Creating a standout insurance resume is key to landing interviews in this competitive and detail-oriented field.

Whether you're applying for a role in underwriting, claims, sales, or actuarial analysis, your application needs to showcase the right mix of industry knowledge, technical skills, and customer-centric experience.

In this guide, you’ll find expert resume creation tips, role-specific resume samples, and formatting strategies to help you craft a document that gets noticed.

Insurance resume examples

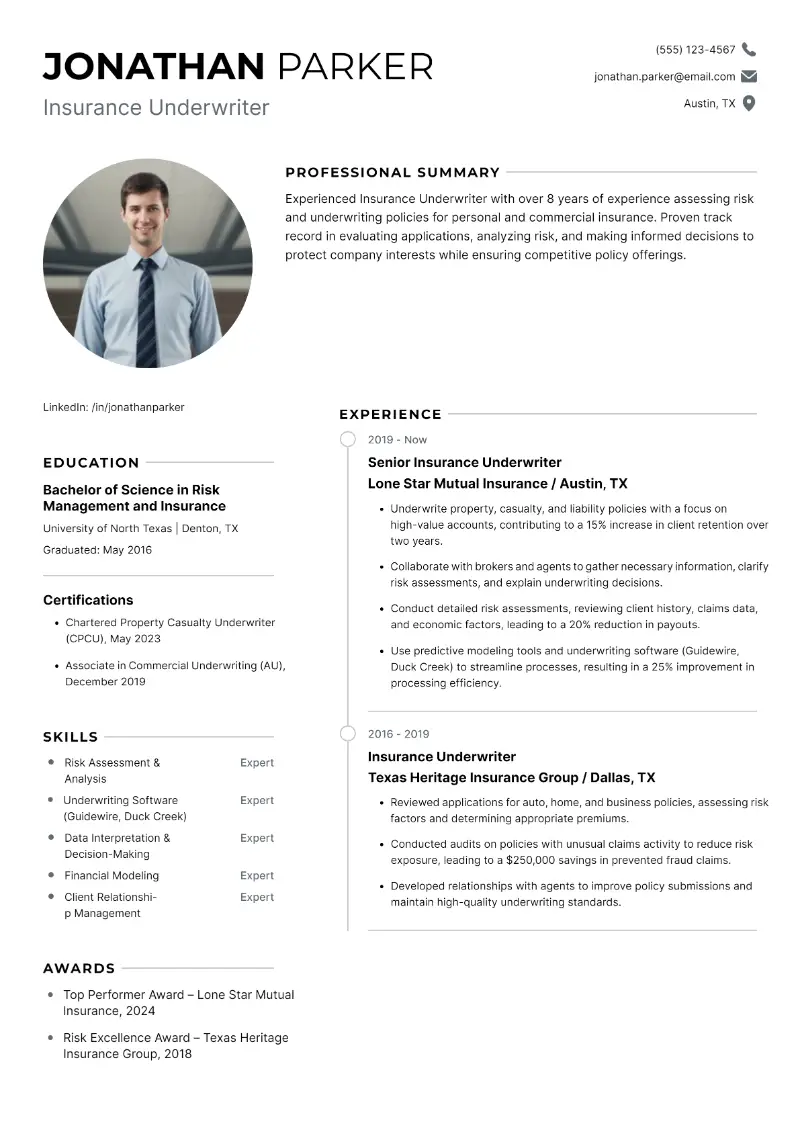

Health insurance underwriting resume sample

Health insurance underwriting resume template

Resume for health insurance underwriting | Plain text

Emily Novak

emilynovak@email.com | +1 312-555-2784 | Chicago, IL | LinkedIn.com/in/emilynovakSummary

Detail-oriented health insurance underwriter with experience assessing medical risk, reviewing complex applications, and determining eligibility for private and group plans. Skilled in regulatory compliance and digital underwriting systems, with a track record of reducing claim denials by 20% through proactive risk controls.

Skills

- Medical underwriting

- Risk analysis and classification

- HIPAA and ACA compliance

- Salesforce and Guidewire

- Premium rate calculation

- Digital application processing

- MS Excel (pivot tables, VLOOKUP)

- Attention to detail

- Analytical thinking

- Communication and collaboration

- Decision-making under pressure

Experience

Blue Cross Blue Shield of Illinois – Health Insurance Underwriter

Chicago, IL | Sep 2020 – Present

- Review up to 50 new individual and group health insurance applications per week, focusing on accuracy and risk tolerance thresholds.

