Writing a standout loan processor resume is crucial for making a strong impression in the competitive lending industry.

A well-crafted document can showcase your skills, experience, and qualifications in a way that aligns with the specific demands of the role.

In this article, we'll explore various loan processing resume examples tailored to different types of professionals. We will highlight key elements to include and offer tips to help you create a resume that stands out to potential employers.

Loan processor resume examples

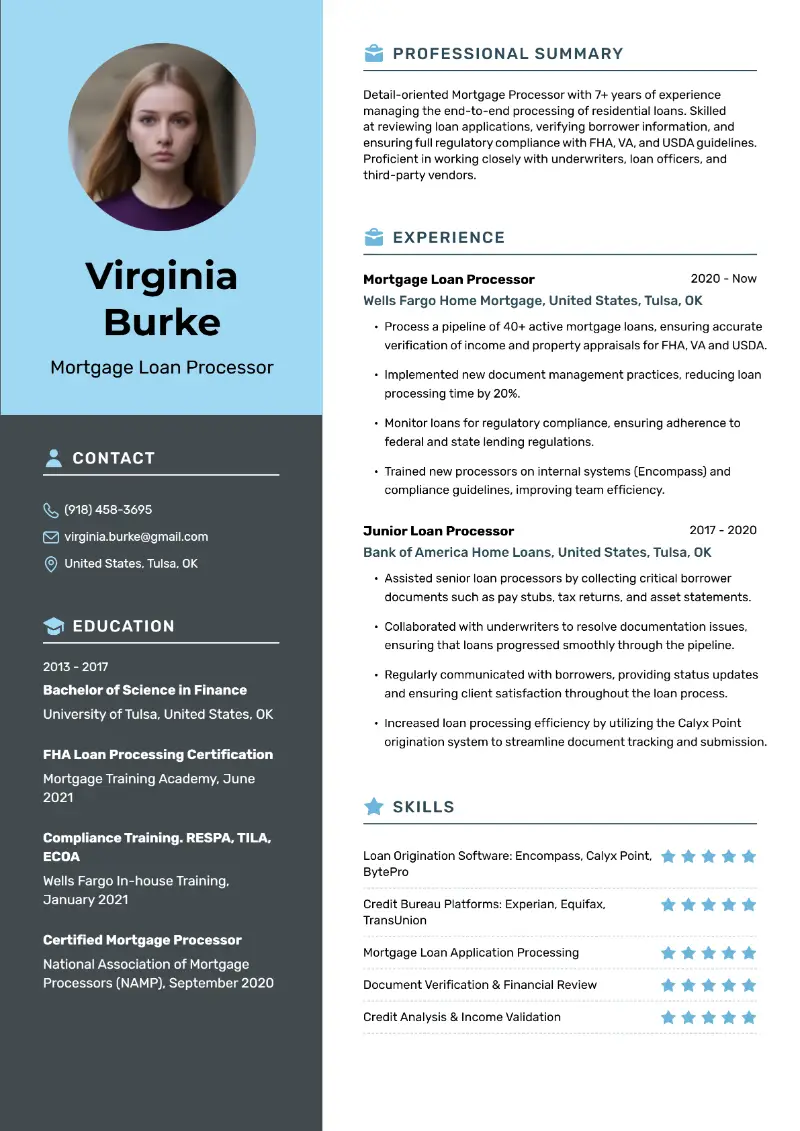

Mortgage loan processor resume template

Mortgage loan processor resume sample | Plain text

Virginia Burke

Tulsa, OK

Email: virginia.burke@gmail.com

Phone: (918) 458-3695Professional Summary

Detail-oriented Mortgage Processor with 8+ years of experience managing the end-to-end processing of residential loans. Skilled at reviewing loan applications, verifying borrower information, and ensuring full regulatory compliance with FHA, VA, and USDA guidelines. Proficient in working closely with underwriters, loan officers, and third-party vendors.

Experience

Mortgage Loan Processor

Wells Fargo Home Mortgage, Tulsa, OK, March 2020 – Present

- Process and manage a pipeline of 40+ active mortgage loans, ensuring accurate verification of income, assets, credit reports, and property appraisals for FHA, VA and USDA.

- Implemented new document management practices, reducing loan processing time by 20%.

- Monitor loans for regulatory compliance, ensuring adherence to federal and state lending regulations.

