A mortgage loan processor resume plays a pivotal role in securing a job in the competitive real estate industry.

Making a resume that highlights your relevant skills and experience can help you stand out to potential employers.

In this guide, we’ll walk you through the essential components to include, as well as provide tips on how to showcase your strengths effectively.

Mortgage loan processor resume examples

- Residential mortgage loan processor resume

- Commercial mortgage loan processor resume

- Senior mortgage loan processor resume

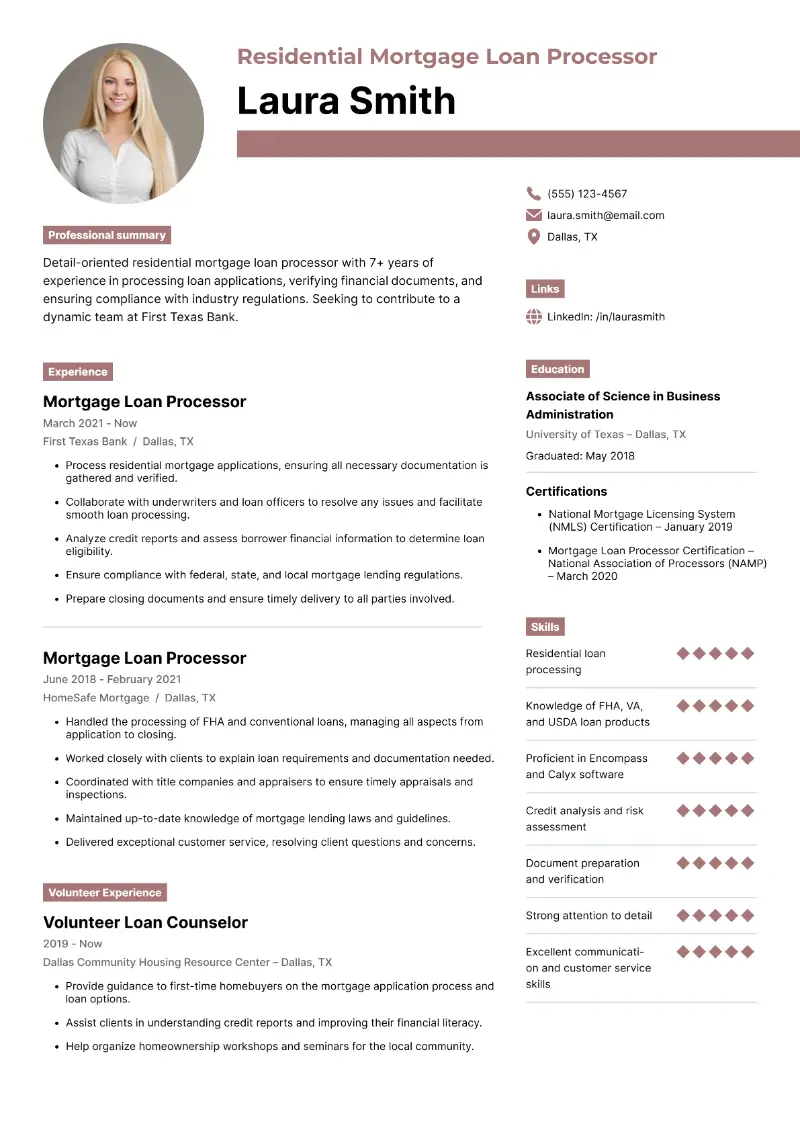

Residential mortgage loan processor resume sample

Residential loan processor resume template

Resume for mortgage loan processor | Plain text

Laura Smith

Dallas, TX

Phone: (555) 123-4567 | Email: laura.smith@email.com | LinkedIn: /in/laurasmithObjective

Detail-oriented residential mortgage loan processor with 7+ years of experience in processing loan applications, verifying financial documents, and ensuring compliance with industry regulations. Seeking to contribute to a dynamic team at First Texas Bank.

Skills

- Residential loan processing

- Knowledge of FHA, VA, and USDA loan products

- Proficient in Encompass and Calyx software

- Credit analysis and risk assessment

- Document preparation and verification

- Strong attention to detail

- Excellent communication and customer service skills

Experience

Mortgage Loan Processor

First Texas Bank – Dallas, TX

March 2021 – Present

- Process residential mortgage applications, ensuring all necessary documentation is gathered and verified.

- Collaborate with underwriters and loan officers to resolve any issues and facilitate smooth loan processing.

- Analyze credit reports and assess borrower financial information to determine loan eligibility.

- Ensure compliance with federal, state, and local mortgage lending regulations.