- Collaborate with medical directors and actuarial teams to assess complex cases involving chronic conditions or prior claim histories.

- Reduce average claim rejection by 20% by implementing an internal pre-screening checklist for high-risk applicants.

- Deliver monthly compliance reports aligned with ACA and HIPAA requirements, maintaining a 100% audit success rate.

Wellmark Blue – Junior Underwriter

Des Moines, IA | Jul 2017 – Aug 2020

- Processed and verified applicant data for new health and supplemental policy requests under direct supervision.

- Communicated with brokers and internal stakeholders to gather missing information or clarify documentation, reducing processing delays.

- Maintained a 99% error-free rate in applicant file reviews, ensuring regulatory alignment.

- Assisted in transitioning to a new digital underwriting platform, providing feedback and training for staff across two offices.

Education

Bachelor of Science in Health Administration

University of Iowa | Iowa City, IA

Graduated: 2017Certifications

- Associate in Underwriting (AU), The Institutes – Mar 2021

- HIPAA Privacy and Security Certification – Jul 2020

Volunteer Experience

Chicago Wellness Foundation – Community Health Volunteer

Chicago, IL | 2021 – Present

- Assist in screening uninsured individuals for eligibility in local health coverage programs.

- Educate community members on preventive health options and policy awareness.

Strong sides of this insurance agent resume example:

- Clearly structured sections with concise summaries that highlight industry-specific achievements.

- Includes significant accomplishments in resume, such as reduced claim rejections, making her impact measurable.

- Features a tailored volunteer section that aligns with the healthcare focus.

- How to properly format an insurance resume?

- Choose a professional font like Calibri, Arial, or Garamond (10–12 pt).

- Keep the ideal resume length to one page (two if you have over 10 years of experience).

- Set margins to 1 inch on all sides of your insurance resume.

- Employ 1.15 or 1.5 line spacing for readability.

- Left-align all body text and dates for consistency.

- Save and send your file as a PDF to preserve the look.

- Add clear section headers like Summary, Skills, Experience, and Education.

- Don’t insert tables or text boxes—they may not scan well in ATS systems.

- Include your contact details at the top in a smaller font (10 pt is fine).

- Utilize bold for job titles and company names, but don’t overuse it.

- Refrain from long paragraphs—stick to short, impactful bullet points.

The best tip to avoid formatting issues and writing from scratch? Try resume builder free of charge.

Resume Trick offers the best template for resume tailored for different industries. They can help you organize your content logically and save time.

