A standout private equity resume is essential for capturing the attention of hiring managers and recruiters.

With firms increasingly focused on finding candidates who not only possess strong analytical skills but also demonstrate a deep understanding of financial markets and investment strategies, making a resume has never been more critical.

This article delves into the essential components of a PE resume, providing actionable tips and strategies to help you showcase your qualifications effectively and position yourself as a top candidate in this demanding field.

Private equity resume examples

- Real estate private equity resume

- Venture capital private equity resume

- Distressed investing private equity resume

- Entry-level private equity resume

- Operating partner in private equity resume

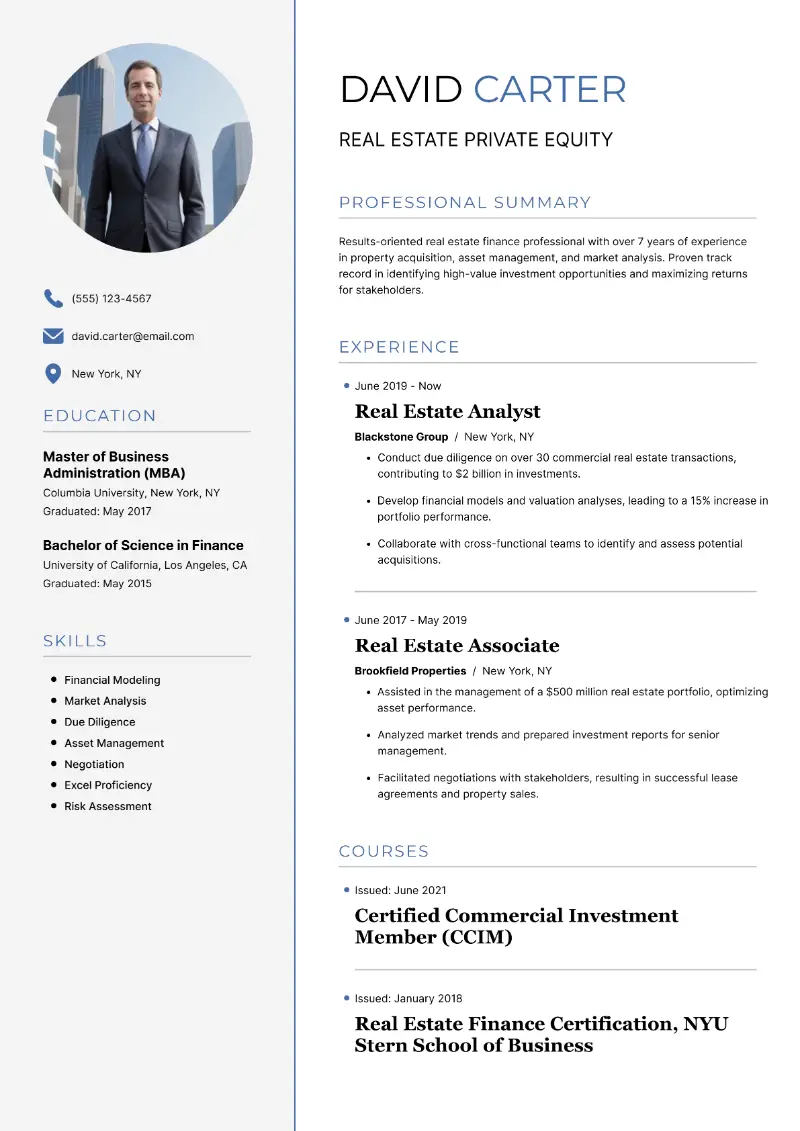

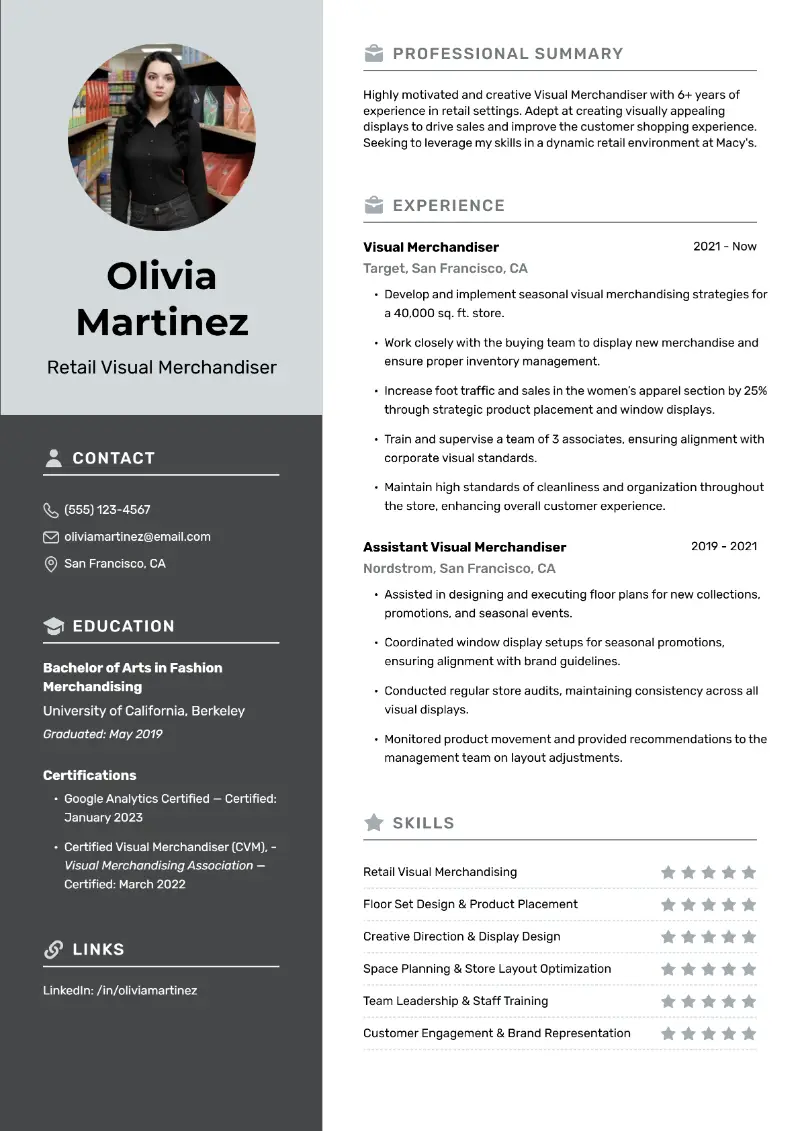

Real estate private equity resume sample

Real estate private equity resume template

Resume for private equity in real estate | Plain text

David Carter

New York, NY

(555) 123-4567

david.carter@email.comProfessional Summary

Results-oriented real estate finance professional with over 8 years of experience in property acquisition, asset management, and market analysis. Proven track record in identifying high-value investment opportunities and maximizing returns for stakeholders.

Experience

Real Estate Analyst

Blackstone Group, New York, NY

June 2019 – Present

- Conduct due diligence on over 30 commercial real estate transactions, contributing to $2 billion in investments.

- Develop financial models and valuation analyses, leading to a 15% increase in portfolio performance.

- Collaborate with cross-functional teams to identify and assess potential acquisitions.

- Implement performance dashboards to monitor KPIs across portfolio assets.

Real Estate Associate

Brookfield Properties, New York, NY

June 2017 – May 2019

- Assisted in the management of a $500 million real estate portfolio, optimizing asset performance.

- Analyzed market trends and prepared investment reports for senior management.

- Facilitated negotiations with stakeholders, resulting in successful lease agreements and property sales.

- Conducted site visits to assess property condition, tenant mix, and capex planning needs.