- Prepare closing documents and ensure timely delivery to all parties involved.

Mortgage Loan Processor

HomeSafe Mortgage – Dallas, TX

June 2018 – February 2021

- Handled the processing of FHA and conventional loans, managing all aspects from application to closing.

- Worked closely with clients to explain loan requirements and documentation needed.

- Coordinated with title companies and appraisers to ensure timely appraisals and inspections.

- Maintained up-to-date knowledge of mortgage lending laws and guidelines.

- Delivered exceptional customer service, resolving client questions and concerns.

Education

Associate of Science in Business Administration

University of Texas – Dallas, TX

Graduated: May 2018

Certifications

- National Mortgage Licensing System (NMLS) Certification – January 2019

- Mortgage Loan Processor Certification – National Association of Processors (NAMP) – March 2020

Volunteer Experience

Volunteer Loan Counselor

Dallas Community Housing Resource Center – Dallas, TX

September 2019 – Present

- Provide guidance to first-time homebuyers on the mortgage application process and loan options.

- Assist clients in understanding credit reports and improving their financial literacy.

- Help organize homeownership workshops and seminars for the local community.

Strong sides of this mortgage loan processor resume example:

- Objective effectively highlights key experience and emphasizes a strong fit for the role at First Texas Bank.

- Skills section includes industry-specific software knowledge, enhancing the candidate's technical expertise.

- Certifications are prominently featured with dates, showcasing up-to-date qualifications and commitment to professional development.

- How to properly format a mortgage processor resume?

- Font. Select a simple option such as Arial, Calibri, or Times New Roman. The ideal size is between 10 and 12 points for easy readability.

- Length. If you have under 10 years of experience, limit your resume to one page. For those with more history, two are acceptable.

- Margins. Set your document margins to 1 inch on all sides for a balanced and neat layout.

- Spacing. Utilize 1.15 or 1.5 to create space between lines, improving clarity and preventing a cluttered appearance.

- Headers. Highlight section titles, like “Experience” and “Skills,” in bold to differentiate them from the rest of the text.

- Bullets. Organize your responsibilities and achievements with bullet points for concise presentation.

- Alignment. Keep text left-aligned to maintain a consistent and professional look across all sections.

- Graphics. Refrain from unnecessary visuals, such as images or borders, as they can clutter the page.

For those who want to avoid formatting headaches, AI resume builder are an excellent solution.

Resume Trick offers online resume templates that can save time while guaranteeing a polished, structured appearance.

Create your professional Resume in 10 minutes for FREE

Build My Resume

Commercial mortgage loan processor resume example

Sample commercial mortgage loan processor resume

Sarah Johnson

San Francisco, CA

Phone: (555) 987-6543 | Email: sarah.johnson@email.com | LinkedIn: /in/sarahjohnsonObjective

Experienced commercial mortgage loan processor with 8+ years of expertise in managing large-scale commercial loans, conducting financial analyses, and ensuring all documents comply with regulations. Seeking to bring my skills to The Pacific Loan Group.

Skills

- Commercial loan documentation and processing

- Knowledge of commercial real estate transactions

- Expertise in underwriting guidelines for commercial loans

- Financial statement analysis

- Proficient in Microsoft Excel and A360

- Strong attention to detail and organizational skills

- Excellent written and verbal communication

Experience

Senior Commercial Loan Processor

The Pacific Loan Group – San Francisco, CA

August 2020 – Present

- Process and manage high-volume commercial mortgage loans, ensuring all loan documentation is complete and accurate.

- Collaborate with loan officers, underwriters, and clients to ensure timely processing of loan applications.

- Review financial statements, credit reports, and appraisals to assess loan viability.

- Ensure compliance with commercial lending regulations and guidelines.

- Prepare detailed loan packages for submission to the underwriting department.

Commercial Loan Processor

Summit Capital Partners – San Francisco, CA

July 2017 – June 2020

- Processed loans for commercial properties, including office buildings, retail spaces, and multi-family units.

- Verified borrower financial information, including tax returns, bank statements, and business financials.

- Maintained accurate records and updated loan tracking systems.

- Coordinated with appraisers, environmental consultants, and legal departments to gather necessary documentation.

- Assisted in resolving any issues that arose during loan approval and closing processes.

Education

Bachelor of Science in Finance

University of California – Berkeley, CA

Graduated: May 2017

Certifications

- NMLS Certification – February 2020

- Commercial Real Estate Financing Certification – Commercial Mortgage Association – November 2019

Awards and Recognitions

Employee of the Year

Summit Capital Partners – San Francisco, CA

January 2019

- Recognized for outstanding performance in processing commercial loans and exceeding targets.