- Trained new processors on internal systems (Encompass) and compliance guidelines, improving team efficiency.

- Conduct periodic audits on loan files to ensure data integrity and accuracy.

Junior Loan Processor

Bank of America Home Loans, Tulsa, OK, June 2017 – February 2020

- Assisted senior loan processors by collecting and verifying critical borrower documents such as pay stubs, tax returns, and asset statements.

- Collaborated with loan officers and underwriters to resolve documentation issues, ensuring that loans progressed smoothly through the pipeline.

- Regularly communicated with borrowers, providing status updates and ensuring client satisfaction throughout the loan process.

- Increased loan processing efficiency by utilizing the Calyx Point origination system to streamline document tracking and submission.

Education

Bachelor of Science in Finance

University of Tulsa, OK

- Graduated: May 2017

Certifications

- FHA Loan Processing Certification. | Mortgage Training Academy, Issued: June 2021

- Compliance Training. RESPA, TILA, ECOA | Wells Fargo In-house Training, Completed: January 2021

- Certified Mortgage Processor. | National Association of Mortgage Processors (NAMP), Issued: September 2020

Skills

- Loan Origination Software: Encompass, Calyx Point, BytePro

- Credit Bureau Platforms: Experian, Equifax, TransUnion

- Mortgage Loan Application Processing

- Document Verification & Financial Review

- Credit Analysis & Income Validation

- Regulatory Compliance and Risk Assessment

- Customer Relationship Management (CRM) Tools

- Underwriting Guidelines Interpretation and Application

Reasons why this resume for loan processor is good:

- The experience focuses on core duties such as processing loans, working with underwriters, and ensuring compliance, all of which are crucial in the mortgage lending industry.

- Regulatory compliance is critical in the mortgage industry, and the resume effectively highlights Virginia’s knowledge of FHA, VA, USDA, and conventional loan guidelines.

- The format of the loan processor resume is clean, organized, and easy to follow. Key sections in resume are clearly delineated, making it simple for hiring managers to quickly find relevant information.

- How to format a loan specialist resume?

- Ideally, a loan processor application should be no longer than one page resume, especially if you have less than 10 years of experience.

- Use easy-to-read fonts like Arial, Calibri, Times New Roman, or Helvetica. Avoid overly stylized or decorative fonts as they can look unprofessional for a loan processor resume.

- Utilize a font size of 10 to 12 points for the body text. For headings, you can apply a slightly larger font size (14 to 16 points) to create hierarchy and structure.

- Set the margins to 1 inch on all sides. You can adjust them to as small as 0.5 inches if you need more space.

- Keep the section headers clear and well-spaced so hiring managers can quickly scan your resume.

- Always begin bullets with strong active verbs such as "Processed", "Managed", "Verified", "Reviewed", "Collaborated", or "Implemented".

- While it’s important to include key terms, refrain from overloading your document with too many buzzwords.

- To ensure your paper is ATS-friendly, use standard fonts, stay away from images or complex formatting, and add relevant keywords for resume from the job posting.

- Keep the text left-aligned for readability of your loan processor resume. Prevent text from being centered or right-aligned for the main content.

- Save your resume as a PDF to maintain formatting consistency across different devices. Some job postings might require a Word document, so be sure to follow the instructions.

- How to start a loan processing resume?

Place your official name at the top of the paper in the resume headline. Then put a personal, reliable phone number where employers can easily reach you.

Provide a professional email, preferably using your name. Avoid using outdated domains. You don’t need to write your full home address anymore. Instead, just list the city, state, and ZIP code on a loan processor resume. This gives employers an idea of your location without oversharing.

If you have an updated LinkedIn profile, include a link. This can provide HR with additional details about your professional network.

If these rules seem difficult to remember, we have a simple solution—use a free online resume builder to streamline the process and ensure your resume is polished.

Resume Trick provides job resume templates, making it quicker to create an application from scratch. You simply input your information and the service organizes loan processor resume for you, saving hours of formatting and design work.

Create your professional Resume in 10 minutes for FREE

Build My Resume

Refinance loan processor resume example

Mary Burns

Bloomington, IN 47408

Email: maryj.burns@gmail.com

Phone: (812) 555-9876Summary

Results-driven Loan Processor with 7+ years of experience specializing in refinancing residential mortgages. Adept at managing loan files from application to closing, with a focus on streamlining processes. Expertise in maintaining regulatory compliance and facilitating seamless communication between borrowers, loan officers, and underwriters.

