As a senior tax accountant, you possess a wealth of experience and expertise that can set you apart from other candidates.

This article will provide you with essential examples and tips for writing an effective senior tax accountant resume.

From tailoring your application to specific job descriptions to emphasizing your accomplishments, we’ll explore key elements that will help you make a great resume and a lasting impression on potential employers.

Senior tax accountant resume examples

- Corporate senior tax accountant resume

- Senior international tax accountant resume

- Senior state tax accountant resume

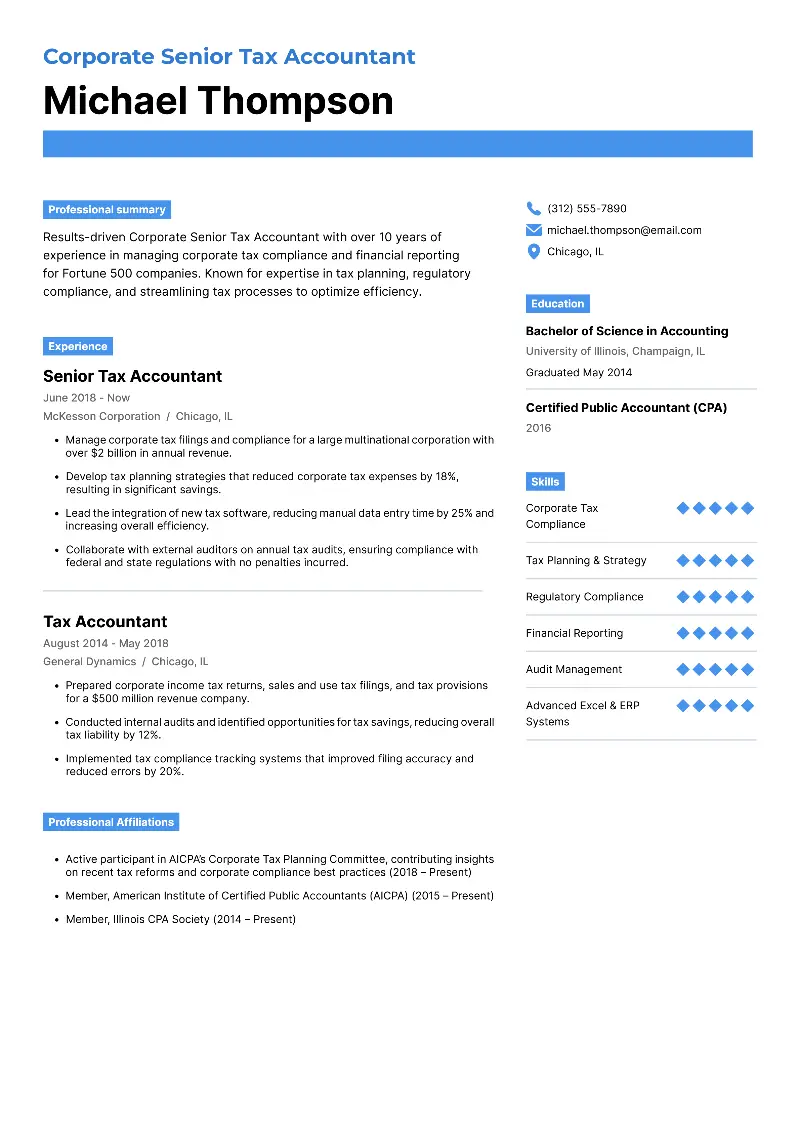

Senior corporate tax accountant resume sample

Corporate senior tax accountant resume template

Resume for corporate senior tax accountant | Plain text

Michael Thompson

Chicago, IL

(312) 555-7890

michael.thompson@email.comProfessional Summary

Results-driven Corporate Senior Tax Accountant with experience in managing corporate tax compliance and financial reporting for Fortune 500 companies. Known for expertise in tax planning, regulatory compliance, and streamlining tax processes to optimize efficiency.

Professional Experience

Senior Tax Accountant

McKesson Corporation, Chicago, IL

June 2018 – Present

- Manage corporate tax filings and compliance for a large multinational corporation with over $2 billion in annual revenue.

- Develop tax planning strategies that reduced corporate tax expenses by 18%, resulting in significant savings.

- Lead the integration of new tax software, reducing manual data entry time by 25% and increasing overall efficiency.