Education

Master of Business Administration (MBA)

Columbia University, New York, NY

Graduated: May 2017

Bachelor of Science in Finance

University of California, Los Angeles, CA

Graduated: May 2015

Skills

- Financial Modeling

- Market Analysis

- Due Diligence

- Asset Management

- Negotiation

- Excel Proficiency

- Risk Assessment

- Real Estate Valuation

- Lease Structuring

Certifications

- Certified Commercial Investment Member (CCIM) — Issued: June 2021

- Real Estate Finance Certification, NYU Stern School of Business — Issued: January 2018

Strong sides of this PE resume example:

- The experience section is organized chronologically, highlighting key achievements with bullet points. This makes it easy for hiring managers to scan for relevant information.

- The use of specific metrics (e.g., “contributing to $2 billion in investments”) demonstrates the candidate’s impact and effectiveness in previous roles.

- The education part is clearly laid out, including the name of the institution, degree, and graduation date, making it easy for employers to assess academic qualifications.

How to properly format a private equity resume

- Choose a professional and easy-to-read font such as Arial, Calibri, or Times New Roman. A font size between 10 and 12 points is ideal for readability.

- Aim for a one-page resume if you have less than 10 years of experience. For professionals with extensive backgrounds, two-pages resume format is acceptable but should be concise and relevant.

- Use standard one-inch margins to ensure ample white space, which makes your application visually appealing.

- Add bullet points for listing experiences and achievements to enhance readability. Keep them brief and impactful.

- Clearly define parts of a resume (e.g., Summary, Skills, Education, Experience) with bold headers to guide the reader.

- Maintain consistent layout for dates, headings, and bullet points throughout the document.

To avoid common formatting pitfalls and ensure your application looks polished, consider using an online resume builder for free.

Resume Trick provides free sample resume templates and simplifies the writing process, allowing you to focus on content while maintaining a professional appearance.