Experience

Senior Refinance Loan Processor

Freedom Mortgage, Bloomington, IN, July 2022 – Present

- Oversee a high-volume pipeline of refinance loan applications, managing 50+ files at any given time and ensuring they move efficiently through the underwriting and approval processes.

- Specialize in cash-out and rate-and-term refinancing, ensuring accurate documentation of loan terms, payoff statements, and borrower financials for underwriting review.

- Serve as the main point of contact for borrowers, providing guidance on refinance options, rates, and required documentation while maintaining a high level of customer service.

- Coordinate with title companies and third-party vendors to secure necessary documents (e.g., payoff statements, insurance, appraisals) for timely loan closings.

- Train junior processors on compliance standards and document verification techniques.

Mortgage Loan Processor (Refinance)

Carrington Mortgage Services, Indianapolis, IN, April 2017 – June 2022

- Processed refinance mortgage applications, verifying borrower credit, income, and asset documentation to ensure eligibility and compliance with underwriting guidelines.

- Worked closely with loan officers to assess refinance options for borrowers, resulting in over 500 successful refinances during tenure.

- Implemented a tracking system to monitor borrower documentation submission, reducing file delays by 20%.

- Assisted in preparing loan disclosure forms, statements, and managing post-closing issues related to refinance payoffs.

- Earned a quarterly award for maintaining a 100% on-time file submission rate to underwriting.

Education

Bachelor of Science in Finance

Ball State University, Muncie, IN

Graduated: May 2017

Certifications

- USDA Refinance Loan Processing

National Association of Mortgage Brokers, Issued: December 2022

- Certified Mortgage Specialist

American Bankers Association, Issued: October 2019

Skills

- Loan Origination Systems: LoanSphere, Floify, BytePro

- Project Management Tools: Trello, Slack

- CRM Systems: Salesforce, HubSpot

- Regulatory Compliance (Dodd-Frank, CFPB Guidelines)

- Borrower Relationship Management

- Deadline Adherence

- Data Security and Privacy Best Practices

- Cross-functional Team Collaboration

- Analytical Reporting and Performance Tracking

References

Available upon request.

Why this resume for loan processor will attract recruiters?

- The application clearly focuses on Mary’s specialization in refinance loans, a highly specific and sought-after skill set in the mortgage industry.

- Candidate’s ability to maintain strong relationships with borrowers, loan officers, and underwriters is emphasized throughout her work experience.

- Her certifications demonstrate a commitment to continuous professional development. This adds credibility to loan processor resume and shows employers that she stays current with industry trends and best practices.

- How to show experience on a loan processor resume?

- Start each position with a job title that accurately reflects your role. This helps hiring team quickly understand your experience level and specialization.

- Arrange your work history starting with the most recent position and follow backwards.

- State the name of the company, its location, and the dates of your employment (month and year).

- Include a brief overview of your main responsibilities.

- Use bullet points to detail your achievements and contributions on loan processor resume.

- Quantify your impact with numbers, percentages, or specific examples whenever possible.

- How to choose loan processor skills for resume?

Hard and soft skills are two distinct categories of competencies that contribute to overall job performance. By clearly delineating and demonstrating both of them, you can present a comprehensive picture of your qualifications, making you a more attractive candidate.

- Hard skills are teachable knowledge sets that are often acquired through education, training, or hands-on experience. They are measurable and can be quantified or tested.

- Soft skills, also known as interpersonal, are non-technical attributes related to how you interact with others and manage work-related situations. They are more subjective and often pertain to personality traits and emotional intelligence.

