As a professional working in the banking industry, you must have extensive knowledge of financial management, budgeting, accounting, and customer service. Therefore, a banker's resume should highlight credentials and experiences that illustrate such expertise.

This article provides guidelines on how to write a resume for the banking industry. So if you want to take your career to the next level, keep reading to learn how to create an outstanding banker resume!

Banking resume examples

- Experienced banker's resume

- Entry-level banker resume

- Investment banker resume

- Private banker resume

- Mortgage banker resume

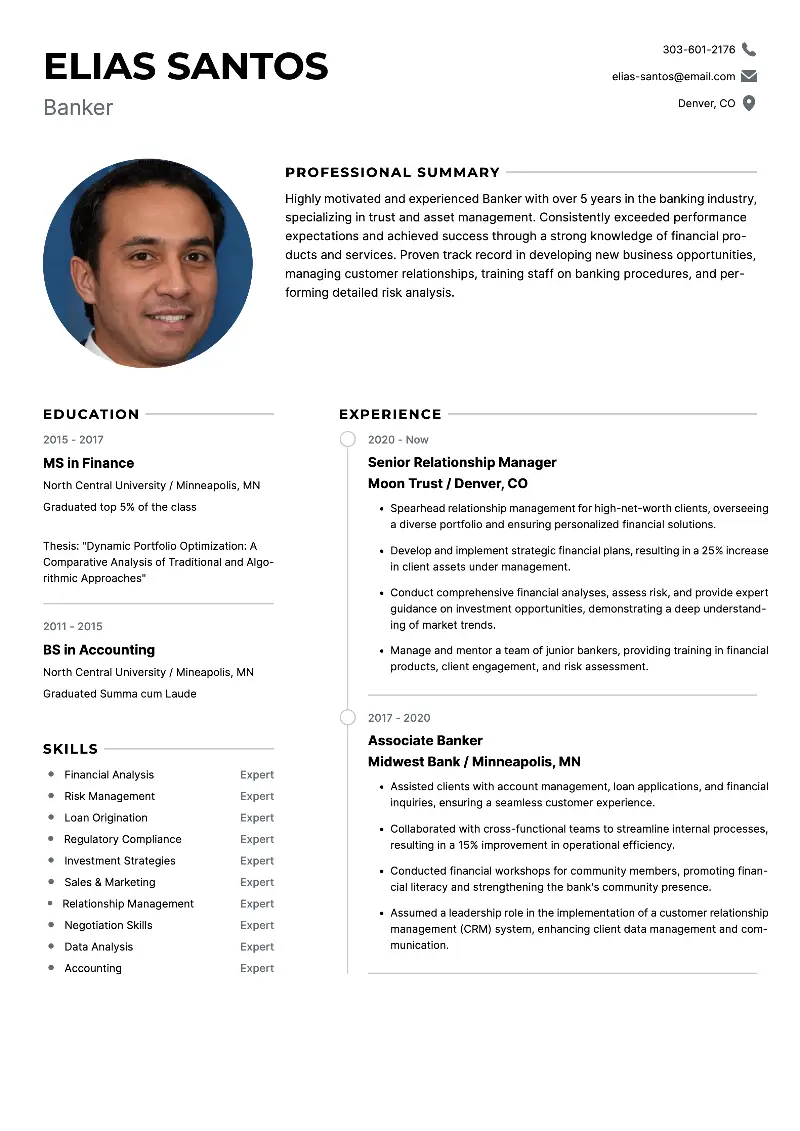

Experienced banker's resume template:

Entry-level banker resume example:

Objective:

Dedicated and detail-oriented recent graduate with a degree in Finance, seeking an entry-level position in Financial Risk Management. Aiming to leverage academic knowledge, analytical skills, and a strong understanding of risk assessment to contribute effectively to a dynamic financial environment.

Education:

Bachelor of Science in Finance, University of Alaska - Anchorage (2024)

Experience:

Financial Risk Intern at North Bank | Anchorage, AK (Summer 2023)

- Developed and monitored financial models to identify and mitigate potential risks.

- Assisted with market research, client onboarding, and portfolio performance review.

- Conducted extensive analyses of investment portfolios and provided strategic advice on investments and risk management.

Skills:

- Proficient in financial regulations and compliance.

- Experienced in portfolio management and risk assessment.