Create your professional Resume in 10 minutes for FREE

Build My Resume

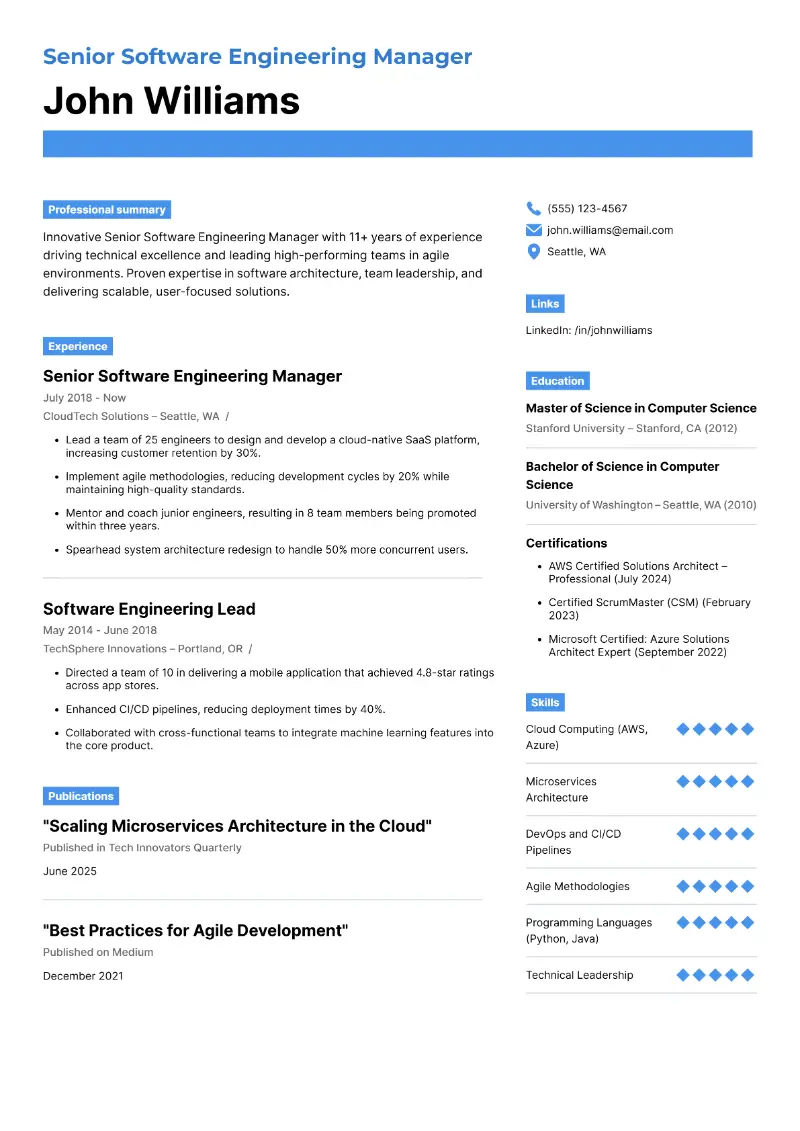

Venture capital private equity resume example

Sample venture private equity resume

Emily Thompson

San Francisco, CA

(555) 987-6543

emily.thompson@email.comProfessional Summary

Dynamic venture capital analyst with 7 years of experience in evaluating early-stage technology investments. Strong analytical skills and a passion for innovation, coupled with a background in finance and entrepreneurship.

Experience

Venture Capital Analyst

Sequoia Capital, San Francisco, CA

July 2020 – Present

- Evaluate over 100 startup pitches, conducting market research and financial analysis to identify viable investment opportunities.

- Assist in closing deals totaling $150 million in various sectors, including SaaS and fintech.

- Develop a comprehensive database of industry trends, improving investment decision-making processes.

- Conduct founder interviews to assess leadership potential, team cohesion, and execution capability.

Investment Associate

Y Combinator, Mountain View, CA

June 2018 – June 2020

- Supported the funding process for over 50 startups, providing due diligence and market validation.

- Analyzed financial projections and prepared investment memoranda for internal stakeholders.

- Engaged with portfolio companies to support growth strategies and operational improvements.

- Acted as a liaison between founders and strategic partners for fundraising and product rollouts.

Education

Master of Business Administration (MBA)

Stanford University, Stanford, CA

Graduated: June 2018

Bachelor of Arts in Economics

Harvard University, Cambridge, MA

Graduated: May 2016

Skills

- Investment Analysis

- Market Research

- Financial Modeling

- Pitch Evaluation

- Startup Ecosystem Knowledge

- Networking

- Excel Proficiency

- Term Sheet Review

- Cap Table Analysis

Languages

- English (Native)

- Mandarin (Conversational)

- Spanish (Basic)

This example of a private equity associate resume will impress recruiters:

- The professional summary uses engaging language to highlight the candidate’s passion for venture capital and analytical skills, making her stand out to potential employers.

- The experience section is tailored to the specific industry of venture capital, showing relevant positions and responsibilities that match the target job.

- Each bullet point begins with strong action verbs, creating a dynamic and impactful reading experience that captures achievements succinctly.

Should I choose a private equity resume objective or summary

Resume summary is best for experienced professionals.

- This section highlights your key qualifications and achievements.

- It summarizes your career trajectory and demonstrates your value to potential employers.

Private equity resume summary sample:

Results-driven finance professional with over 8 years of experience in private equity. Proven track record in deal sourcing, financial modeling, and portfolio management, successfully driving an average annual return of 20% across multiple funds.

Resume objective is ideal for entry-level candidates or those transitioning into private equity.

It states your career goals and what you hope to achieve in the role.

Private equity resume objective example:

Dedicated finance graduate seeking an entry-level analyst position in private equity to leverage strong analytical skills and a passion for investment strategies in contributing to high-performing teams.

