An assistant bank manager resume should highlight your leadership skills, banking expertise, and customer service experience to help you stand out to employers.

Whether you're looking for a retail role or a corporate position, your application needs to demonstrate your ability to manage teams, oversee operations, and maintain strong client relationships.

In this article, we'll cover key sections, essential resume writing skills, and resume samples to help you create a compelling document that captures attention.

Assistant bank manager resume examples

Retail assistant bank manager resume sample

Retail assistant bank manager resume template

Resume for retail assistant bank manager | Plain text

Emma Carter

New York, NY | (555) 678-9034 | emma.carter@email.com | LinkedIn.com/in/emmacarterSummary

Results-driven Retail Assistant Bank Manager with experience leading teams, enhancing customer satisfaction, and driving branch performance. Skilled in sales growth, compliance, and staff development to ensure efficient daily operations.

Skills

- Team leadership

- Customer service management

- Sales and cross-selling

- Compliance and regulations

- Staff training and development

- Conflict resolution

- Cash flow management

- Banking software proficiency

- Time management

- Communication

Experience

Retail Assistant Bank Manager

Chase Bank | Brooklyn, NY | July 2018 – Present

- Supervise a team of 12 employees, ensuring high levels of performance and customer service.

- Increased branch revenue by 18% through targeted sales initiatives and personalized banking solutions.

- Manage daily operations, including cash handling, account openings, and loan processing.

- Ensure compliance with federal and state banking regulations, reducing audit findings by 20%.

- Train and mentor new staff, leading to a 15% improvement in employee retention rates.

Banking Associate

TD Bank | Jersey City, NJ | May 2015 – June 2018

- Assisted customers with account inquiries, loan applications, and financial products.

- Exceeded monthly sales goals by 12% through proactive cross-selling and personalized service.

- Handled cash transactions, account maintenance, and compliance tasks with 100% accuracy.

Education

Bachelor of Business Administration (BBA), Finance

New York University (NYU), New York, NY | 2015

Certifications

- Certified Bank Manager (CBM), American Bankers Association | 2020

- Certified Customer Service Professional (CCSP), National Customer Service Association | 2019

- Certified Retail Banking Associate (CRBA), American Bankers Association | 2018

Additional Information

Fluent in Spanish, enhancing customer service for diverse clientele.

Strong sides of this assistant manager resume:

- Clear and concise bullet points that highlight quantifiable achievements, such as revenue growth and retention rates.

- Balanced focus on both leadership and customer service skills, essential for retail banking.

- Well-structured layout that makes it easy to read, with consistent formatting and spacing.

- How to properly format a bank manager resume?

- Choose a classic clean font like Arial, Calibri, or Times New Roman (size 10-12).

- Keep the length to one page (or two if you have extensive experience).

- Set margins to 1 inch on all sides for a balanced look.

- Use 1.0 or 1.15 line spacing for readability.

- Organize sections with clear headings and bullet points.

- Save the document as a PDF to preserve the layout.

To avoid formatting issues and save time, use an AI resume builder.

Resume Trick offers professional resume templates that help ensure consistency, proper alignment, and a polished appearance. This reduces the risk of errors and allows you to focus on the content of your application.

Create your professional Resume in 10 minutes for FREE

Build My Resume

Corporate assistant bank manager resume example

Sample corporate assistant bank manager resume

Michael Reynolds

Chicago, IL | (555) 456-7890 | michael.reynolds@email.com | LinkedIn.com/in/michaelreynoldsSummary

Detail-oriented Corporate Assistant Bank Manager with years of experience supporting corporate clients, managing high-value accounts, and ensuring regulatory compliance. Proven success in optimizing financial solutions and fostering long-term client relationships.

Skills

- Corporate account management

- Financial analysis and reporting

- Risk assessment and mitigation

- Compliance with regulations

- Customer relationship management (CRM)

- Team collaboration and leadership

- Problem-solving and decision-making

- Cash flow management

- Communication and negotiation

- Banking software proficiency

Experience

Corporate Assistant Bank Manager

Wells Fargo Corporate Banking | Chicago, IL | August 2017 – Present

- Manage a portfolio of 75+ corporate clients, ensuring tailored financial solutions and exceptional service.

- Conduct financial analysis and risk assessments to support loan approvals and mitigate potential risks.

- Collaborate with senior management to develop customized financial products for large-scale clients.

- Ensure compliance with federal and state regulations, maintaining 100% audit success over five years.

- Lead a team of eight corporate banking associates, providing training and performance feedback.

Corporate Banking Associate

Bank of America | Chicago, IL | June 2014 – July 2017

- Supported corporate clients with account management, cash flow optimization, and credit solutions.

- Prepared financial reports, analyzed key performance indicators, and assessed credit risks.

- Assisted senior managers with complex transactions, ensuring accuracy and compliance.