- Knowledgeable in financial modeling and reporting.

- Skilled in data analysis and market research.

- Excellent communication and customer service skills.

- Ability to coordinate with clients and team members.

Certification:

Chartered Financial Analyst (CFA) Level I Certified (2023)

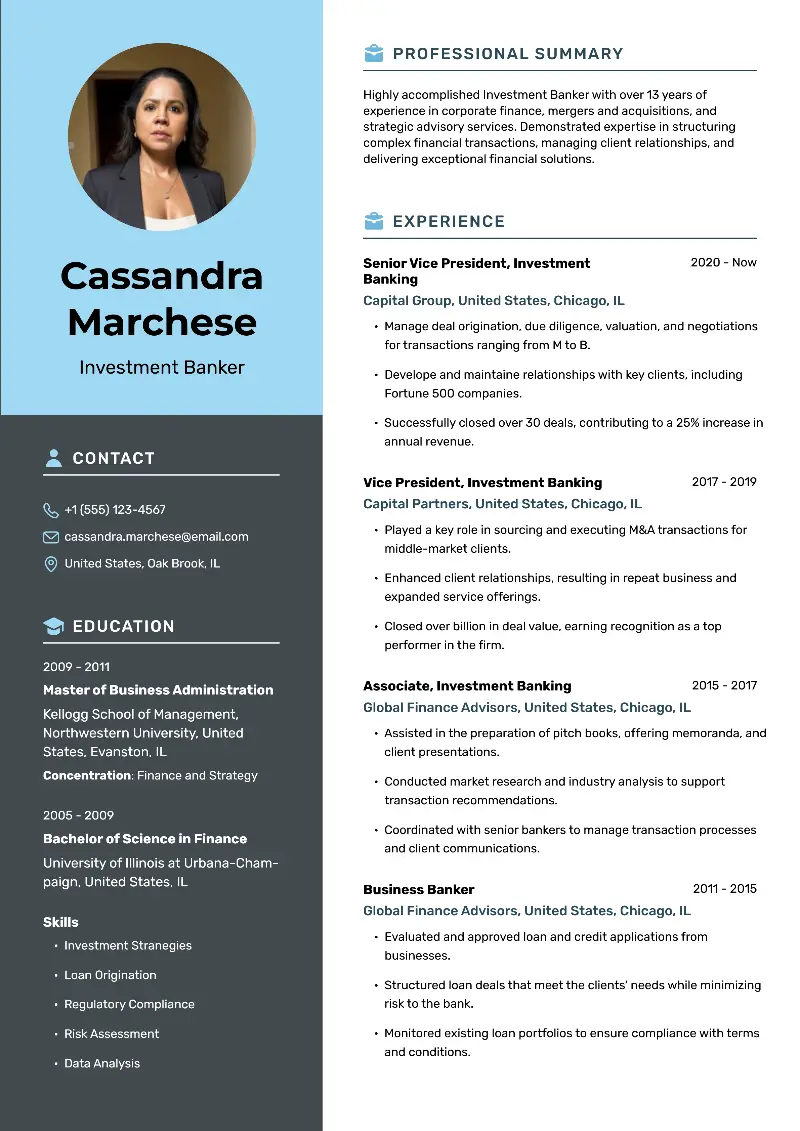

Investment banker resume example:

Private banker resume sample

Professional Summary

Experienced Private Banker with expertise in providing high-net-worth clients with personalized financial solutions, including investment management, wealth planning, and risk management. Proven track record of building strong client relationships, driving business growth, and delivering exceptional customer service.

Experience

Senior Private Banker

First National Bank, Worcester, MA, March 2018 – Present

- Manage a portfolio of high-net-worth clients, delivering tailored investment strategies and financial solutions.

- Develop and maintain strong client relationships through regular meetings, personalized advice, and exceptional service.

- Collaborate with financial advisors, estate planners, and tax professionals to create comprehensive wealth management plans.

- Monitor market trends and economic conditions to provide timely investment recommendations and risk assessments.

Private Banker

Elite Financial Services, Boston, MA, June 2013 – February 2018

- Provided bespoke banking and investment services to affluent clients, focusing on personalized financial planning and portfolio management.

- Conducted in-depth financial assessments and created customized plans to meet clients’ financial goals.

- Facilitated the growth of client portfolios by identifying and capitalizing on investment opportunities.