Create your professional Resume in 10 minutes for FREE

Build My Resume

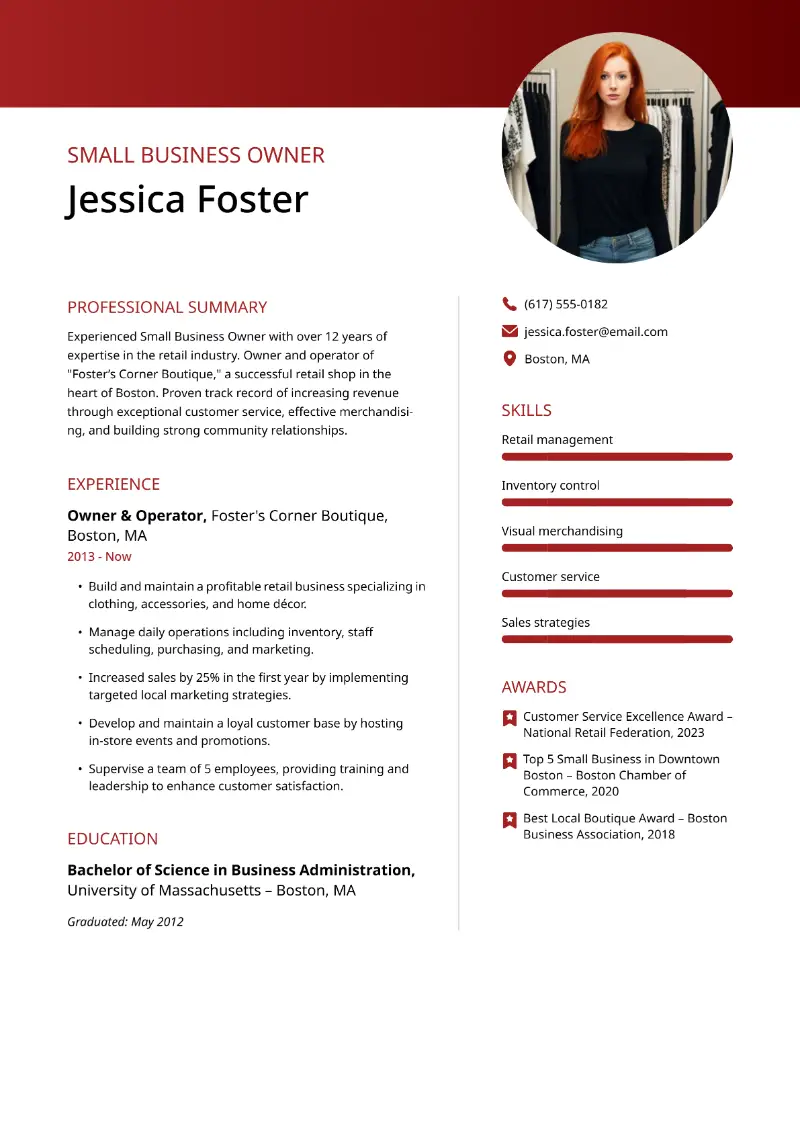

Claims insurance adjuster resume example

Sample claims insurance adjuster resume

Tyrese Coleman

tyrese.coleman@email.com | +1 404-555-1032 | Atlanta, GA | LinkedIn.com/in/tyresecolemanSummary

Licensed insurance adjuster with experience investigating auto and property claims. Skilled in field inspections, customer negotiation, and legal liability assessment. Known for fast, accurate evaluations and clear communication under pressure.

Skills

- Claims investigation and resolution

- Property and casualty insurance

- Auto accident claims

- Xactimate estimating software

- On-site inspections and damage assessment

- Legal liability and policy coverage analysis

- MS Excel and claims tracking CRM

- Conflict de-escalation

- Customer negotiation

- Empathy and professionalism

- Field reporting

- Root cause analysis

- Time management

- Cross-functional collaboration

- Regulatory compliance

Experience

State Farm – Claims Insurance Adjuster

Atlanta, GA | Feb 2020 – Present

- Manage over 80 property and auto claims monthly, handling damage evaluations, interviews, and documentation for fast resolution.

- Conduct on-site inspections for residential damage, using Xactimate to create detailed repair estimates within 48 hours.

- Reduce average claim cycle time by 25% by streamlining documentation practices and digital intake forms.

- Receive "Top Adjuster Award" in 2022 for maintaining a 95% customer satisfaction rate and $3.2M+ in resolved claims.

GEICO – Claims Representative

Macon, GA | Jun 2017 – Jan 2020

- Investigated automobile accident reports and police statements to determine liability and policy coverage.

- Negotiated settlements with policyholders and third parties, resolving claims up to $50,000 with minimal disputes.

- Created comprehensive case files and adhered to state-specific compliance laws throughout each claim cycle.

- Collaborated closely with in-house legal and repair shop teams to expedite claims with potential legal complications.

Education

Bachelor of Arts in Criminal Justice

Georgia State University | Atlanta, GA

Graduated: 2017Certifications

- Georgia Insurance Adjuster License – Active since Jan 2018

- Xactimate Level 1 Certification – May 2023

- NAIC Claims Handling Ethics Certificate – Sep 2022

Languages

- English (native)

- Spanish (professional proficiency)

Here are a few reasons why this example of an insurance agent resume will impress recruiters:

- Offers detailed, result-oriented bullet points that reflect the high-stakes nature of claims work.

- Demonstrates bilingual skills and certifications to support career flexibility and professionalism.

- Highlights both auto and property claims, showing a well-rounded experience range.

- Should I choose an insurance agent resume objective or summary?

Use a professional summary for resume if you have a job history in insurance and want to show career highlights.

- Length: 2–4 lines

- Include: Title, years of experience, one or two achievements or strengths, and industry focus.

Insurance resume summary sample:

Licensed insurance underwriter with 5+ years of experience in property and casualty insurance. Skilled in risk assessment, policy evaluation, and client relationship management. Reduced claim disputes by 22% through process improvements.