Loan processor hard skills:

- Automated Underwriting Systems (e.g., DU, LP)

- Loan Documentation and Compliance Checks

- Risk Management and Fraud Detection

- Title and Escrow Coordination

- Appraisal Review and Analysis

- Loan Closing Procedures

- Mortgage Servicing and Support

- Knowledge of State and Federal Lending Regulations

- Data Analysis Tools (e.g., SQL, Tableau)

- CRM Systems (e.g., Salesforce, HubSpot)

Loan processor soft skills:

- Communication and Interpersonal Skills

- Customer Service and Relationship Management

- Problem-Solving and Critical Thinking

- Attention to Detail

- Organizational and Time Management

- Team Collaboration and Coordination

- Adaptability and Flexibility

- Conflict Resolution

- Stress Management

- Initiative and Proactiveness

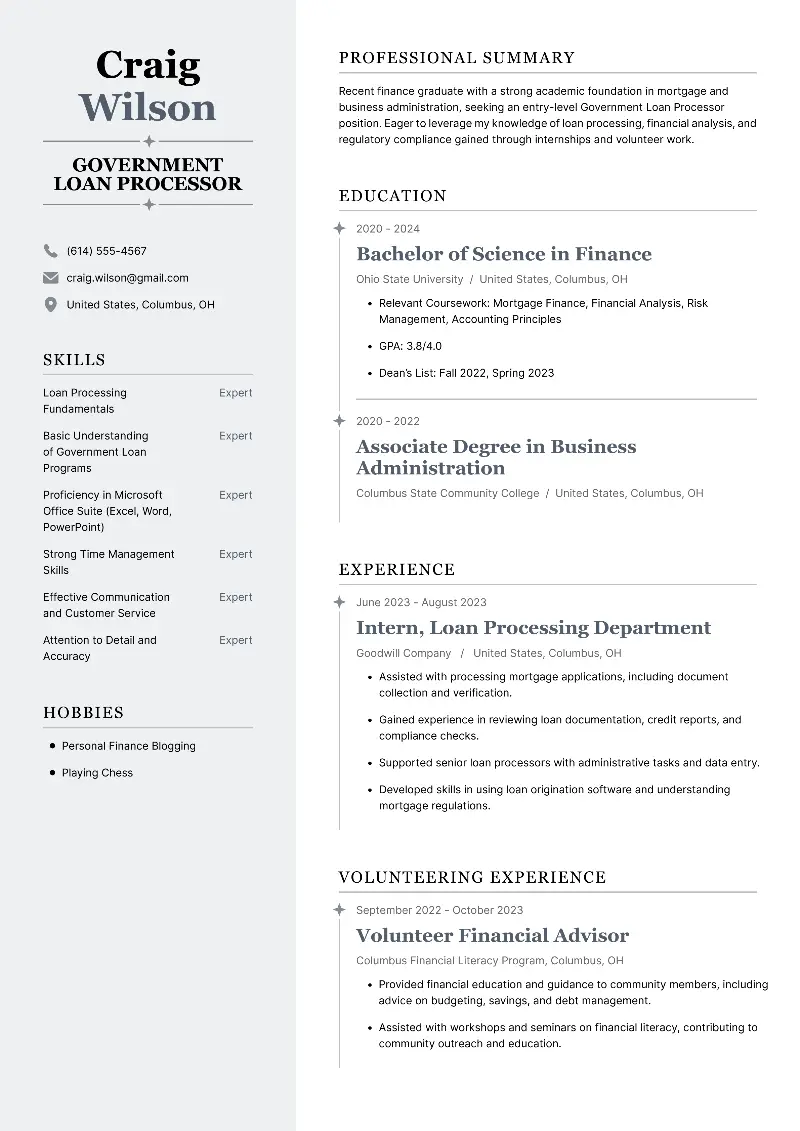

Government loan processor resume template

Government loan processor resume sample | Plain text

Craig Wilson

Columbus, OH

Email: craig.wilson@gmail.com

Phone: (614) 555-4567Resume Objective

Recent finance graduate with a strong academic foundation in mortgage and business administration, seeking an entry-level Government Loan Processor position. Eager to leverage my knowledge of loan processing, financial analysis, and regulatory compliance gained through internships and volunteer work.

Education

Bachelor of Science in Finance

Ohio State University, Columbus, OH

- Graduated: May 2024

- Relevant Coursework: Mortgage Finance, Financial Analysis, Risk Management, Accounting Principles

- GPA: 3.8/4.0

- Dean’s List: Fall 2022, Spring 2023

Associate Degree in Business Administration

Columbus State Community College, Columbus, OH

- Graduated: May 2022

Experience

Intern, Loan Processing Department

Goodwill Company, Columbus, OH, June – August 2023

- Assisted with processing mortgage applications, including document collection and verification.

- Gained experience in reviewing loan documentation, credit reports, and compliance checks.

- Supported senior loan processors with administrative tasks and data entry.