- Ensured compliance with regulatory requirements and internal policies.

- Recognized for exceptional client service and awarded the "Top Performer" accolade in 2016.

Financial Advisor

Global Wealth Advisors, Providence, RI, August 2009 – May 2013

- Advised clients on investment strategies, retirement planning, and wealth preservation.

- Developed financial plans that addressed clients' short-term and long-term financial objectives.

- Built a client base through networking, referrals, and excellent service.

- Conducted market research and analysis to inform investment decisions and recommendations.

Education

Master of Business Administration (MBA)

Harvard Business School, Boston, MA

- Graduated: 2009

Bachelor of Science in Finance

University of Massachusetts, Amherst, MA

- Graduated: 2005

Skills

- Client Relationship Management

- Wealth Management

- Investment Analysis

- Financial Planning

- Risk Management

- Regulatory Compliance

- Market Research

- Strategic Planning

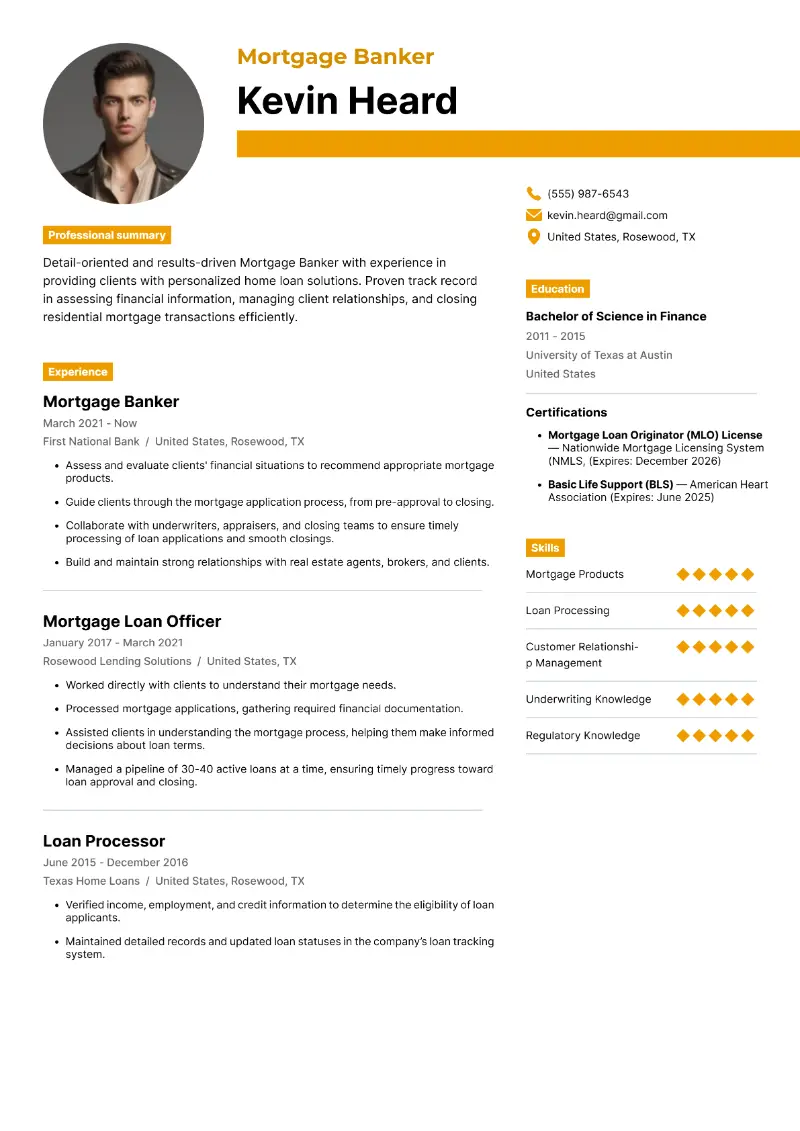

Mortgage banker resume template

Formatting tips

- Choose plain fonts such as Arial, Calibri, or Times New Roman.

- Maintain font sizes between 10 and 12 points for the main text.

- Apply uniform margins of approximately 1 inch on all sides.

- Incorporate consistent spacing between sections and bullet points.

- Limit the document length to one page resume format for early-career candidates.

- Align dates on resume and all the text to the left margin.