Why this example of a loan processor resume will impress recruiters:

- Strong emphasis on commercial loan, demonstrating a niche expertise that appeals to potential employers.

- Leadership exposure in the "Experience" section, showcasing management and mentoring capabilities.

- Inclusion of a specific award demonstrates recognition of outstanding performance, making the resume stand out.

- Should I choose a mortgage loan processor resume objective or summary?

- Suitable for individuals with extensive experience who wish to highlight their qualifications and accomplishments.

- Emphasizes what you can offer to the company.

Mortgage loan processor resume summary sample:

Experienced mortgage loan processor with a strong track record in managing loan applications. Expertise in verifying documentation and ensuring compliance with all regulatory requirements.

- Perfect for those just entering the field or changing careers.

- Outlines what you hope to achieve and why you’re interested in the role.

Mortgage loan processor resume objective example:

Eager to apply my background in customer service and finance to a mortgage loan processor position, with the goal of contributing to a team’s success.

- How to showcase your mortgage loan processor resume skills?

The skills section shows employers the expertise you bring to the role.

- Hard skills are specific, teachable abilities or technical knowledge relevant to the job. They are typically acquired through formal education or on-the-job training.

- Soft skills include interpersonal and communication traits that affect how you interact with others. These are often developed through experience in the workplace or other social settings.

Mortgage loan processor resume hard skills:

- Mortgage software proficiency

- Credit analysis

- Loan document preparation

- Financial statement review

- Compliance with regulations

- Understanding of underwriting processes

- Loan servicing systems

- FHA and VA loan knowledge

- Data accuracy and entry

- Ability to analyze credit reports

Soft skills for mortgage loan processor resume:

- Attention to detail

- Effective communication

- Customer service

- Organizational skills

- Time management

- Analytical thinking

- Problem-solving abilities

- Team collaboration

- Adaptability

- Conflict resolution

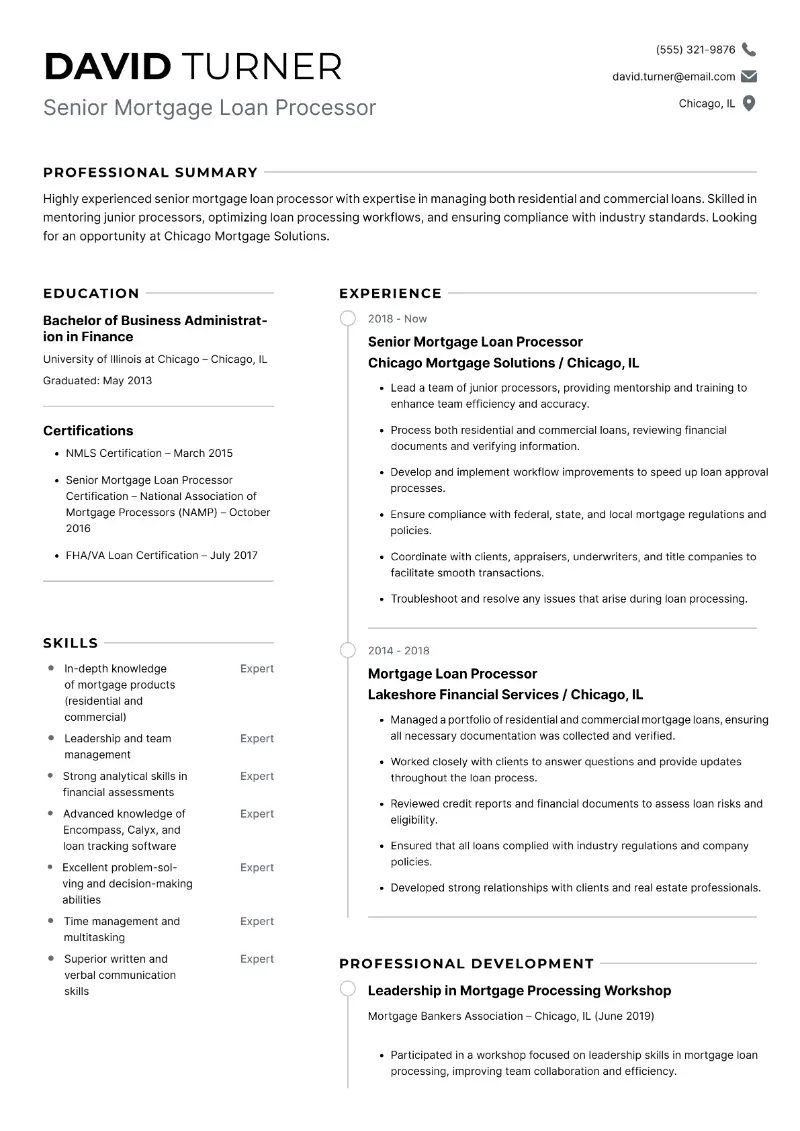

Senior mortgage loan processor resume template

Senior mortgage loan processor resume sample

Resume for senior loan processor | Text version

David Turner

Chicago, IL

Phone: (555) 321-9876 | Email: david.turner@email.com | LinkedIn: /in/davidturnerObjective