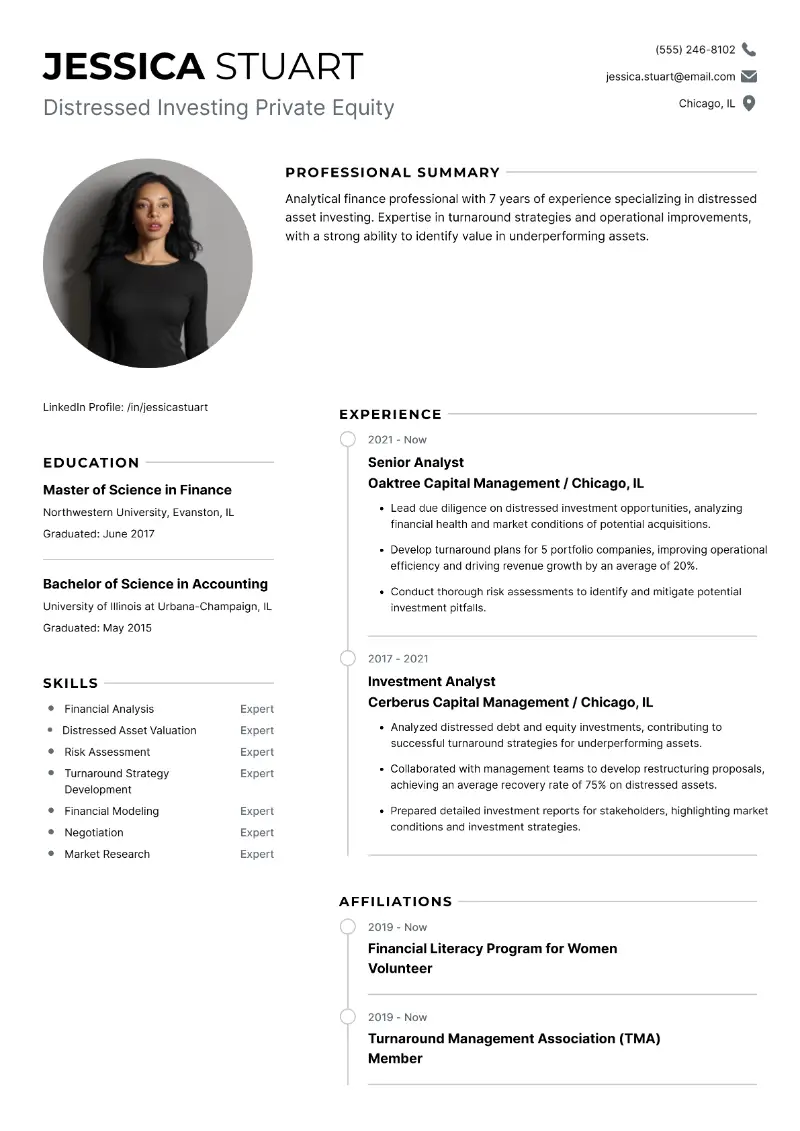

Distressed investing private equity resume template

Distressed investing private equity resume sample

Resume for investing private equity | Text version

Jessica Stuart

Chicago, IL

(555) 246-8102

jessica.stuart@email.com

LinkedIn Profile: /in/jessicastuartProfessional Summary

Analytical finance professional with 8 years of experience specializing in distressed asset investing. Expertise in turnaround strategies and operational improvements, with a strong ability to identify value in underperforming assets.

Experience

Senior Analyst

Oaktree Capital Management, Chicago, IL

August 2021 – Present

- Lead due diligence on distressed investment opportunities, analyzing financial health and market conditions of potential acquisitions.

- Develop turnaround plans for 5 portfolio companies, improving operational efficiency and driving revenue growth by an average of 20%.

- Conduct thorough risk assessments to identify and mitigate potential investment pitfalls.

- Partner with legal teams to navigate bankruptcy proceedings and creditor negotiations.

Investment Analyst

Cerberus Capital Management, Chicago, IL

July 2017 – July 2021

- Analyzed distressed debt and equity investments, contributing to successful turnaround strategies for underperforming assets.

- Collaborated with management teams to develop restructuring proposals, achieving an average recovery rate of 75% on distressed assets.