- Collaborate with external auditors on annual tax audits, ensuring compliance with federal and state regulations with no penalties incurred.

- Train and mentor junior accountants, fostering a deeper understanding of tax laws and improving team performance.

Tax Accountant

General Dynamics, Chicago, IL

August 2014 – May 2018

- Prepared corporate income tax returns, sales and use tax filings, and tax provisions for a $500 million revenue company.

- Conducted internal audits and identified opportunities for tax savings, reducing overall tax liability by 12%.

- Implemented tax compliance tracking systems that improved filing accuracy and reduced errors by 20%.

Education

Bachelor of Science in Accounting

University of Illinois, Champaign, IL

Graduated May 2014

Certified Public Accountant (CPA), 2016

Professional Affiliations

- Active participant in AICPA’s Corporate Tax Planning Committee, contributing insights on recent tax reforms and corporate compliance best practices (2018 – Present)

- Member, American Institute of Certified Public Accountants (AICPA) (2015 – Present)

- Member, Illinois CPA Society (2014 – Present)

Skills

- Corporate Tax Compliance

- Tax Planning & Strategy

- Regulatory Compliance

- Financial Reporting

- Audit Management

- Advanced Excel & ERP Systems

- Data Analysis and Interpretation

- Cross-functional Collaboration

- Risk Assessment and Mitigation

Strong sides of this senior tax accountant resume example:

- It includes significant accomplishments, like reducing corporate tax expenses by 18% and improving efficiency by 25%, which demonstrate measurable impact.

- The summary immediately signals relevant experience for a corporate setting. It concisely highlights the candidate's expertise in tax, regulatory compliance, and process efficiency.

- Membership in professional organizations like AICPA and active involvement in committees shows ongoing engagement and expertise in tax reform—relevant for corporate roles.

How to format a resume for a senior tax accountant

- Choose an easy-to-read font such as Arial, Calibri, or Times New Roman.

- Your font size should typically be between 10 and 12 points.

- The ideal senior tax accountant resume length is typically one to two pages.

- It’s important to keep the content concise and focused on your most impressive accomplishments and qualifications.

- Use standard margins of one inch on all sides to ensure the page has enough white space for easy reading.

- Each resume section should be clearly labeled with bold headings to facilitate navigation.

To ensure your document maintains its layout across different devices and platforms, consider using an AI resume creator for free.

Resume Trick offers professional resume templates for free that can help you avoid common formatting pitfalls, so your application looks polished and professional regardless of where it's viewed.