Highly experienced senior mortgage loan processor with expertise in managing both residential and commercial loans. Skilled in mentoring junior processors, optimizing loan processing workflows, and ensuring compliance with industry standards. Looking for an opportunity at Chicago Mortgage Solutions.

Skills

- In-depth knowledge of mortgage products (residential and commercial)

- Leadership and team management

- Strong analytical skills in financial assessments

- Advanced knowledge of Encompass, Calyx, and loan tracking software

- Excellent problem-solving and decision-making abilities

- Time management and multitasking

- Superior written and verbal communication skills

Experience

Senior Mortgage Loan Processor

Chicago Mortgage Solutions – Chicago, IL

November 2018 – Present

- Lead a team of junior processors, providing mentorship and training to enhance team efficiency and accuracy.

- Process both residential and commercial loans, reviewing financial documents and verifying information.

- Develop and implement workflow improvements to speed up loan approval processes.

- Ensure compliance with federal, state, and local mortgage regulations and policies.

- Coordinate with clients, appraisers, underwriters, and title companies to facilitate smooth transactions.

- Troubleshoot and resolve any issues that arise during loan processing.

Mortgage Loan Processor

Lakeshore Financial Services – Chicago, IL

January 2014 – October 2018

- Managed a portfolio of residential and commercial mortgage loans, ensuring all necessary documentation was collected and verified.

- Worked closely with clients to answer questions and provide updates throughout the loan process.

- Reviewed credit reports and financial documents to assess loan risks and eligibility.

- Ensured that all loans complied with industry regulations and company policies.

- Developed strong relationships with clients and real estate professionals.

Education

Bachelor of Business Administration in Finance

University of Illinois at Chicago – Chicago, IL

Graduated: May 2013

Certifications

- NMLS Certification – March 2015

- Senior Mortgage Loan Processor Certification – National Association of Mortgage Processors (NAMP) – October 2016

- FHA/VA Loan Certification – July 2017

Professional Development

Leadership in Mortgage Processing Workshop

Mortgage Bankers Association – Chicago, IL

June 2019

- Participated in a workshop focused on leadership skills in mortgage loan processing, improving team collaboration and efficiency.

This sample loan processing resume is effective for several reasons:

- Well-balanced mix of residential and commercial mortgage processing experience, appealing to a broader range of employers.

- The objective emphasizes leadership skills, making the candidate a strong contender for senior roles.

- Professional development section highlights continuous growth, reinforcing commitment to staying current in the industry.

- What academic credentials should I add to my mortgage processor resume?

The education section highlights your foundation, ensuring employers that you possess the necessary qualifications. This part should clearly communicate your relevant achievements.

What to include:

- The highest degree obtained, specifying the field of study (e.g., Finance, Business).

- The name and location of the school where you got your diploma.

- Your graduation year or expected completion date. You can omit this if you’ve been in the workforce for many years.

- Any certifications you have earned, especially those relevant to mortgage loan processing or the finance industry.

- How to organize the experience section in a loan processor resume?

- Reverse chronological order. Start with your most recent job and move backward.

- Key details. For each position, list your title, the company's name, and the dates of employment.

- Results. Highlight achievements and specific contributions in each role, rather than just duties.

- Action verbs. Use strong verbs like “managed,” “processed,” and “resolved” to show proactive engagement.

- Tailor for the role. Customize each entry to match the requirements of the job you're applying for. Use specific metrics, such as “Processed 50+ loan applications per month.”

- Be concise. Limit descriptions to 4-6 bullet points for each role to maintain clarity and focus.

Conclusion

Creating a strong mortgage loan processor resume is essential for advancing in this specialized field.

By focusing on relevant experience, key skills, and your ability to meet deadlines and manage documentation, you can increase your chances of landing your desired role.

Keep these tips in mind, and tailor your application to reflect your unique qualifications and expertise.

Create your professional Resume in 10 minutes for FREE

Build My Resume