- Developed skills in using loan origination software and understanding mortgage regulations.

- Conducted preliminary eligibility assessments to identify potential loan issues early.

Volunteering Experience

Volunteer Financial Advisor

Columbus Financial Literacy Program, Columbus, OH

September 2022 – October 2023

- Provided financial education and guidance to community members, including advice on budgeting, savings, and debt management.

- Assisted with workshops and seminars on financial literacy, contributing to community outreach and education.

Skills

- Loan Processing Fundamentals

- Basic Understanding of Government Loan Programs

- Proficiency in Microsoft Office Suite (Excel, Word, PowerPoint)

- Strong Time Management Skills

- Effective Communication and Customer Service

- Attention to Detail and Accuracy

- Problem-Solving and Critical Thinking

- Adaptability to Fast-Paced Environments

- Multitasking with Prioritization Techniques

Hobbies

- Personal Finance Blogging

- Playing Chess

Why this is an outstanding example of an entry-level loan processing resume?

- Craig’s education section highlights coursework pertinent to loan processing, demonstrating that he has a solid academic foundation.

- Candidate’s role in the internship helped him develop technical skills with loan origination software and provided insight into the mortgage industry.

- Including hobbies like personal finance blogging reinforces his passion for the field and keeps him engaged with industry trends.

- What is the difference between a loan processor resume objective and a summary?

The resume objective is designed to convey the applicant's career goals and what they aim to achieve in the position. It sets the tone for the loan processor resume and is particularly useful for students or those changing careers.

Example of a loan processor resume objective:

Self-motivated business graduate with 2 years of experience in remote loan processing. Seeking to leverage my skills in managing loan applications, utilizing digital platforms, and ensuring compliance to support organizational goals.

The resume summary provides a concise overview of the job seeker’s background, key achievements, and skills. It summarizes the years of experience relevant to the position.

Example of a loan processor resume summary:

Seasoned loan processor with 5+ years of experience in handling complex mortgage applications, including conventional, FHA, and VA loans. Proven track record of streamlining processes, reducing turnaround times by 20%, and maintaining compliance with federal regulations. Adept at managing client relationships and leading processing teams.

Cover letter for loan processor

A cover letter is a formal document that accompanies a resume. It serves as an introduction to the recruiter, providing additional context and highlighting the applicant's qualifications, experience, and interest in the occupation.

The cover letter is typically addressed to the HR and contains the following components:

- Introduction. Explains who you are and the role you're searching for.

- Why You're Interested. Outlines why you want to work in the company.

- Qualifications. Highlights your motivation, experience, and achievements.

- Conclusion. Expresses your desire for an interview or further discussion.

Loan processor cover letter example

Dear Hiring Manager,

I am writing to express my interest in the Loan Processor position at Wells Fargo Home Mortgage, as advertised. With over 5 years of experience in the mortgage and finance industry, I am confident that my strong attention to detail, organizational skills, and thorough understanding of loan processing procedures would make me a valuable addition to your team.

In my previous role as a Loan Processor at Flagstar Bank, I was responsible for reviewing loan applications, ensuring all documentation was complete, and working closely with underwriters, borrowers, and other stakeholders to ensure smooth loan approval and closing processes.

I developed a keen ability to assess financial documents, identify discrepancies, and ensure compliance with industry regulations. I am well-versed in various loan types, including FHA, VA, and conventional loans, and am proficient in using loan processing software such as Encompass and Calyx Point.

I am particularly drawn to Wells Fargo Home Mortgage because of its reputation for delivering exceptional customer service and its commitment to fostering a collaborative and supportive work environment. I am eager to contribute my expertise in loan processing and work with your team to ensure timely and accurate loan approvals.

Thank you for considering my application. I would welcome the opportunity to discuss my qualifications further and how I can contribute to the success of your team.

I look forward to hearing from you soon to schedule an interview.

Sincerely,

Mercedes A. Robins

Conclusion

Writing an effective loan processor resume requires a careful balance of highlighting your strengths, experiences, and personal attributes.

Utilizing the examples provided, you can create a compelling narrative that emphasizes your qualifications and demonstrates your ability to contribute effectively to a financial institution.

Remember, a well-structured and thoughtfully prepared loan processor resume can significantly enhance your chances of landing your desired loan processor role and advancing your career.

Create your professional Resume in 10 minutes for FREE

Build My Resume