The world of accounting is both dynamic and critical for business success. Whether you're an experienced student aiming to build on your prior knowledge or a fresh graduate eager to kickstart your career, your tax intern resume is the first step toward securing a position.

A well-structured application highlights your technical skills, practical experience, and enthusiasm for the field. This resume making guide walks you through the key sections of a successful document, with specific examples of resume that can inspire your own journey.

Tax intern resume examples

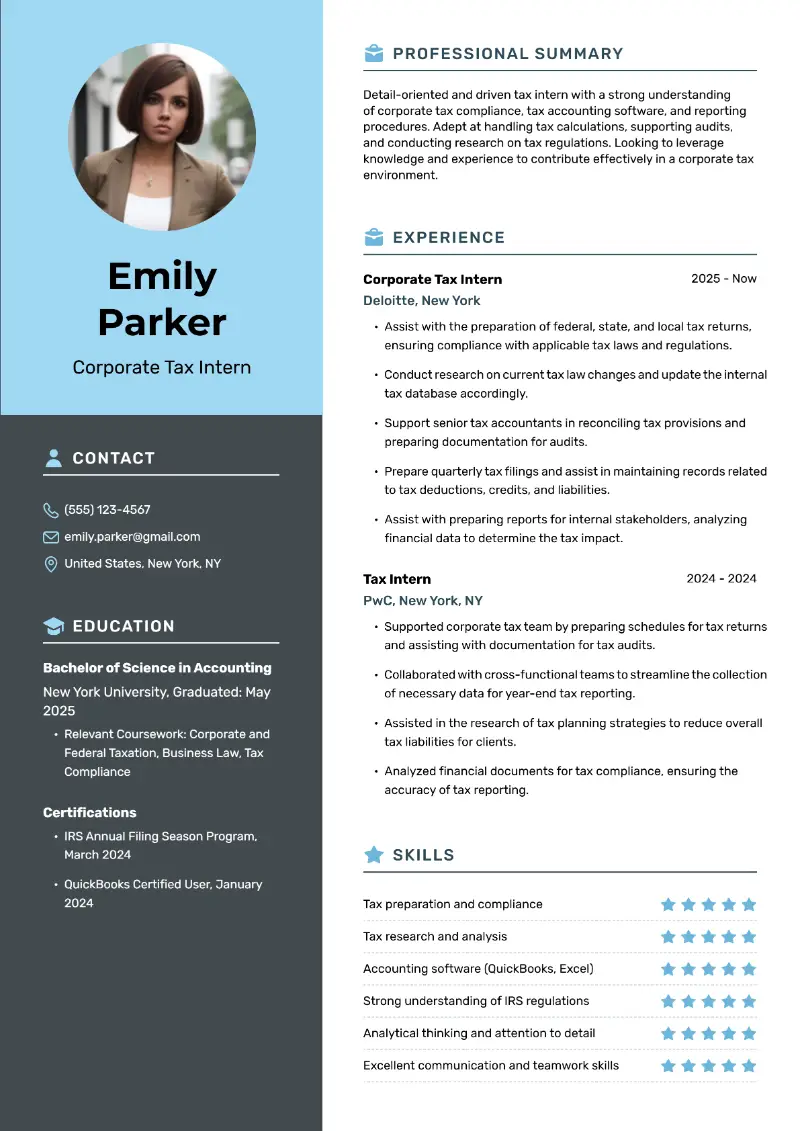

Corporate tax intern resume

Corporate tax intern resume template

Corporate tax intern resume sample | Plain text

Emily Parker

New York, NY

Email: emily.parker@gmail.com

Phone: (555) 123-4567Resume Summary

Detail-oriented and driven tax intern with a strong understanding of corporate tax compliance, tax accounting software, and reporting procedures. Adept at handling tax calculations, supporting audits, and conducting research on tax regulations. Looking to leverage knowledge and experience to contribute effectively in a corporate tax environment.

Experience

Corporate Tax Intern

Deloitte, New York, NY, June 2025 – Present

- Assist with the preparation of federal, state, and local tax returns, ensuring compliance with applicable tax laws and regulations.

- Conduct research on current tax law changes and update the internal tax database accordingly.

- Support senior tax accountants in reconciling tax provisions and preparing documentation for audits.

- Prepare quarterly tax filings and assist in maintaining records related to tax deductions, credits, and liabilities.

- Assist with preparing reports for internal stakeholders, analyzing financial data to determine the tax impact.

