problem-solving skills. I manage customer inquiries, resolve issues, and process transactions efficiently. My attention to detail and ability to work accurately under pressure have been instrumental in maintaining high standards of service and productivity.

One of my significant achievements was implementing a streamlined transaction process that reduced customer wait times by 20%. This initiative involved utilizing QuickBooks and Fiserv banking software to automate routine tasks, ensuring more efficient handling of transactions and improved customer satisfaction. My knowledge of these systems, combined with my ability to train colleagues on their use, has been a key factor in enhancing operational efficiency.

My academic background includes a Bachelor’s degree in Finance from Arizona State University, where I gained a comprehensive understanding of financial principles, banking regulations, and economic trends. This education has equipped me with the analytical skills necessary to perform effectively in a bank teller role.

I am particularly drawn to Evergreen National Bank because of its outstanding reputation for customer service and commitment to community engagement. I am inspired by your bank's efforts to build strong relationships with customers and support local initiatives, and I am eager to contribute to these endeavors.

I am excited about the opportunity to bring my skills and passion for customer service to Evergreen National Bank as a bank teller. I am confident that my dedication, professionalism, and commitment to excellence will make a positive impact on your team.

Thank you for considering my application.

Sincerely, Wade Estrada

Sample cover letter for a bank teller with no experience:

Dear Mr. Shaw,

I am writing to express my interest in the position of bank teller at Citywide Financial Bank. Despite not having any prior background as a bank teller, I am eager to gain knowledge and thrive in this capacity.

I am confident that my exceptional ability to provide top-notch customer service. I have meticulous attention to detail and an aptitude for thriving in demanding situations that make me a suitable candidate for this role.

As a recent graduate with a degree in Finance from The University of St. Thomas, I have gained a solid understanding of banking operations and procedures through my coursework. In addition, my part-time job at Green Market Retail Store has provided me with valuable experience in managing financial exchanges and communicating effectively with customers.

I am highly organized and possess excellent numerical skills, which I believe are crucial for success as a bank teller. Additionally, I am skilled in utilizing a variety of computer applications, including MS Excel and banking software like Finacle.

While I may not have direct experience handling transactions as a bank teller, I am confident in my transferable skills and strong work ethic that would benefit your team. I am a quick learner and will be able to adapt to the unique processes and systems of your bank quickly.

In addition to my qualifications, I am also passionate about providing exceptional customer service and building relationships with clients. As someone who values honesty and integrity, I understand the importance of maintaining confidentiality when handling sensitive financial information.

Enclosed is my resume for your consideration. I would welcome the opportunity to further discuss how my skills can contribute to the success of your team.

Thank you for your time and consideration.

Sincerely, Walter Markham

Create your professional Cover letter in 10 minutes for FREE

Build My Cover Letter

Proofread everything

Polishing your bank teller resume and cover letter before sending them to recruiters is crucial to ensure they are error-free and present you in the best light.

Tips to effectively proofread your documents:

- Have a break. Step away from your bank teller's resume and cover letter for a few hours or a day before reviewing them.

- Read aloud. This approach helps you catch awkward phrasing and grammatical errors.

- Take advantage of helpers. Utilize grammar and spell-check tools to improve your writing.

- Print out. Looking at a hard copy can help you spot errors you might miss on a screen.

- Get a second opinion. Have someone else review your documents for mistakes you might overlook.

By carefully reviewing your application materials, you can increase your chances of making a great impression on potential employers.

Conclusion

Crafting a standout bank teller resume involves highlighting your skills, experience, and unique qualifications through well-organized sections.

Use the above bank teller resume examples for guidance and follow our tips to create a compelling document that gets the attention of potential employers. You'll be well on your way to securing your desired position!

Create your professional Resume in 10 minutes for FREE

Build My Resume