Create your professional Resume in 10 minutes for FREE

Build My Resume

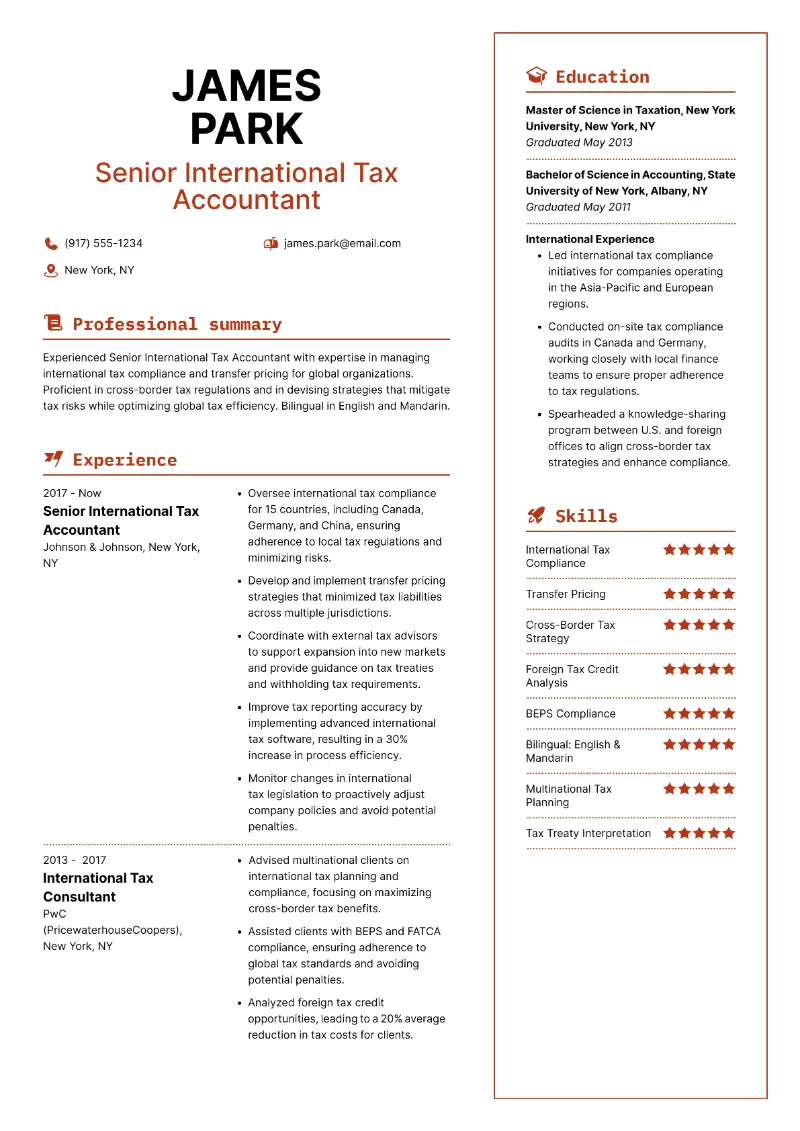

Senior international tax accountant resume example

Senior international tax accountant resume template

Sample senior tax accountant resume

James Park

New York, NY

(917) 555-1234

james.park@email.comProfessional Summary

Experienced Senior International Tax Accountant with expertise in managing international tax compliance and transfer pricing for global organizations. Proficient in cross-border tax regulations and in devising strategies that mitigate tax risks while optimizing global tax efficiency. Bilingual in English and Mandarin.

Professional Experience

Senior International Tax Accountant

Johnson & Johnson, New York, NY

March 2017 – Present

- Oversee international tax compliance for 15 countries, including Canada, Germany, and China, ensuring adherence to local tax regulations and minimizing risks.

- Develop and implement transfer pricing strategies that minimized tax liabilities across multiple jurisdictions.

- Coordinate with external tax advisors to support expansion into new markets and provide guidance on tax treaties and withholding tax requirements.

- Improve tax reporting accuracy by implementing advanced international tax software, resulting in a 30% increase in process efficiency.

- Monitor changes in international tax legislation to proactively adjust company policies and avoid potential penalties.

International Tax Consultant

PwC (PricewaterhouseCoopers), New York, NY

June 2013 – February 2017

- Advised multinational clients on international tax planning and compliance, focusing on maximizing cross-border tax benefits.

- Assisted clients with BEPS and FATCA compliance, ensuring adherence to global tax standards and avoiding potential penalties.

- Analyzed foreign tax credit opportunities, leading to a 20% average reduction in tax costs for clients.

Education

Master of Science in Taxation

New York University, New York, NY

Graduated May 2013

Bachelor of Science in Accounting

State University of New York, Albany, NY

Graduated May 2011

International Experience

- Led international tax compliance initiatives for companies operating in the Asia-Pacific and European regions.

- Conducted on-site tax compliance audits in Canada and Germany, working closely with local finance teams to ensure proper adherence to tax regulations.

- Spearheaded a knowledge-sharing program between U.S. and foreign offices to align cross-border tax strategies and enhance compliance.

Skills

- International Tax Compliance

- Transfer Pricing

- Cross-Border Tax Strategy

- Foreign Tax Credit Analysis

- BEPS Compliance

- Bilingual: English & Mandarin

- Multinational Tax Planning

- Tax Treaty Interpretation

- Global Risk Management

Why this example of a senior tax accountant resume will impress recruiters:

- The resume opening statement is tailored to highlight cross-border compliance expertise, positioning the candidate well for multinational or global tax roles.

- Tasks related to international tax compliance, such as transfer pricing strategies and understanding of BEPS and FATCA, reflect deep specialization in tax matters.

- Including bilingual skills (English and Mandarin) shows additional value in a global role where language skills might be beneficial for cross-border communication.

Should I choose a resume objective or summary?

A resume summary is typically more effective for seasoned professionals who have a wealth of experience to draw from.

- It is a brief paragraph that highlights your qualifications and skills.