- Prepared detailed investment reports for stakeholders, highlighting market conditions and investment strategies.

- Created liquidation value models to support decision-making on divestiture timing.

Education

Master of Science in Finance

Northwestern University, Evanston, IL

Graduated: June 2017

Bachelor of Science in Accounting

University of Illinois at Urbana-Champaign, IL

Graduated: May 2015

Skills

- Financial Analysis

- Distressed Asset Valuation

- Risk Assessment

- Turnaround Strategy Development

- Financial Modeling

- Negotiation

- Market Research

- Creditor Communication

- Bankruptcy Process Navigation

- Performance Tracking

Affiliations

- Volunteer, Financial Literacy Program for Women — Ongoing since January 2020

- Member, Turnaround Management Association (TMA) — Joined: August 2019

This sample PE resume is effective for several reasons:

- The private equity resume summary emphasizes Jessica's specialization in distressed asset investing, immediately clarifying her niche and the value she can bring to potential employers.

- The mention of developing turnaround plans and conducting risk assessments showcases strategic thinking and problem-solving abilities, appealing to firms looking for candidates with analytical skills.

- Including professional affiliations and volunteer work demonstrates a commitment to the field and community involvement, which can positively influence hiring decisions.

How to showcase your private equity resume skills

The skills section of resume is a critical component of your application. It provides a quick snapshot of your qualifications and helps hiring managers assess whether you possess the necessary capabilities for the role.

- Hard skills are specific, teachable attributes or knowledge sets that can be quantified

- Soft skills are interpersonal traits that enhance your ability to work with others.

Private equity hard skills:

- Financial modeling

- Valuation techniques

- Due diligence

- Market research

- Excel proficiency

- Portfolio management

- Risk analysis

- Investment strategies

- Financial statement analysis

- Quantitative analysis

Soft skills for private equity:

- Communication skills

- Team collaboration

- Problem-solving

- Critical thinking

- Adaptability

- Attention to detail

- Networking

- Negotiation skills

- Leadership qualities

- Time management

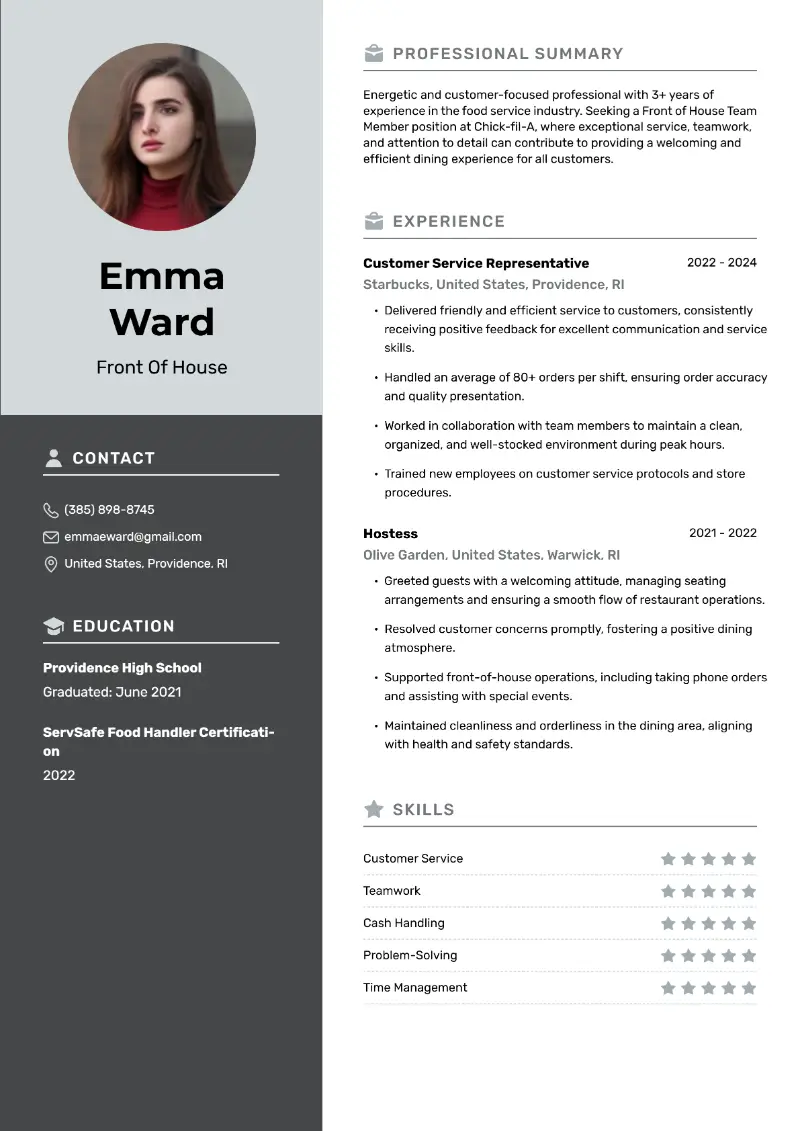

Entry-level private equity resume example

Sample private equity intern resume

Christopher Reed

Boston, MA

(555) 321-0987

christopher.reed@email.comProfessional Summary

Motivated finance graduate with a strong foundation in investment analysis and financial modeling. Seeking an entry-level position in private equity to leverage analytical skills and a passion for financial markets.

Education

Bachelor of Science in Finance

Boston College, Chestnut Hill, MA

Graduation: May 2025

- Dean’s List for 6 semesters

- Member of the Finance Club

Internship Experience

Private Equity Intern

HarbourVest Partners, Boston, MA

June 2024 – August 2024

- Assisted in due diligence processes for potential investment opportunities, performing market research and financial analysis.

- Supported the preparation of investment memos and presentations for senior management.

- Collaborated with team members to analyze portfolio performance and suggest improvements.

- Built simple leveraged buyout (LBO) models to support initial deal screening.

Finance Intern

Goldman Sachs, Boston, MA

June 2022 – August 2022

- Conducted financial modeling and valuation analyses for client projects.

- Assisted in preparing pitch books for new business opportunities.

- Participated in team meetings and contributed to strategy discussions.

- Researched macroeconomic trends to inform investment strategy recommendations.

Skills

- Financial Modeling

- Market Analysis

- Excel Proficiency

- Research Skills

- Communication Skills

- Team Collaboration

- Problem-Solving

- Industry Benchmarking

- Strategic Thinking

- Analytical Writing

Certifications

- Bloomberg Market Concepts (BMC) — Issued: September 2023

- Financial Risk Manager (FRM) - Level 1 (in progress)

Why is this private equity resume effective?

- It begins with a strong objective that states Christopher's aspirations and the skills he wishes to leverage, setting a clear direction for the reader.

- The education highlights the candidate’s academic achievements and relevant club memberships, emphasizing involvement that aligns with the finance field.

- The internship experience is detailed, with descriptions of responsibilities, demonstrating practical application of academic knowledge.

Education to add to a PE resume

The education section showcases your academic qualifications and sets the foundation for your expertise in finance and investments.

- Include your highest degree first, followed by any relevant undergraduate diplomas. Indicate the major and minor if applicable.

- List the name of the university or college attended and its location.

- Add the graduation date (or expected date) to indicate the recency of your education.

- Highlight any honors (e.g., cum laude) or relevant certifications (e.g., CFA, CAIA) that enhance your qualifications.

The experience section in a private equity associate resume?

List your most recent position first, followed by previous roles in reverse chronological order. This format highlights your current expertise.

- Clearly state your job title to convey your level of responsibility.

- Mention the company name and its location for context.

- Indicate the dates you worked at each position (month and year).

- Use bullet points to describe your responsibilities and achievements, focusing on quantifiable results.