- Employ strong action verbs such as managed, developed, analyzed, and negotiated.

Contact information

This banker resume part serves as the identification. It also contains details on how to get in touch with you to schedule an interview or ask further questions.

The personal details should include full name, address, phone number, and email address. Add a professional website or LinkedIn profile if you have one that is up-to-date.

When listing contact info in your resume for bank job, double-check the accuracy. You want the recruiters and potential employers to easily contact you. Hence, do not overlook this section of your banking resume.

Work experience

When it comes to organizing and listing job history on a banker's resume, the most effective approach is to list it in reverse chronological order. This makes it simple for prospective employers to understand your background and career path.

For every role, provide:

- Your job title on resume

- Company name and location

- Employment period (month and year)

Utilize bullet points to outline primary duties and responsibilities and key successes. Emphasize measurable results.

Banking experience on resume examples:

Financial Analyst

Bank of Prosperity (West Palm Beach, FL) June 2020 - Present

- Conduct in-depth financial analysis for clients, evaluating investment portfolios and recommending strategic adjustments for optimal returns.

- Lead cost-cutting initiative, improving department efficiency by 15%.

- Initiate and lead weekly financial training sessions for junior staff, enhancing their understanding of market trends and investment strategies.

Investment Advisor

Finance Solutions Inc. (Tellico Plains, TN) January 2018 - May 2020

- Managed diverse client portfolios, providing expert advice on investment opportunities and risk management.

- Implemented a client-focused approach, resulting in a 20% increase in customer satisfaction and growth in the base.

- Conducted regular market research to stay abreast of industry trends, ensuring clients receive informed financial advice.

Junior Loan Officer

Metro Bank (Myrtle Beach, SC) July 2016 - December 2017

- Assessed loan applications, evaluating creditworthiness and risk factors for informed lending decisions.

- Collaborated with clients to structure loan agreements aligned with financial goals and the bank's risk tolerance.

- Conducted workshops for small business owners, promoting financial literacy and community engagement.

This type of organization helps employers quickly understand what your background is and how long you have been employed in each position. It also provides a straightforward method to draw attention to any promotions and noteworthy outcomes you have had in each role on banking job resume.

By exhibiting your work history in this way, you help employers swiftly determine how your competencies and qualifications are suitable for the job you're applying.

Education

When compiling a resume for a bank job, it is essential to list and arrange your educational details efficiently. It should be ordered chronologically, with the latest experience appearing first. This will ensure that potential employers can follow your academic journey smoothly.

For example, if you have recently graduated from college, you should list your degree on a banker resume first. This would be followed by other education or certifications that may be relevant to the job position. You may add any extracurricular activities or honors that could be beneficial for your application.

Education on a banker resume example:

Bachelor's Degree in Finance | University of New York (2019-2021)

- Certified Financial Professional | Financial Services Authority (2020)

- Member of the Beta Gamma Sigma Honor Society (2020-2021)

Associate's Degree in Accounting | Grand Valley State University (2017-2019)

Your qualifications must be listed on banker resume in a way that presents your expertise in the best light. Incorporate relevant activities that could enhance your chances of landing the job, as well as averting formatting issues that may cause misinterpretation.

Banker's skills

It is beneficial to describe both soft and hard skills in your banker's resume to maximize the chances of success.

Soft banker resume skills demonstrate the capacity to collaborate with others, while hard skills exhibit the technical competencies required for the job. Integrating both types of skills helps create a comprehensive list and gives employers an understanding of your qualifications

Soft skills for a banker resume examples:

- Communication Skills. Clear and concise communication is essential for explaining financial products and services to clients.

- Customer Service. Providing excellent customer service to build and maintain positive relationships with clients.

- Adaptability. The financial industry is dynamic; bankers need to adapt to changes in regulations, technologies, and market conditions.

- Problem Solving. Identifying issues and finding practical solutions for clients' financial needs.

- Time Management. Effectively managing time to handle multiple tasks, meet deadlines, and prioritize important activities.

- Attention to Detail. Accuracy is vital in financial transactions and documentation; attention to detail helps prevent errors.

- Negotiation Skills. Negotiating terms and conditions with clients, vendors, or other financial institutions.

- Teamwork. Collaborating with colleagues from various departments to provide comprehensive financial solutions.

- Ethical Judgment. Upholding ethical standards and integrity in financial transactions and decision-making.