- Exceeded monthly sales goals by 12% through proactive cross-selling and personalized service.

Education

Bachelor of Science (BS), Finance

University of Illinois at Urbana-Champaign, IL | 2014

Certifications

- Certified Corporate Banker (CCB), American Bankers Association | 2019

- Certified Treasury Professional (CTP), Association for Financial Professionals | 2018

- Certified Commercial Loan Officer (CCLO), American Bankers Association | 2017

Additional Information

Proficient in corporate banking platforms such as Oracle Financial Services and Fiserv Signature. Skilled in advanced Excel functions, including financial modeling and data analysis.

Why this example of a resume for assistant bank manager will impress recruiters:

- Strong emphasis on client management, financial analysis, and compliance, tailored to corporate banking.

- Uses metrics like portfolio size and audit success rates to showcase performance.

- Clearly differentiates leadership experience while highlighting collaboration with senior management.

- Should I choose an assistant bank manager resume objective or summary?

A resume summary is recommended for those with several years of experience in banking or related fields.

It consists of 2-4 sentences highlighting your key skills, professional accomplishments, and background. The goal is to provide a concise overview that demonstrates your value to the employer.

Assistant bank manager resume summary sample:

Results-driven Assistant Bank Manager with 5+ years of experience in team leadership, customer service, and financial operations. Proven track record of increasing branch revenue, improving operational efficiency, and enhancing client satisfaction through strategic banking solutions. Skilled in compliance, risk management, and staff development, with a commitment to delivering exceptional service.

An objective is ideal for entry-level candidates, recent graduates, or those transitioning from another industry.

It typically consists of 2-3 sentences focused on your goals and what you can bring to the organization. Unlike a summary, it emphasizes what you hope to achieve rather than what you have already accomplished.

Assistant bank manager resume objective example:

Dedicated finance professional with strong analytical and leadership skills, seeking an Assistant Bank Manager role to apply banking knowledge and customer service expertise to drive operational success. Eager to contribute to a dynamic team and support the bank's growth through exceptional financial services and client relationships.

- How to showcase your assistant bank manager resume skills?

Hiring managers often scan the skills section first to assess whether you have the qualifications needed for the role.

- Hard skills are specific, measurable abilities acquired through education, training, and work history. These are essential for performing banking tasks such as financial analysis, cash management, and regulatory compliance.

- Soft skills are personal attributes that influence how you interact with others and approach your work. They are often developed through experience and are crucial for leading teams, communicating with clients, and solving problems.

Assistant bank manager hard skills:

- Financial reporting

- Cash flow management

- Loan processing

- Risk assessment

- Customer relationship management (CRM)

- Compliance and regulations knowledge

- Budgeting and forecasting

- Staff supervision

- Banking software proficiency

- Sales and cross-selling

Soft skills for assistant bank manager:

- Leadership

- Communication

- Problem-solving

- Time management

- Adaptability

- Team collaboration

- Conflict resolution

- Decision-making

- Attention to detail

- Customer service

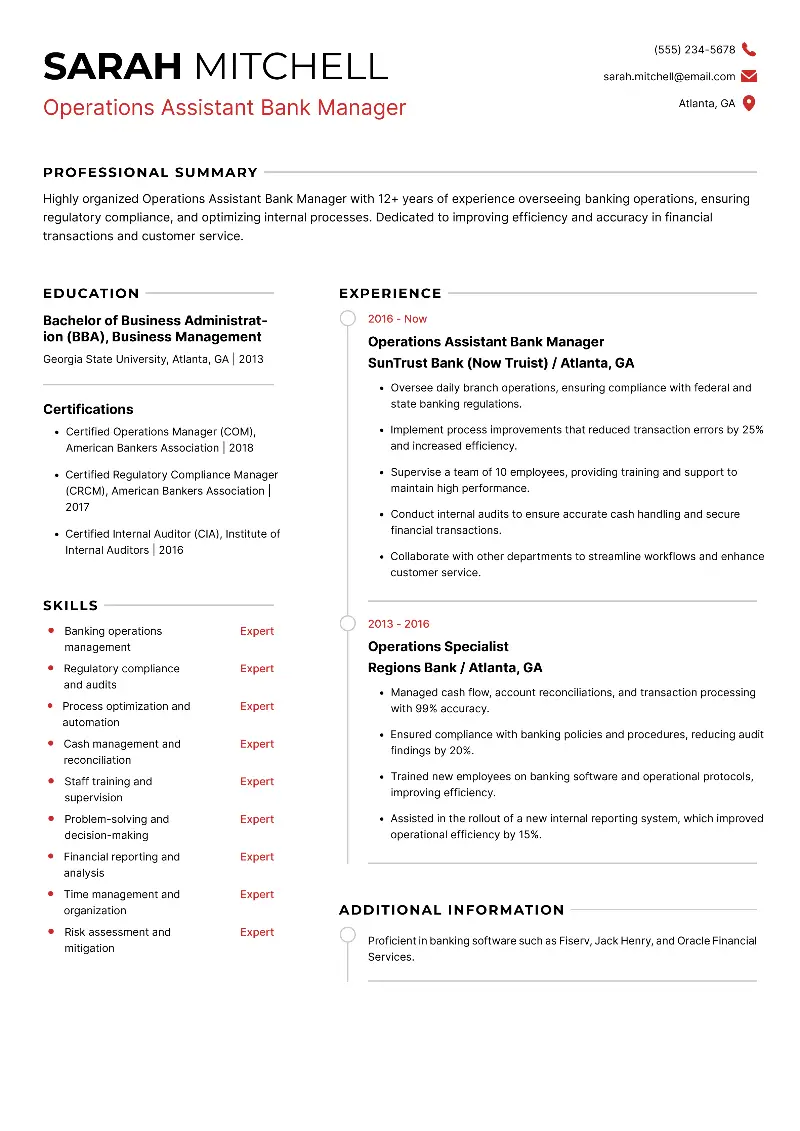

Operations assistant bank manager resume template

Operations assistant bank manager resume sample

Resume for operations assistant bank manager | Text version

Sarah Mitchell

Atlanta, GA | (555) 234-5678 | sarah.mitchell@email.com | LinkedIn.com/in/sarahmitchellSummary

Highly organized Operations Assistant Bank Manager with 12+ years of experience overseeing banking operations, ensuring regulatory compliance, and optimizing internal processes. Dedicated to improving efficiency and accuracy in financial transactions and customer service.

Skills

- Banking operations management

- Regulatory compliance and audits

- Process optimization and automation

- Cash management and reconciliation

- Staff training and supervision

- Problem-solving and decision-making

- Financial reporting and analysis

- Time management and organization

- Risk assessment and mitigation

- Communication and teamwork

Experience

Operations Assistant Bank Manager

SunTrust Bank (Now Truist) | Atlanta, GA | September 2016 – Present

- Oversee daily branch operations, ensuring compliance with federal and state banking regulations.

- Implement process improvements that reduced transaction errors by 25% and increased efficiency.

- Supervise a team of 10 employees, providing training and support to maintain high performance.

- Conduct internal audits to ensure accurate cash handling and secure financial transactions.

- Collaborate with other departments to streamline workflows and enhance customer service.

Operations Specialist

Regions Bank | Atlanta, GA | April 2013 – August 2016

- Managed cash flow, account reconciliations, and transaction processing with 99% accuracy.

- Ensured compliance with banking policies and procedures, reducing audit findings by 20%.

- Trained new employees on banking software and operational protocols, improving efficiency.

- Assisted in the rollout of a new internal reporting system, which improved operational efficiency by 15%.

Education

Bachelor of Business Administration (BBA), Business Management

Georgia State University, Atlanta, GA | 2013

Certifications

- Certified Operations Manager (COM), American Bankers Association | 2018

- Certified Regulatory Compliance Manager (CRCM), American Bankers Association | 2017

- Certified Internal Auditor (CIA), Institute of Internal Auditors | 2016

Additional Information

Proficient in banking software such as Fiserv, Jack Henry, and Oracle Financial Services.

This sample resume is effective for several reasons:

- Focuses on efficiency, compliance, and process optimization, aligning with operations management goals.

- Provides quantifiable results, such as error reduction and efficiency improvements, demonstrating impact.

- Organized structure with consistent formatting that highlights both hard and soft skills effectively.

- What academic credentials should I add to my resume?

The education section validates your background and demonstrates that you have the knowledge required for a career. Many employers require a diploma in finance, business administration, or a related field.

What to include:

- Degree name and major

- University name and location

- Graduation date (or expected year, if still studying)

- Relevant coursework (if applicable)

- Certifications and additional training (e.g., Certified Bank Manager, Financial Risk Manager)

- How to organize the experience section in a resume?

- List roles in reverse chronological order (most recent first).

- Write job title, company name, location, and dates of employment.

- Use bullet points to describe responsibilities and accomplishments.

- Start bullets with action verbs (e.g., "Managed," "Developed," "Implemented").

- Quantify achievements where possible (e.g., "Increased branch revenue by 20%").

Focus on leadership, customer service, and financial management.

Conclusion

A well-crafted resume can make a significant difference in your job search.

By showcasing your leadership, financial knowledge, and customer service abilities, you position yourself as a strong candidate in the competitive banking industry.

Use the tips and great resume examples from this guide to tailor your document to the specific role you're applying for, ensuring you highlight the skills and achievements that matter most to potential employers.

Create your professional Resume in 10 minutes for FREE

Build My Resume