Operating partner in private equity resume template

Operating partner in private equity resume sample

Operating partner in private equity resume | Text version

Michael Thompson

New York, NY

(555) 123-4567

michael.thompson@gmail.comProfessional Summary

Seasoned Operating Partner with experience driving operational excellence and strategic growth within private equity-backed portfolio companies. Proven track record of enhancing EBITDA, streamlining operations, and leading large-scale transformation initiatives.

Experience

Operating Partner

Silver Lake Partners, New York, NY

January 2018 – Present

- Partner with executive leadership teams across portfolio companies to develop and execute operational improvement plans, resulting in average EBITDA growth of 25% within two years.

- Provide strategic guidance on talent acquisition and organizational restructuring to support scalable growth.

- Collaborate with investment teams to identify operational risks and opportunities during due diligence and post-acquisition integration phases.

Chief Operating Officer

Vista Equity Partners Portfolio Company – Advanced Data Systems, Austin, TX

June 2013 – December 2017

- Implemented scalable operational frameworks that reduced customer churn by 15% and accelerated product development cycles by 30%.

- Managed a team of 120+ employees across product, sales, and customer support departments.

Vice President, Operations

The Blackstone Group, New York, NY

August 2008 – May 2013

- Spearheaded turnaround initiatives for underperforming assets resulting in a 35% increase in operating cash flow over 18 months.

- Played a key role in identifying acquisition targets and conducting operational due diligence.

Education

MBA, Operations Management

Wharton School, University of Pennsylvania, Philadelphia, PA

Graduated: 2008

Bachelor of Science in Industrial Engineering

Georgia Institute of Technology, Atlanta, GA

Graduated: 2003

Skills

- Operational Due Diligence

- Business Process Improvement

- Change Management

- Financial Analysis & Budgeting

- Strategic Planning

- M&A Integration

- Team Leadership & Development

- Technology & Digital Transformation

Certifications

- Certified Six Sigma Black Belt, 2025

- Project Management Professional (PMP), 2024

Why this resume is winning?

- Contact information is concise and prominently placed.

- It uses quantifiable impact which grabs recruiters' attention.

- Demonstrates a progressive career path moving from VP to COO to Operating Partner, showing growth and increasing responsibility.

Cover letter for private equity

A cover letter is a document that accompanies your resume.

It introduces you to the hiring manager, explains your interest in the position, and highlights your qualifications and skills that make you a good fit for the job.

Create your professional Cover letter in 10 minutes for FREE

Build My Cover Letter

Private equity cover letter example

Dear Hiring Manager,

I am writing to express my strong interest in the Private Equity Analyst position at Blackstone Group. With a Bachelor’s degree in Finance from the University of Georgia, coupled with my hands-on experience in financial analysis and deal evaluation at a leading investment firm, I am eager to bring my expertise in financial modeling, market analysis, and strategic investment decision-making to your distinguished team.

In my previous role as an Investment Analyst at Winston Capital Partners, I gained practical experience in evaluating potential investment opportunities, conducting thorough due diligence, and preparing detailed financial models. I worked closely with senior associates and managers to analyze market trends, company valuations, and the financial health of target companies.

I am particularly drawn to Blackstone Group due to its industry leadership and reputation for value creation through strategic investments. Your firm’s approach to identifying high-potential companies and transforming them into market leaders resonates deeply with my professional aspirations.

I am excited about the opportunity to contribute my skills in financial analysis and portfolio management to such an esteemed organization.

Thank you for considering my application. I look forward to the possibility of joining your team.

Sincerely,

Christopher Holt

Conclusion

In conclusion, a well-crafted PE resume is your ticket to opening doors in a competitive industry.

By emphasizing relevant experience, showcasing quantifiable achievements, and tailoring your document to the specific role you seek, you can set yourself apart from the competition.

Remember, your private equity resume is a strategic tool that communicates your unique value proposition to potential employers. Invest the time and effort into refining it, and you will significantly increase your chances of landing that coveted position.

Create your professional Resume in 10 minutes for FREE

Build My Resume