- Analytical Thinking. Assessing financial data, market trends, and client information to make informed decisions.

- Sales Skills. Promoting and selling financial products and services to meet sales targets.

- Networking. Building and maintaining a professional network to enhance business opportunities.

- Emotional Intelligence. Understanding and managing one's emotions and being attuned to the feelings of clients and colleagues.

- Leadership. Taking initiative and leading projects or teams when required.

- Conflict Resolution. Effectively resolving conflicts and addressing issues that may arise in client relationships or within the team.

- Cultural Sensitivity. Working effectively with clients from diverse cultural backgrounds.

- Presentation Skills. Delivering clear and compelling presentations to clients or internal stakeholders.

Hard skills for a banker resume examples:

- Financial Analysis. Ability to analyze financial statements, assess risk, and make informed decisions based on financial data.

- Credit Analysis. Evaluating the creditworthiness of individuals and businesses to determine loan approval.

- Regulatory Compliance. Staying up-to-date with financial regulations and ensuring compliance with legal requirements.

- Accounting. Expertise in accounting principles for accurate financial reporting.

- Risk Management. Identifying and managing risks associated with financial transactions and investments.

- Loan Origination. Knowledge of the loan application and approval process, including documentation and eligibility criteria.

- Investment Management. Understanding various investment products and managing investment portfolios.

- Financial Modeling. Creating financial models to analyze and forecast financial performance.

- Economic Analysis. Understanding macroeconomic factors and their impact on financial markets.

- Data Analysis. Utilizing tools and techniques for analyzing large sets of financial data to extract meaningful insights.

- Excel Proficiency. Advanced skills in Microsoft Excel for financial modeling, data analysis, and reporting.

- Cash Management. Efficiently managing cash flow and liquidity to meet operational needs.

- Market Research. Researching market trends, industry developments, and competitor analysis.

- Portfolio Management. Managing and optimizing investment portfolios for clients.

- Treasury Management. Handling treasury functions, including cash and liquidity management, risk management, and capital structure.

- Financial Planning. Assisting clients with financial planning, including budgeting, retirement planning, and investment strategies.

- Commercial Lending. Understanding the intricacies of commercial lending, including terms, conditions, and risk assessment.

- Financial Software. Proficiency in using financial software and banking systems for transactions and record-keeping.

- Fraud Prevention. Implementing measures to prevent and detect fraudulent activities.

- Foreign Exchange (Forex) Trading. Knowledge of currency markets and conducting foreign exchange transactions.

The skills section of your resume for banking job exhibits your capabilities as a specialist. Ensure to employ precise job-related vocabulary throughout this part.

Banker's resume summary

A successful banking resume summary should be succinct, yet informative and compelling. It should highlight your key professional strengths.

Example of banker resume summary 1:

Highly skilled and experienced banking professional with over 10 years of experience in customer service, loan processing, and financial analysis. Demonstrated proficiency in managing complex financial operations and overseeing multiple accounts. Adept at developing innovative strategies to increase client satisfaction and enhance profitability. Excellent communication and organizational skills with an innate ability to build strong relationships with clients.

Example of banker resume summary 2:

Experienced banker with 5+ years of experience in corporate banking. Skilled in financial analysis, portfolio management, client relationships, and credit risk assessment. Demonstrated success in meeting tight deadlines and providing high-quality customer service. Proven ability to increase profitability and reduce costs.

Tips for writing a banker resume summary:

- Highlight key accomplishments that demonstrate your expertise in the banking industry.

- Focus on specific results that you have achieved in the past, such as successful loan processing or increased customer satisfaction.

- Use active language and abstain from excessively lengthy phrases that could divert the reader's focus.

- Tailor your banker resume summary specifically for the role by emphasizing specific abilities that are applicable to the job.

- Highlight characteristics that will make you unique from other applicants.

- Keep it concise yet informative.

As an alternative to the banker resume summary, you can opt to write a resume objective instead. Instead of focusing on the past, it states what you're looking for in a new role.