Opt for an good objective for resume if you're just starting or switching fields.

- Length: 1–2 lines

- Include: Career goal and what you aim to contribute.

Insurance resume objective example:

Motivated business graduate seeking an entry-level claims analyst role in a fast-paced insurance company. Eager to apply strong analytical and communication skills to support efficient claims processing.

- How to showcase your insurance resume skills?

The skills section helps recruiters quickly evaluate your qualifications—especially if your document is being scanned by software (ATS).

- Hard skills are teachable, job-specific abilities like underwriting or data analysis. You can gain them through formal education, training, or on-the-job experience.

- Soft skills are personality-driven traits that affect how you work and interact with others. These are developed through practice and reflection.

Insurance resume hard skills:

- Underwriting

- Risk analysis

- Claims processing

- Actuarial modeling

- Legal compliance

- CRM software (e.g., Salesforce)

- Policy drafting

- Microsoft Excel (advanced)

- Regulatory knowledge (e.g., GDPR, HIPAA)

- Insurance software (e.g., Guidewire, Applied Epic)

- Data entry accuracy

- Report writing

- Loss adjustment

- Budget forecasting

- Fraud detection

Soft skills for insurance resume:

- Attention to detail

- Analytical thinking

- Time management

- Communication

- Empathy

- Negotiation

- Organization

- Problem-solving

- Conflict resolution

- Adaptability

- Initiative

- Stress tolerance

- Listening

- Teamwork

- Ethical judgment

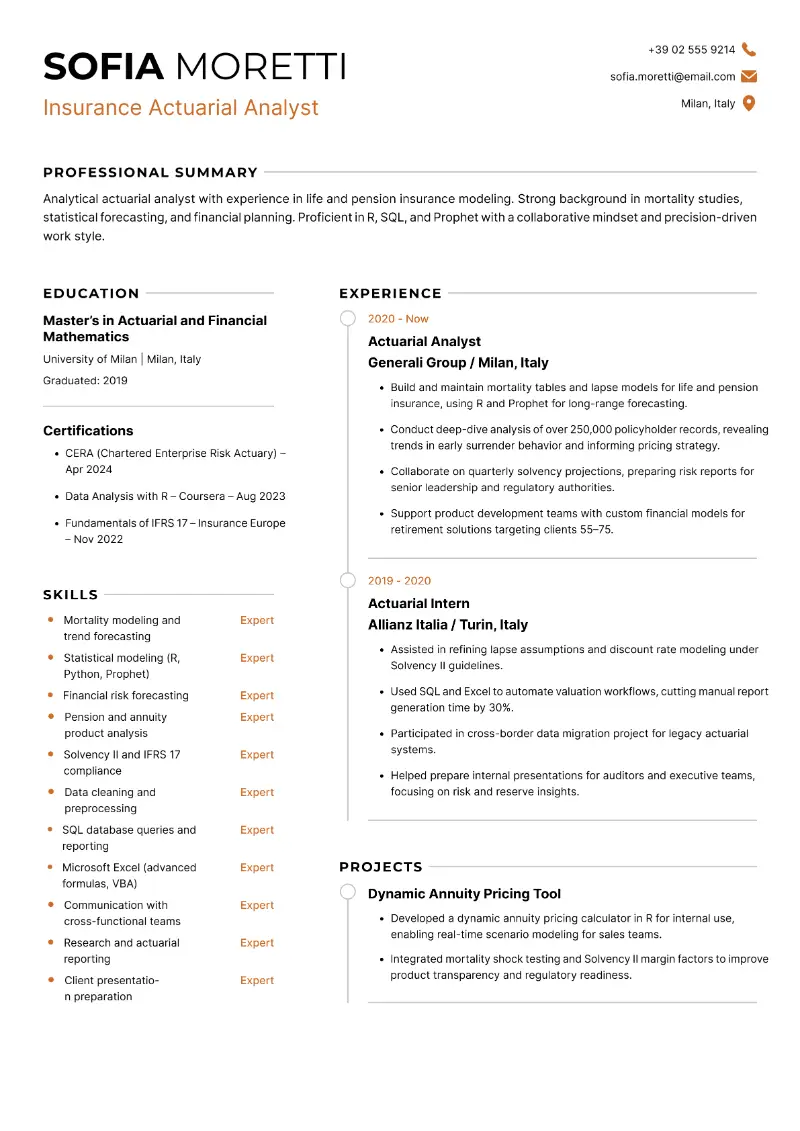

Actuarial insurance resume template

Actuarial insurance resume sample

Resume for actuarial insurance | Text version

Sofia Moretti

sofia.moretti@email.com | +39 02 555 9214 | Milan, Italy | LinkedIn.com/in/sofiamorettiSummary

Analytical actuarial analyst with experience in life and pension insurance modeling. Strong background in mortality studies, statistical forecasting, and financial planning. Proficient in R, SQL, and Prophet with a collaborative mindset and precision-driven work style.