Senior tax accountant resume summary sample:

Detail-oriented senior tax accountant with over 15 years of experience in tax preparation and compliance. Proven track record of maximizing tax deductions and credits, enhancing clients' financial positions, and delivering strategic tax planning solutions. Exceptional analytical skills combined with a comprehensive understanding of current tax regulations.

On the other hand, a resume objective can be beneficial for entry-level positions or if you're changing careers.

- It is a statement of your work goals and what you hope to achieve in the position you're applying for.

Senior tax accountant resume objective example:

Dedicated accounting professional seeking a senior tax accountant position to leverage extensive experience in tax preparation and compliance while contributing to organizational success through innovative tax solutions.

For most senior tax accountant positions, a summary is more impactful as it allows you to prove your relevant experience and skills.

Senior tax accountant resume skills

The skills section is crucial as it provides employers with a quick snapshot of your qualifications. This part can be a deciding factor in whether your resume makes it to the next round.

- Hard skills are specific, teachable abilities that are quantifiable.

- Soft skills are interpersonal attributes that help you work well with others.

Senior tax accountant hard skills:

- Tax Preparation

- Tax Compliance

- Financial Reporting

- Tax Planning

- Audit Management

- Accounting Software (e.g., QuickBooks, SAP)

- Financial Analysis

- Regulatory Knowledge

- Data Analysis

- Risk Management

Soft skills for a senior tax accountant:

- Communication

- Analytical Thinking

- Detail-Oriented

- Problem-Solving

- Time Management

- Leadership

- Team Collaboration

- Adaptability

- Client Relations

- Critical Thinking

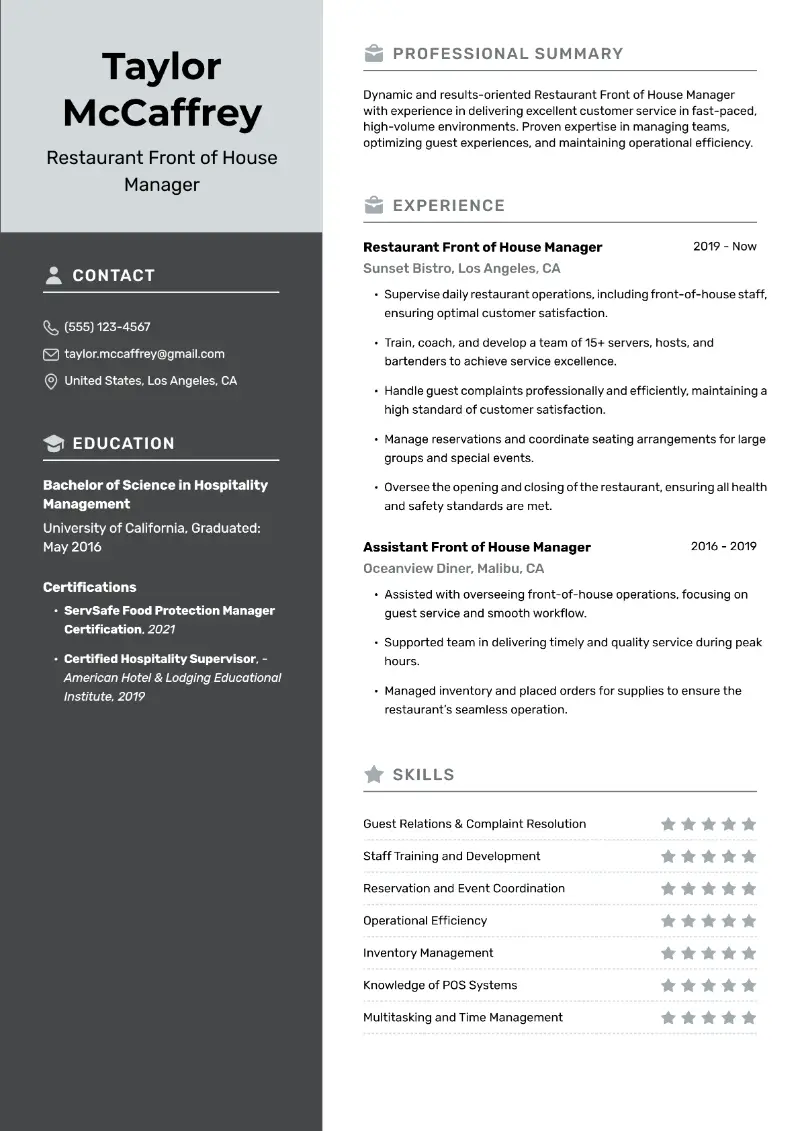

Senior state tax accountant resume template

Senior state tax accountant resume sample

Resume for senior state tax accountant | Text version

Linda Garcia

Dallas, TX

(214) 555-5678

linda.garcia@email.comProfessional Summary

Highly skilled Senior State Tax Accountant with experience in state and local tax compliance, specializing in multi-state tax returns and state tax audits. Adept at managing large tax portfolios and developing strategies to minimize state tax liabilities while ensuring full regulatory compliance.

Professional Experience

Senior State Tax Accountant

Texas Instruments, Dallas, TX

January 2019 – Present

- Lead state and local tax compliance across 15 states, filing over 100 returns annually and achieving a 98% accuracy rate.

- Analyze and implement tax strategies to reduce state tax liabilities by 15%, resulting in significant savings.

- Manage state tax audits, successfully resolving potential issues and achieving favorable outcomes with no additional liabilities.

- Develop a tax compliance calendar to streamline filing processes, reducing late filings by 25%.

- Monitor legislative changes in key states to assess impact and update compliance procedures accordingly.

State Tax Associate

AT&T Inc., Dallas, TX

September 2015 – December 2018

- Prepared multi-state tax returns, focusing on compliance and accuracy for a multi-million dollar telecommunications company.

- Assisted with state tax audits and provided supporting documentation that helped reduce assessed liabilities by 20%.

- Researched state tax legislation changes, advising management on potential impacts to the organization.

Education

Bachelor of Business Administration in Accounting

University of Texas at Austin, TX

Graduated May 2015

Certifications

- Continuing Education in Multi-State Taxation and Legislative Updates (2019 – Present)

- Certificate in Advanced Tax Compliance and Audits from Texas Society of CPAs (TSCPA) (Issued in 2018)

- Certified State and Local Tax (SALT) Specialist (Certified in 2017)

Skills

- Multi-State Tax Compliance

- State & Local Tax Strategy

- State Tax Audits

- Tax Research & Legislation Analysis

- Tax Return Preparation

- Tax Calendar Management

- Interdepartmental Communication

- Tax Software Proficiency (e.g., Avalara, Vertex)

- Process Improvement Initiatives

This sample senior tax accountant resume is effective for several reasons:

- It is tailored to state and local tax, a niche area within accounting. This specialization is shown in both the summary and experience sections.

- Specific accomplishments, such as reducing state tax liabilities by 15% and maintaining a 98% accuracy rate, highlight effectiveness in compliance and financial savings at a state level.

- The certifications and continuous learning in multi-state taxation underscore a commitment to staying current with legislation.

Education for senior tax accounting resume

The education section of your application is critical as it validates your qualifications for the position.

- Write your highest degree first (e.g., Bachelor’s, Master’s).

- Indicate your major (e.g., Accounting, Finance).

- Mention the name of the school or university.

- You may choose to include your graduation year, especially if it's recent.

- If you have relevant certifications (e.g., CPA, EA), consider adding them here as well, or in a separate section.

Experience section in a senior tax accountant resume

This part provides employers with insights into your professional background and achievements.

- List your work experience in reverse chronological order on resume starting with your most recent position and go backward. This format helps highlight your current skills and responsibilities.

- Clearly state your job title and the company’s name. You can also mention its location.

- Include the month and year you started and ended each position.

- Use bullet points to outline your responsibilities and accomplishments.

- Start each bullet with an action verb and quantify achievements when possible.