Additional information

Providing supplementary details to your banker's resume can be beneficial by helping present unique aspects of your personality. It will allow the recruiter to get a more comprehensive view of your character and evidence initiative. This can help them make an informed decision when choosing the right candidate for the job.

| Section | Description |

|---|---|

| Hobbies | Show how you spend your free time and what interests you have outside of your professional life. For instance, if you enjoy volunteering in the community or playing a musical instrument, it can show that you have strong interpersonal skills and are involved in meaningful activities. |

| Courses | Demonstrate that you have taken the initiative in furthering your knowledge and expanding your skill set. This could include taking online courses or attending seminars focused on banking or financial matters. This indicates you are willing to learn, stay current with industry trends, and continuously develop your skills. |

| Languages | Mention the capability to communicate with foreigners. It can be advantageous for a banker, as it may give you a competitive edge compared to other applicants who only speak one language. Showcasing language proficiency on your banker resume can signify that you are open-minded and have valuable communication proficiencies which may be beneficial for a customer service role. |

| Awards | Illustrate that you have attained something praiseworthy in the occupation. Any awards or recognitions won for outstanding performance or customer service should be listed on the resume as it will impress hiring managers and express that you are capable of achieving great results. |

| Internships | Explain that you have valuable work experience and can add value to a banker's resume. They demonstrate that you have already acquired some experience in the finance industry and have learned various skills that will enable you to excel as a banker. |

| References | Allow recruiters to obtain insight from those familiar with you professionally. The references should be from previous employers or colleagues capable of providing a positive assessment of your work ethic and experience. |

| Certificates | Signal that you have earned certain qualifications in the profession. These could include certificates of completion for courses connected to banking or finance, certifications from financial institutions, etc. Having these qualifications will indicate that you have specialized knowledge and are capable of performing well in your role as a banker. |

Build your resume online

Are you looking for a quick and easy way to create an impressive banking resume? Look no further! Resume Trick provides a great selection of unique resume templates. Save time and effort by using one of the professionally-designed resume layouts.

Using a resume template has many advantages:

- The free resume builder offers layouts designed to have clean structure, so your banker resume looks neat and is easy to follow.

- All templates come with pre-formatted resume sections that can be easily filled in with your information.

- There is an integrated AI assistant to help you make sure you don't struggle with picking the best words that highlight all qualifications.

Create your professional Resume in 10 minutes for FREE

Build My Resume

Banker's cover letter

Composing an outstanding cover letter is one of the most important steps to take to get your foot in the door. This document is your chance to make a good first impression, and it should be tailored to the job you are applying for.

Here are some tips on how to construct an effective cover letter when applying for a banking role.

Format

Make sure that your cover letter follows a professional format, including 1-inch margins all around and a 12-point font size.

Use an appropriate font like Arial or Times New Roman. Also, ensure that you use proper grammar and punctuation, and check your spelling.

Content

Your cover letter should include three main parts: an introduction, a body, and a conclusion.

The introduction should briefly explain why you are writing the letter and what position you are applying for. In the body of your letter, elaborate on the qualifications you possess for the position by highlighting relevant skills and experiences. Finally, in the conclusion, express your interest in speaking with the hiring manager about the role.

Cover letter writing tips

- Make sure you customize your cover letter to the job you are applying for.

- Use a professional, yet warm writing style. Be sure to demonstrate enthusiasm and show that you are excited about the opportunity.

- Highlight your achievements and successes in the banking industry, especially any awards or recognition you have received.

- Be specific about your qualifications and experience, and provide examples to illustrate why you are the best fit for the role.

- Keep your letter to one-page without sacrificing important details or crucial information.

- Double-check for spelling and grammar mistakes, as they can leave a lasting impression on recruiters.

Good example of banker cover letter:

Dear Ms. Rutledge,

I am writing to express my enthusiastic interest in the Financial Analyst position advertised on your company website. With a solid background in finance and a commitment to delivering exceptional service, I desire to contribute my skills and experience to the esteemed team at Link Exchange.

My current role is as a Financial Analyst at Verde Trust. There, I have honed my ability to conduct in-depth financial analysis, evaluate investment portfolios, and provide strategic recommendations for optimal returns. This experience has equipped me with a keen understanding of market trends and risk assessment, essential skills for navigating the complexities of the financial sector.

Moreover, my proficiency in Spanish and German languages has allowed me to communicate effectively with a diverse clientele, aligning seamlessly with Link Exchange's commitment to global perspectives. I believe that effective communication is crucial in the financial industry, and my language skills complement my analytical capabilities.