Tax Intern

PwC, New York, NY, June – August 2024

- Supported corporate tax team by preparing schedules for tax returns and assisting with documentation for tax audits.

- Collaborated with cross-functional teams to streamline the collection of necessary data for year-end tax reporting.

- Assisted in the research of tax planning strategies to reduce overall tax liabilities for clients.

- Analyzed financial documents for tax compliance, ensuring the accuracy of tax reporting.

Education

Bachelor of Science in Accounting

New York University, NY

Graduated: May 2025

- Relevant Coursework: Corporate and Federal Taxation, Business Law, Tax Compliance

Certifications

- IRS Annual Filing Season Program, March 2024

- QuickBooks Certified User, January 2024

Skills

- Tax preparation and compliance

- Tax research and analysis

- Accounting software (QuickBooks, Excel)

- Strong understanding of IRS regulations

- Analytical thinking and attention to detail

- Excellent communication and teamwork skills

Why this tax internship resume example is effective?

- Shows relevant corporate roles and responsibilities, providing a clear picture of Emily’s capabilities.

- Lists key technical skills, demonstrating proficiency in tax preparation and software.

- Recent certifications highlight that she is serious about her professional development.

- How to format a resume for tax intern?

1. Layout & Structure

- Length: One page resume

- Font: Calibri, Arial, or Times New Roman (11-12 pt)

- Margins: One inch on all sides

- Spacing: Single within resume sections, double between headers

2. Language & Tone

- Use active verbs: Assisted, analyzed, researched, prepared

- Industry terms: GAAP, IRC, audit support, tax deductions, liabilities

- Concise statements: Direct, no filler words

3. Styling & Design

- Consistency: Uniform font, size, and bullet styles

- Professional look: Black text, no excessive colors or graphics

- Bold headers, italicized job titles for clarity

- Save as PDF: Use format "FirstName_LastName_Tax_Intern_Resume.pdf"

4. Final Checks

- Proofread: No grammar or spelling errors

- Match job description: Include relevant keywords in resume

If you're unsure how to begin, try quick resume builder for guidance.

Resume Trick offers a variety of modern resume templates and examples to help users create polished documents.

Create your professional Resume in 10 minutes for FREE

Build My Resume

Transfer pricing tax intern resume

Transfer pricing tax intern resume example

Michael Clark

Chicago, IL

Email: michael.clark@gmail.com

Phone: (555) 987-6543Resume Summary

Detail-oriented tax intern with hands-on experience in transfer pricing research, documentation, and international tax compliance. Proficient in analyzing financial data, conducting benchmarking studies, and ensuring adherence to OECD guidelines.

Experience

Transfer Pricing Tax Intern

EY (Ernst & Young), Chicago, IL | June 2025 – Present

- Assist in preparing transfer pricing documentation reports, including financial analysis and benchmarking studies.

- Conduct research on domestic and international tax laws to ensure regulatory compliance.

- Collaborate with cross-border tax teams to structure intercompany pricing agreements.

- Support senior consultants in drafting reports and tax planning strategies for multinational clients.

- Analyze financial statements to assess the tax implications of related-party transactions.

Tax Intern

KPMG, Chicago, IL | January – May 2025

- Conducted research on transfer pricing methodologies and international tax regulations.

- Assisted in preparing comparability analyses and gathering data for local file documentation.

- Worked with global tax teams to analyze cross-border pricing strategies and ensure OECD compliance.

- Prepared client deliverables, including tax reports and supporting financial documentation.

Education

Bachelor of Science in International Business and Taxation

University of Chicago, IL | Graduated May 2025

- Relevant Coursework: Transfer Pricing, International Taxation, Multinational Business Operations, Financial Reporting

Certifications

- Certificate in Transfer Pricing – American Institute of CPAs (AICPA), February 2024

- Advanced Excel for Financial Analysis – Coursera, April 2023

Skills

- Transfer pricing analysis and documentation

- International tax compliance and regulations

- Benchmarking studies and financial modeling

- Proficiency in Excel, Bloomberg BNA, and tax software

- Strong research and technical writing skills

- Multilingual: Fluent in English and Spanish

Professional Development

- OECD Transfer Pricing Guidelines Workshop – Attended April 2024

- Taxation of Multinational Enterprises Seminar – Hosted by AICPA, November 2023

Projects

- Transfer Pricing Risk Assessment for a Fortune 500 Client – Assisted in evaluating financial data and identifying potential compliance risks in intercompany transactions.