Skills

- Mortality modeling and trend forecasting

- Statistical modeling (R, Python, Prophet)

- Financial risk forecasting

- Pension and annuity product analysis

- Solvency II and IFRS 17 compliance

- Data cleaning and preprocessing

- SQL database queries and reporting

- Microsoft Excel (advanced formulas, VBA)

- Communication with cross-functional teams

- Research and actuarial reporting

- Client presentation preparation

- Technical documentation

- Attention to detail

- Teamwork and support

- Project time estimation

Experience

Generali Group – Actuarial Analyst

Milan, Italy | Mar 2020 – Present

- Build and maintain mortality tables and lapse models for life and pension insurance, using R and Prophet for long-range forecasting.

- Conduct deep-dive analysis of over 250,000 policyholder records, revealing trends in early surrender behavior and informing pricing strategy.

- Collaborate on quarterly solvency projections, preparing risk reports for senior leadership and regulatory authorities.

- Support product development teams with custom financial models for retirement solutions targeting clients 55–75.

Allianz Italia – Actuarial Intern

Turin, Italy | Jul 2019 – Feb 2020

- Assisted in refining lapse assumptions and discount rate modeling under Solvency II guidelines.

- Used SQL and Excel to automate valuation workflows, cutting manual report generation time by 30%.

- Participated in cross-border data migration project for legacy actuarial systems.

- Helped prepare internal presentations for auditors and executive teams, focusing on risk and reserve insights.

Education

Master’s in Actuarial and Financial Mathematics

University of Milan | Milan, Italy

Graduated: 2019Certifications

- CERA (Chartered Enterprise Risk Actuary) – Apr 2024

- Data Analysis with R – Coursera – Aug 2023

- Fundamentals of IFRS 17 – Insurance Europe – Nov 2022

Projects

Dynamic Annuity Pricing Tool

- Developed a dynamic annuity pricing calculator in R for internal use, enabling real-time scenario modeling for sales teams.

- Integrated mortality shock testing and Solvency II margin factors to improve product transparency and regulatory readiness.

This sample insurance agent resume is effective for several reasons:

- Uses terms and software tools appropriately to reflect actuarial expertise.

- The project section strengthens the document by showcasing hands-on problem-solving.

- Well-balanced between technical skills and collaborative experience in multinational firms.

- What academic credentials should I add to my insurance adjuster resume?

The education section helps employers verify your background and ensure you meet the basic qualifications for the role. Include:

- Degree type

- University name

- Location (City, State, or Country)

- Graduation date (or expected year)

- GPA (if recent and 3.5+)

- Relevant coursework (optional for entry-level candidates)

- Certifications (can be listed here or in a separate section)

- How to organize the experience section in an insurance agent resume?

- Begin with your most recent job and go backward and create a reverse chronological order resume.

- Include your title, company name, city, and employment dates.

- Utilize bullet points (4–6 per role is ideal).

- Start each point with an action verb (e.g., "Developed," "Processed," "Led").

- Highlight measurable results and outcomes (percentages, dollar amounts, efficiency gains).

- Mention software, tools, or systems you used regularly.

- Show promotion on resume or role progression within the company if relevant.

- Employ past tense for previous roles and present for current positions.

- Keep the language straightforward and results-focused.

- Avoid long paragraphs—make the insurance resume easy to scan.

Conclusion

An effective insurance resume doesn’t just list your job duties—it highlights your impact, demonstrates your understanding of the industry, and aligns your experience with the role you're targeting.

Tailor your application to each position, use clear formatting, and focus on quantifiable achievements whenever possible.

Whether you're student or aiming for a senior-level role, a strong document is your ticket to standing out in the insurance world.

Create your professional Resume in 10 minutes for FREE

Build My Resume