I have successfully managed diverse client portfolios, implementing strategic investment approaches tailored to individual needs. This hands-on experience has further enhanced my ability to navigate the dynamic landscape of financial transactions and market trends. Additionally, I am committed to staying abreast of industry developments through continuous research, ensuring up-to-date and informed financial advice for clients.

I am enthusiastic about the chance to contribute my skills and passion to a vibrant and highly esteemed institution. My experience, coupled with my passion for delivering personalized financial solutions, are similar to the values and goals of Link Exchange.

Thank you for considering my application. I look forward to the possibility of contributing to the continued success of Link Exchange.

Sincerely,

Dequinn Thompson

This cover letter sample is good because it highlights the applicant's relevant skills and experience while also expressing interest and is tailored to this particular job.

Bad example of banker cover letter:

To whom it may concern,

I am writing this letter because I want to work at your company as a Banker. I'm sure I'd be great at this job because I like numbers and money! My previous experience includes working at KFC, but it wasn't related to banking so that doesn't matter here...right? Anyway, I would be grateful if you could give me this opportunity so please let me know if this works out!

Thank you! [Name]

This illustration does not suffice because it fails to provide any meaningful information about why the applicant is qualified or interested in the role they are applying for. Additionally, it does not demonstrate any understanding of banking or any other relevant skills or experiences that could add value to the position.

Cover letter for an entry-level banking job:

Dear Mr. George Pearson,

I am writing to express my keen interest in the Banker position at your esteemed organization. I'm a recent graduate with a Bachelor's Degree in Economics and a minor in Business Administration. I am eager to contribute my skills and enthusiasm to a dynamic and reputable institution like Nova Bank.

My academic background, coupled with my membership in the Financial Management Association of America, has equipped me with a solid foundation in finance and a deep understanding of economic principles. I am confident that my knowledge and abilities will not only meet but exceed the expectations of the Banker role at Nova Bank.

What sets me apart is not only my academic achievement but also my strong motivation and work ethic. I am ready to apply my skills to tackle challenges and contribute to the success of your organization. My experience working collaboratively in team environments has honed my communication and interpersonal skills, further complementing my ability to work effectively in the banking sector.

I am excited about the opportunity to bring my dedication and passion for finance to Nova Bank. I am confident that my qualifications align well with the values and goals of your organization. Should you require any additional details regarding my candidacy, please do not hesitate to contact me.

Thank you for considering my application.

Sincerely,

Felipe Pareja

Advice on writing a cover letter for a banker's resume with no experience:

- Keep it short. Your cover letter should be no longer than one page in length.

- Highlight relevant skills. Focus on the transferable skills you have acquired through other experiences such as internships or volunteer work, which are relevant to the banking job you are applying for.

- Showcase your enthusiasm. Demonstrate your genuine interest in the job and enthusiasm for learning more about what is required to be successful in this role.

- Tailor it to the job. Customize each cover letter you write based on the specific job description so it stands out from other applicants' letters.

- Proofread. Read through the banker cover letter several times before sending it off. Check for any typos or grammatical errors that could hurt your chances of being considered for the job.

Create your professional Cover letter in 10 minutes for FREE

Build My Cover Letter

Proofreading

Submitting a well-proofread and spellchecked banker resume and cover letter when applying for a job is essential. These documents are the first impression you leave on the employer.

You want to ensure your application materials are as strong and professional as possible. Poor grammar, spelling mistakes, and typos can quickly give a negative perception of your character.

- Start by reading it out loud. This will be beneficial if you catch any awkward phrasing that you may have missed before.

- Have someone else read it over for a fresh perspective. Consider using a grammar checker if available or ask an experienced friend for assistance.

- Print a hard copy. Reviewing a physical version of your paper can help you spot issues that are easy to miss on a screen.

Carefully review the job description to check that you are using the same terminology they are using in the advertisement. This will show that you understand their needs and have customized your banker resume specifically for their job requirements.

If you adhere to these guidelines, you can guarantee that your job application is noticed by potential employers and leaves a good impression.

Banker resume: conclusion

This article provides a comprehensive breakdown of crafting a resume for a bank job. Bankers play an essential role in the financial industry and they need to have specific qualifications and skills.

Constructing a banker's resume may take time but there are some strategies to simplify it. For instance, you can use an online resume builder that will help you produce a perfect document quickly. So don't wait any longer – start creating your outstanding banking resume now!