- Comparability Study on Tech Industry Pricing Models – Conducted research and benchmarking analysis for transfer pricing reports.

Why this intern resume example works?

- Highlights workshops and seminars, revealing commitment to learning.

- Projects resume section demonstrates real-world application of skills.

- Professional development shows a proactive approach to staying updated.

- What is the difference between tax intern resume objective and summary?

| Feature | Objective | Summary |

|---|---|---|

| Purpose | Expresses goals and what the candidate aims to accomplish. | Showcases expertise and value to the employer. |

| Focus | Outlines aspirations and willingness to develop. | Emphasizes relevant knowledge and past contributions. |

| Best for | Individuals with minimal or no background (students, career changers). | Those with prior internships or academic projects. |

| Example | Finance student with a keen interest in transfer pricing, aiming to gain expertise in multinational tax strategy. Seeking an internship to apply research and analytical skills in compliance and benchmarking studies. | Tax intern with hands-on experience in compliance, financial analysis, and tax research. Proficient in assisting with documentation, preparing reports, and ensuring regulatory adherence for multinational businesses. |

- How to organize education on a tax intern resume?

- Include the full degree title.

- Provide the institution's name.

- Mention the city and state (or country if applicable).

- Write the graduation dates.

- List pertinent courses.

- Incorporate GPA if 3.5 or above.

- Note significant honors.

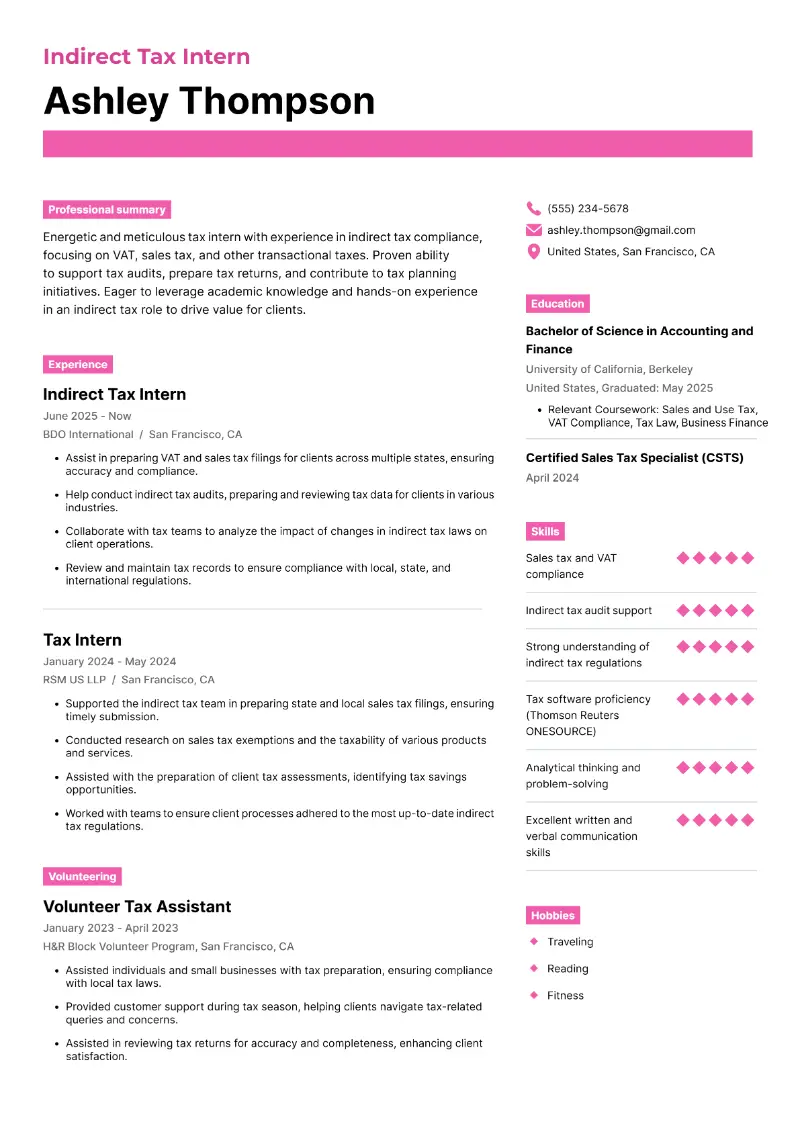

Indirect tax intern resume

Indirect tax intern resume template

Indirect tax intern resume sample | Plain text

Ashley Thompson

San Francisco, CA

Email: ashley.thompson@gmail.com

Phone: (555) 234-5678Resume Summary

Energetic and meticulous tax intern with experience in indirect tax compliance, focusing on VAT, sales tax, and other transactional taxes. Proven ability to support tax audits, prepare tax returns, and contribute to tax planning initiatives. Eager to leverage academic knowledge and hands-on experience in an indirect tax role to drive value for clients.