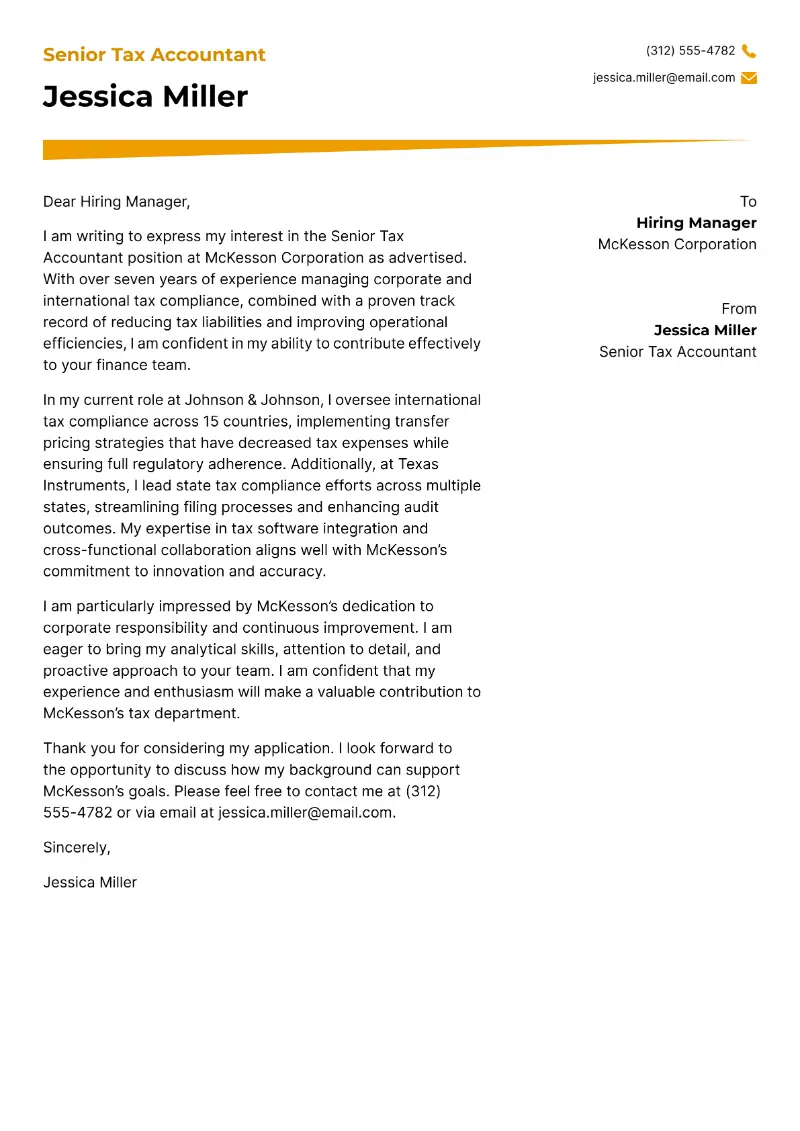

Cover letter for senior tax accountant

A cover letter is a formal document that accompanies your resume. It serves as an introduction to your application, giving you the opportunity to highlight qualifications, skills, and experience relevant to the specific job.

A cover letter is typically addressed to the recruiter and should demonstrate your enthusiasm for the position and how your background aligns with the company's needs.

Create your professional Cover letter in 10 minutes for FREE

Build My Cover Letter

Senior tax accountant cover letter example

Dear Hiring Manager,

I am writing to express my interest in the Senior Tax Accountant position at Ernst & Young. With over eight years of experience, I am excited about the opportunity to contribute to your team.

My background in managing complex tax filings, conducting tax research, and advising clients on tax strategies has prepared me to excel in a senior role at a prestigious firm like Ernst & Young.

In my current role as a Tax Senior at KPMG, I am responsible for overseeing the preparation and review of federal, state, and local tax returns for a diverse portfolio of clients, including multinational corporations and high-net-worth individuals. I am adept at identifying tax-saving opportunities, performing complex tax research, and ensuring compliance with the ever-changing tax laws.

I am particularly drawn to Ernst & Young because of your reputation for providing innovative tax solutions and fostering professional development for your employees. I believe my technical proficiency in tax law, strong attention to detail, and ability to manage multiple client accounts align well with the goals and values of your firm.

I would welcome the opportunity to further discuss how my experience and skills align with the needs of your department.

Thank you for considering my application. I look forward to the possibility of contributing to Ernst & Young’s continued success.

Sincerely,

Kyle T. Taylor

Conclusion

Creating a standout senior tax accountant resume requires careful consideration of your skills, experience, and the specific demands of the positions you are targeting.

By focusing on your accomplishments, tailoring your document to align with job descriptions, and showcasing your expertise in tax regulations and software, you can significantly increase your chances of landing an interview.

Remember, your application is your first impression with potential employers, so invest the time to ensure it reflects your professional identity accurately and compellingly.

Create your professional Resume in 10 minutes for FREE

Build My Resume