Experience

Indirect Tax Intern

BDO International, San Francisco, CA | June 2025 – Present

- Assist in preparing VAT and sales tax filings for clients across multiple states, ensuring accuracy and compliance.

- Help conduct indirect tax audits, preparing and reviewing tax data for clients in various industries.

- Collaborate with tax teams to analyze the impact of changes in indirect tax laws on client operations.

- Review and maintain tax records to ensure compliance with local, state, and international regulations.

Tax Intern

RSM US LLP, San Francisco, CA | January – May 2024

- Supported the indirect tax team in preparing state and local sales tax filings, ensuring timely submission.

- Conducted research on sales tax exemptions and the taxability of various products and services.

- Assisted with the preparation of client tax assessments, identifying tax savings opportunities.

- Worked with teams to ensure client processes adhered to the most up-to-date indirect tax regulations.

Education

Bachelor of Science in Accounting and Finance

University of California, Berkeley, CA

Graduated: May 2025

- Relevant Coursework: Sales and Use Tax, VAT Compliance, Tax Law, Business Finance

Certifications

Certified Sales Tax Specialist (CSTS), April 2024

Skills

- Sales tax and VAT compliance

- Indirect tax audit support

- Strong understanding of indirect tax regulations

- Tax software proficiency (Thomson Reuters ONESOURCE)

- Analytical thinking and problem-solving

- Excellent written and verbal communication skills

Volunteering

Volunteer Tax Assistant

H&R Block Volunteer Program, San Francisco, CA | January 2023 – April 2023

- Assisted individuals and small businesses with tax preparation, ensuring compliance with local tax laws.

- Provided customer support during tax season, helping clients navigate tax-related queries and concerns.

- Assisted in reviewing tax returns for accuracy and completeness, enhancing client satisfaction.

Hobbies

- Traveling

- Reading

- Fitness

Why this sample resume of tax intern stands out?

- The opening statement in resume effectively highlights key skills and experience while aligning them with the applicant's goals.

- Volunteering demonstrates her dedication to helping clients and improving tax expertise.

- The hobbies section humanizes Ashley and reveals personal interests that could contribute to her teamwork and communication abilities.

- How to list experience on a tax resume?

- Place your most recent occupation first, followed by the previous ones in reverse order.

- Include clear dates of employment.

- Start each position with a specific job title.

- Define the company name and the location.

- Describe your duties and any quantifiable achievements or contributions.

- What skills to put on a tax intern resume?

- Hard skills are teachable abilities that can be measured and acquired through education, training, or experience. They are technical in nature and are necessary to perform specific tasks.

- Soft skills are personal attributes that influence how well individuals work and interact with others. These are more subjective and are harder to quantify.

Hard skills:

- Tax software proficiency (e.g., Bloomberg BNA, Thomson Reuters ONESOURCE)

- Sales tax and VAT compliance

- Financial reporting

- Transfer pricing documentation

- Tax preparation and filing

- Accounting principles (GAAP, IFRS)

- Tax research and analysis

- Excel (advanced functions, pivot tables, macros)

- Data analysis and modeling

- Tax law knowledge

- Benchmarking studies

- Audit support

- Report writing (financial and tax reports)

- Multilingual (e.g., English, Spanish, French)

- Project management tools (e.g., Microsoft Project, Trello)

Soft skills:

- Communication (verbal and written)

- Teamwork and collaboration

- Time management

- Attention to detail

- Problem-solving

- Adaptability and flexibility

- Critical thinking

- Organizational skills

- Strong work ethic

- Multitasking

- Leadership potential

- Client relationship management

- Conflict resolution

- Emotional intelligence

Conclusion

A standout tax intern resume should clearly highlight your background. Include relevant coursework, internships, and certifications to showcase your academic qualifications and commitment to your professional development.

These basic resume examples, designed to offer structure and clarity, can serve as templates for building your application.

Create your professional Resume in 10 minutes for FREE

Build My Resume